-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Oil on the Skids

Highlights:

- Oil prices slide as Biden proposes fuel tax cuts

- Equities reverse week's recovery ahead of Powell testimony

- JPY on the bounce, but downside risks remain

US TSYS SUMMARY: Bull Steeper Ahead Of Washington Stagflation Watch

The Tsy curve has bull steepened overnight amid a renewed bout of risk-off, recession-fearing trade: the 2-Yr yield is down 7.1bps at 3.1255%, 5-Yr is down 7.2bps at 3.2915%, 10-Yr is down 5.5bps at 3.2201%, and 30-Yr is down 3.7bps at 3.3004%.

- A sharp drop in oil prices overnight, triggered in part on global growth concerns, has helped drag on yields (and equities). In related news, Pres Biden is set to ask Congress to suspend the Federal fuel tax; he speaks at 1400ET.

- With a schedule largely devoid of data (0700ET sees weekly MBA mortgage applications), focus will be on supply and Fed speakers.

- Foremost among the latter is Chair Powell's semi-annual Congressional testimony which will begin in the Senate at 0930ET. For the last hearings in March, Powell's testimony text was published at 0830ET for a 1000ET appearance.

- We also get a few more appearances by Richmond Fed's Barkin (0900ET, 1200ET, 1330ET), and the first post-FOMC comments from Chicago's Evans (1250ET) and Philly's Harker (at 1330ET alongside Barkin).

- $14B 20Y Bond auction re-open at 1300ET highlights the supply calendar; $22B in 2Y FRNs sell at 1130ET.

EGB/GILT SUMMARY: UK Rate Expectations Revised Lower

European government bonds have rallied sharply this morning with gilts leading the charge alongside weaker trading in equities and FX vs USD.

- UK CPI for May printed in line with expectations (9.1% Y/Y) and inched higher from the previous month. Core CPI came in slightly below expected (5.9% Y/Y vs 6.0%) and dropped 0.3pp from the previous month. The lack of another material inflation surprise has contributed to this morning's rate re-pricing at the short end.

- Gilt yields are down 10-18bp with the curve bull steepening.

- Bunds have rallied with the belly of the curve outperforming. Cash yields are now 8-11bp lower on the day.

- The belly of the OAT curve has similarly outperformed with yields 8-10bp lower.

- The long end of the BTP curve has slightly bull steepened with the 2s20s spread widening 2bp.

- Italy's populist 5-Star Movement (M5S) has lost its position as the largest in the Chamber of Deputies after Foreign Minister Luigi Di Maio resigned in order to form his own political party.

- Supply this morning came from Germany (Bund, EUR1.263bn allotted)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ2 152 call, bought for 10 in 6k and 10.5 in 4k

RXQ2 153/154.5cs, bought for 3 in 5.8k

ERZ2 98.25/98.00ps, sold at 6.75 in 10k (ref 98.545)

ERZ2 98.50/98.25/98.00p fly bought for 2.75 in 6k

US:

Wk1 Tnotes 114/113ps, bought for 4 in 30k

EUROPE ISSUANCE UPDATE

German auction results:

- E1.5bln (E1.263bln allotted) of the 1.00% May-38 Bund. Avg yield 1.91% (bid-to-cover 1.32x).

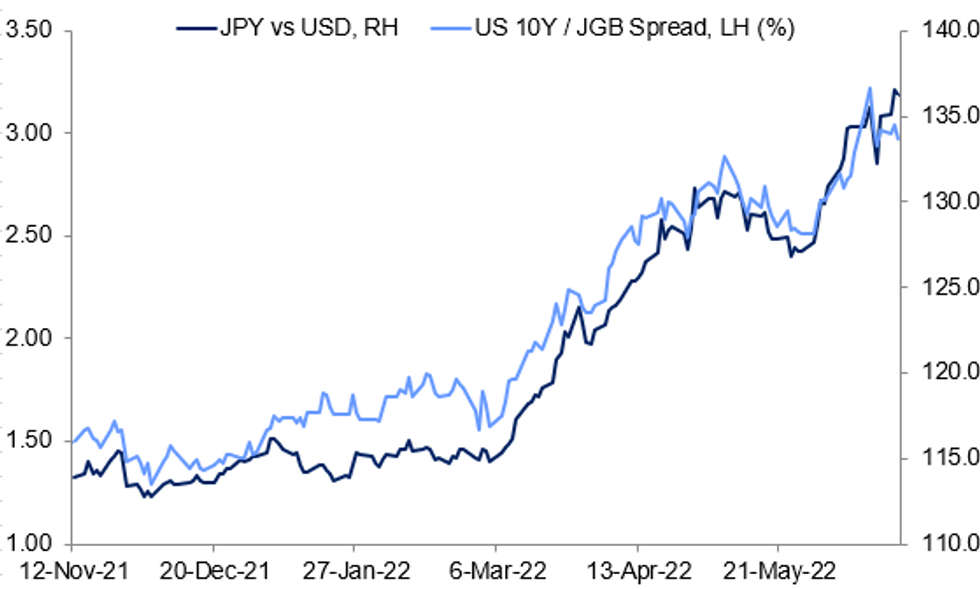

GLOBAL MARKET/OPINION: BOJ Action Would Roil Global Stocks, Steepen Curves

Per our Insight piece out earlier today: the Bank of Japan could adjust its easy monetary policy around the autumn if the yen stabilises at a lower level around 140 to the dollar, sending inflation to temporary peaks near 3% and driving wage hikes into 2023, MNI understands. That could involve adjusting yield curve control (currently the defended yield ceiling on 10Y JGBs is 0.25%).

- While our reporting points to a BOJ policy move further down the line (as our Insight headline suggests, only in autumn) and not immediately, we've had client questions about implications of potential hawkish BOJ policy shifts.

- In the case of unexpected intervention, or adjusting YCC, expect a big knee jerk move lower in the USD vs the yen (first key support comes in at 132.70/131.50 currently, vs 136.22 spot).

- Japanese stocks would sell off strongly, with global equities moving lower on the follow.

- Despite a risk-off move, global long-end yields would rise, with potential for bear steepening in tandem with JGBs. Even if the JGB employs just FX intervention and not YCC adjustment, there would be increasing speculation that the latter would be approaching.

- Likewise oil/industrial metal commodities would weaken as a negative growth impact would be anticipated (though a softer USD could mitigate some of the downside).

- Emerging Market assets would sell off sharply, in part because of the above global impact, and also because the yen is seen as a carry trade funder.

- The overall impact of an FX intervention would be sizeable for a short period of time but might not last, as unilateral interventions in the yen historically haven't worked for long. Abandoning YCC would have more lasting impact.

Source: BBG, MNI

Source: BBG, MNI

FOREX: JPY Stages Solid Bounce, But Outlook Remains Fragile

- USD/JPY is retreating off this week's multi-decade cycle high, putting the rate back below the Y136.50 in what's likely to be only a brief respite. USDJPY broke to new cycle highs this week, with price clearing short-term resistance at 135.59, Jun 15 high. The break higher confirms a resumption of the primary uptrend and maintains the bullish price sequence of higher highs and higher lows.

- The greenback also trades well, with the USD benefiting from the general rolling over of equity prices after Tuesday's corrective bounce.

- A downleg in oil prices has undermined sentiment somewhat, with WTI and Brent futures off around 5% apiece as Biden is set to call on Congress to suspend the Federal fuel tax in an effort to help with record high oil prices. Commodity-tied currencies are suitably lower, with AUD and NZD among the poorest performers Wednesday.

- Oil weakness is dragging on European oil & gas names, while the likes of ExxonMobil and Chevron are trading markedly lower pre-market. This puts US futures on track for a lower open of 1.5-2.0% later today.

- Canadian CPI data for May is the focus going forward, with the Y/Y rate seen accelerating to 7.3% from 6.8% previously. Eurozone consumer confidence data also crosses as well as speeches from Fed's Powell - delivering his semi-annual testimony, Barkin, Evans and Harker.

FX OPTIONS: Expiries for Jun22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E594mln), $1.0580(E595mln), $1.0595-00(E714mln), $1.0630-35(E554mln), $1.0650-60(E760mln)

- USD/JPY: Y134.40-57($710mln)

- GBP/USD: $1.2245(Gbp738mln)

- EUR/GBP: Gbp0.8700(E570mln)

- USD/CAD: C$1.3020($550mln)

- NZD/USD: $0.6300(N$998mln)

- USD/CNY: Cny6.70($920mln)

Price Signal Summary - WTI Futures Trade Through The 50-Day EMA

- In the equity space, S&P E-Minis trend readings remain bearish and short-term gains are still considered corrective. Moving average studies are in a bear mode condition and recent fresh cycle lows point to a continuation of the downtrend. The focus is on 3600.00 next. Initial resistance is at 3843.00, the Jun 15 high. EUROSTOXX 50 futures remain vulnerable despite recent gains. Recent weakness reinforced bearish conditions and the contract is trading lower today. Attention is on the 3300.00 handle next. 3567.00 is first resistance, Jun 16 high.

- In FX, the EURUSD outlook is unchanged and conditions remain bearish. Short-term gains are still considered corrective and the focus is on weakness towards 1.0350, the May 13 low and bear trigger. Initial firm resistance is at 1.0601, the Jun 16 high. GBPUSD continues to trade above last week’s low. The primary trend is down and attention is on 1.1934, Jun 14 low and the short-term bear trigger. Resistance to watch is unchanged at 1.2406, the Jun 16 high. USDJPY broke to new cycle highs Tuesday. The break higher confirms a resumption of the primary uptrend and maintains the bullish price sequence of higher highs and higher lows. The focus is on 136.88 next, the Oct 30 1998 high. A bull channel is also evident on the daily chart - drawn from the Mar 4 low. The top, at 139.07, is a near-term objective too.

- On the commodity front, a bearish threat in Gold remains present. The focus is on $1787.0, May 16 low where a break would resume the downtrend. Key trendline resistance to watch is at $1881.6. The trendline is drawn from the Mar 8 high and a breach would instead highlight a bullish development. In the Oil space, WTI futures are trading on a softer note. The contract has cleared support at the 50-day EMA. The break lower has opened $100.66, the May 19 low. A breach of this level would pave the way for a move towards $95.47, the May 11 low. Initial firm resistance is seen at $116.58, the Jun 17 high.

- In the FI space, Bund futures primary direction remains down and the focus is on the 140.00 psychological handle. Recent consolidation appears to be a bear flag, reinforcing the downtrend. Gilts remain in a downtrend and short-term gains are considered corrective. A resumption of weakness would refocus attention 109.89, Jun 16 low and the near-term bear trigger.

EQUITIES: Tuesday's Gains Swiftly Retreat

- Asian markets closed weaker: Japan's NIKKEI closed down 96.76 pts or -0.37% at 26149.55 and the TOPIX ended 3.55 pts lower or -0.19% at 1852.65. China's SHANGHAI closed down 39.517 pts or -1.2% at 3267.202 and the HANG SENG ended 551.25 pts lower or -2.56% at 21008.34.

- European stocks are down sharply, with the German Dax down 269.73 pts or -2.03% at 13033.41, FTSE 100 down 91.81 pts or -1.28% at 7060.73, CAC 40 down 109.5 pts or -1.84% at 5857.06 and Euro Stoxx 50 down 67.54 pts or -1.93% at 3428.96.

- U.S. equities are retracing Monday's gains, with the Dow Jones mini down 406 pts or -1.33% at 30119, S&P 500 mini down 58.75 pts or -1.56% at 3709, NASDAQ mini down 204.5 pts or -1.77% at 11372.75.

COMMODITIES: Lower Across The Board On Recession Fears

- WTI Crude down $5.09 or -4.65% at $104.49

- Natural Gas down $0.14 or -2.07% at $6.668

- Gold spot down $6.36 or -0.35% at $1825.92

- Copper down $13.45 or -3.32% at $391.55

- Silver down $0.34 or -1.56% at $21.3244

- Platinum down $8.44 or -0.9% at $934.03

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/06/2022 | 1230/0830 | *** |  | CA | CPI |

| 22/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/06/2022 | 1300/0900 |  | US | Richmond Fed President Tom Barkin | |

| 22/06/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 22/06/2022 | 1440/1040 |  | CA | BOC Deputy Rogers "fireside chat" | |

| 22/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/06/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/06/2022 | 1730/1330 |  | US | Fed's Patrick Harker and Tom Barkin | |

| 23/06/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/06/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/06/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/06/2022 | 0600/0800 | ** |  | SE | PPI |

| 23/06/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/06/2022 | 0715/0915 |  | FR | Flash Manufacturing, Services PMI | |

| 23/06/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/06/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/06/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 23/06/2022 | 0800/1000 |  | EU | ECB Economic Bulletin | |

| 23/06/2022 | 0800/1000 |  | EU | Flash Manufacturing, Services PMI | |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/06/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 23/06/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/06/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 23/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/06/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 23/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 23/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/06/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.