-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBOJ Action Would Roil Global Stocks, Steepen Curves

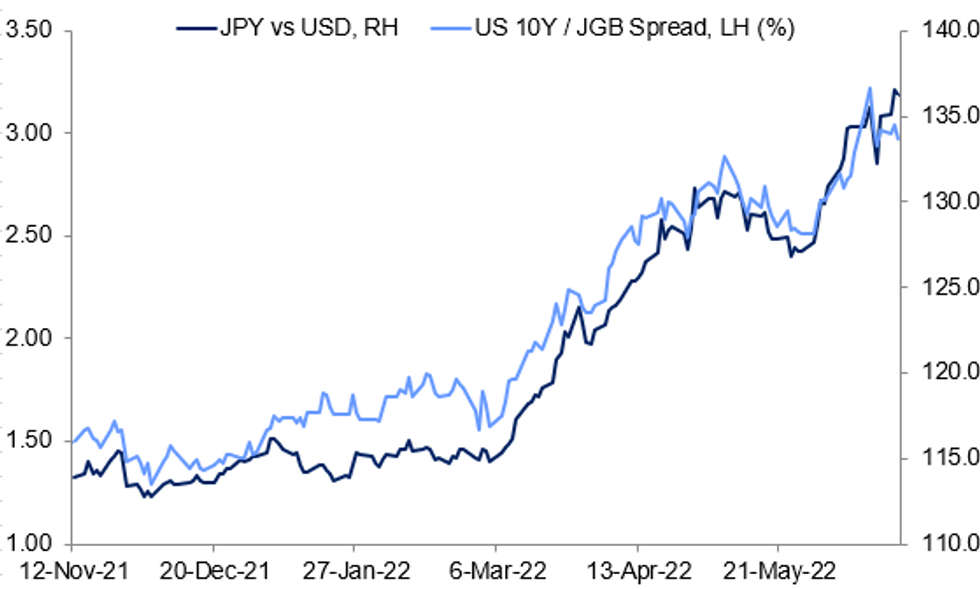

Per our Insight piece out earlier today: the Bank of Japan could adjust its easy monetary policy around the autumn if the yen stabilises at a lower level around 140 to the dollar, sending inflation to temporary peaks near 3% and driving wage hikes into 2023, MNI understands. That could involve adjusting yield curve control (currently the defended yield ceiling on 10Y JGBs is 0.25%).

- While our reporting points to a BOJ policy move further down the line (as our Insight headline suggests, only in autumn) and not immediately, we've had client questions about implications of potential hawkish BOJ policy shifts.

- In the case of unexpected intervention, or adjusting YCC, expect a big knee jerk move lower in the USD vs the yen (first key support comes in at 132.70/131.50 currently, vs 136.22 spot).

- Japanese stocks would sell off strongly, with global equities moving lower on the follow.

- Despite a risk-off move, global long-end yields would rise, with potential for bear steepening in tandem with JGBs. Even if the JGB employs just FX intervention and not YCC adjustment, there would be increasing speculation that the latter would be approaching.

- Likewise oil/industrial metal commodities would weaken as a negative growth impact would be anticipated (though a softer USD could mitigate some of the downside).

- Emerging Market assets would sell off sharply, in part because of the above global impact, and also because the yen is seen as a carry trade funder.

- The overall impact of an FX intervention would be sizeable for a short period of time but might not last, as unilateral interventions in the yen historically haven't worked for long. Abandoning YCC would have more lasting impact.

Source: BBG, MNI

Source: BBG, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.