-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Wide Range Of Payrolls Expectations

EXECUTIVE SUMMARY:

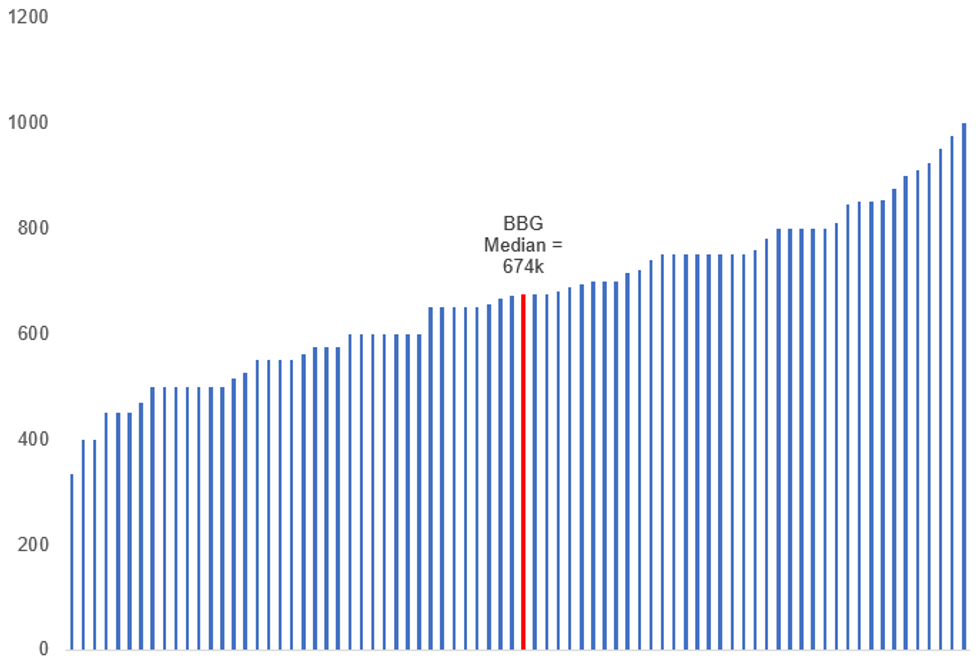

- U.S. NONFARM PAYROLLS SEEN +650K IN MNI DEALER MEDIAN; +674K BBG MEDIAN

- ...BUT LABOR SHORTAGE STILL HAMPERING JOB GAINS (MNI REALITY CHECK)

- HOUSE DEMOCRATS SEEK $547B FOR HIGHWAY, TRANSIT PROGRAMS

- BIDEN REVAMP OF TRUMP'S CHINA BLACKLIST LEAVES ROOM FOR DIALOGUE

Fig. 1: Wide Range Of Nonfarm Payroll Forecasts

Source: Bloomberg Survey, MNI

Source: Bloomberg Survey, MNI

NEWS:

US NONFARM PAYROLLS: The MNI dealer median for nonfarm payroll gains in May is +650k. Bloomberg survey median is +674k.

US NONFARM PAYROLLS (MNI REALITY CHECK): The pace of U.S. job growth improved in May, partially bouncing back from a weaker-than-expected April as the economy continued to recover and businesses opened closer to full capacity, although a shortage of available workers is still capping job gains, recruiters and industry experts told MNI. For full article contact sales@marketnews.com

U.S. (BBG): House Democrats are pushing climate-focused legislation that would authorize $547 billion over five years for surface transportation, including major funding increases for passenger rail, public transit, and carbon reduction.The bill, proposed Friday, both aligns with many of President Joe Biden's infrastructure goals and follows in his footsteps by calling for substantial infrastructure spending increases. The legislation "puts a core piece of President Biden's American Jobs Plan into legislative text," House Transportation and Infrastructure Chair Peter DeFazio(D-Ore.), who introduced the measure, said.DeFazio's committee will consider the bill June 9.

US/CHINA (BBG): U.S. President Joe Biden's "intentionally targeted" revamp of Donald Trump's order to ban investments in certain Chinese companies allows him to maintain a tough line on China in a way that still provides room for dialogue between the world's biggest economies. The amended order signed Thursday by Biden named 59 firms involved in China's defense and surveillance technology sectors, 15 more than were previously named on a Pentagon list of Chinese-military controlled companies that served as the basis for Trump's ban. Unlike the previous order, however, it doesn't affect the many subsidiaries of those firms.

CHINA/HONG KONG (BBG): Hong Kong activists planned private vigils and religious services to commemorate China's deadly Tiananmen Square crackdown in 1989, as a prominent organizer was arrested and thousands of police were deployed to prevent mass protests.Democracy proponents urged supporters to mark the event in any way they could, including turning on their lights at 8 p.m., after the government banned an annual vigil, citing coronavirus concerns. Police planned to deploy 7,000 personnel around the city Friday to enforce bans on gathering, including 3,000 to lock down the traditional vigil site at Victoria Park, local media including Radio Television Hong Kong reported.

CHINA/HUARONG (RTRS): China is pushing China Huarong Asset Management Co to sell non-core assets, two people involved in the revamp told Reuters, while considering offering an implicit guarantee of the liabilities of the debt-laden bad-debt manager.Regulators are pressing the state-controlled "bad bank", which has been trying to restructure since 2018, to sell units including a bank, a trust, an investment firm and a consumer finance firm, the sources said.

FRANCE/E.U./COVID (BBG): France will allow vaccinated travelers from the European Union to enter without showing negative Covid-19 tests starting June 9, a move designed to ease travel before the traditional summer holiday season.The looser rules unveiled Friday for one of the region's top destinations will organize countries into three categories, with visitors from so-called "green" nations accepted with proof of vaccination. These include all EU members as well as seven others ranging from Australia and Japan to Singapore and South Korea.

SWITZERLAND/BANKS (BBG): Swiss government says in statement "the liquidity requirements for systemically important banks should be adjusted."Analysis shows "liquidity requirements currently imposed on systemically important banks would probably not be enough to cover liquidity needs in an emergency or in a default event."

EUROZONE DATA: Europe's construction industry continues to recover from the Covid-19 pandemic across the euro area, led mainly by an increase in homebuilding, but costs are rising at the fastest pace on record, a survey released Friday shows.

DATA:

PREVIEW: Primary Dealer Nonfarm Payroll Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| UBS | 810K | Deutsche Bank | 800K |

| Citi | 760K | Goldman Sachs | 750K |

| Societe Generale | 750K | Amherst Pierpont | 700K |

| Nomura | 700K | Wells Fargo | 700K |

| Barclays | 675K | BMO | 650K |

| Daiwa | 650K | Morgan Stanley | 650K |

| Credit Suisse | 600K | Bank of America | 575K |

| HSBC | 550K | J.P.Morgan | 550K |

| NatWest | 550K | Mizuho | 500K |

| RBC | 500K | Scotiabank | 500K |

| TD Securities | 500K | BNP Paribas | 450K |

| Jefferies | 450K | ||

| Dealer Median | 650K | BBG Whisper | 790K |

MNI: EZ APR RET SALES -3.1% M/M, +23.9% Y/Y; MAR +2.7% M/M

MNI: EZ MAY CONSTRUCTION PMI 50.3; APR 50.1

BOND SUMMARY: Awaiting payrolls

After a brief move higher around an hour after the European open, core fixed income is now little changed on yesterday's close as the market eagerly awaits today's US employment report.

- Both the manufacturing and services ISM reports point to a more disappointing employment print, while ADP came in above expectations. Consensus today looks for 674k but we have even been asked questions about what the revised April print is likely to be as an illustration of how much focus there is on today's print.

- Outside of the US labour market report, US factory orders and a final print of durable goods orders are expected while Italy's sovereign debt rating is due to be reviewed by Fitch today and Germany's by DBRS.

- TY1 futures are unch today at 131-19 with 10y UST yields up 0.1bp at 1.628% and 2y yields up 0.5bp at 0.162%.

- Bund futures are up 0.07 today at 171.57 with 10y Bund yields down -0.4bp at -0.188% and Schatz yields up 0.3bp at -0.672%.

- Gilt futures are down -0.10 today at 126.77 with 10y yields up 0.2bp at 0.842% and 2y yields down -0.1bp at 0.082%.

FOREX: USD Mixed Pre-Payrolls, GBP Bouncing

- After a convincing late-Thursday rally, the USD is mixed headed into NY hours, with the USD index holding just above 90.50 and comfortably off last week's cycle lows.

- GBP is among the strongest in G10, with GBP/USD bouncing smartly off yesterday's lows. The rate eyes resistance at 1.4146 and 1.4185 before the cycle highs of 1.4248 can be challenged.

- JPY also trades firm, reversing recent underperformance. The medium-term trend remains bullish, with prices holding well north of the Y110 handle at pixel time.

- NOK and CAD are the weakest ahead of the NY crossover, with oil markets stalling ahead of cycle highs Thursday.

- The May jobs report takes focus going forward, with consensus seeing job gains of 674k jobs added across the month, pressing the unemployment rate lower by 0.2ppts to 5.9%. Markets may be gearing for a higher-than-consensus release, however, with the whisper number today at 800k.

EQUITIES: Holding Pattern Ahead Of US Payrolls

Asian stocks closed mixed, with Japan's NIKKEI down 116.59 pts or -0.4% at 28941.52 and the TOPIX up 0.49 pts or +0.03% at 1959.19. China's SHANGHAI closed up 7.633 pts or +0.21% at 3591.845 and the HANG SENG ended 47.93 pts lower or -0.17% at 28918.1.

European equities are a little lower, with the German Dax down 4.11 pts or -0.03% at 15661.73, FTSE 100 down 18.09 pts or -0.26% at 7066.19, CAC 40 down 6 pts or -0.09% at 6512.4 and Euro Stoxx 50 down 4.99 pts or -0.12% at 4082.22.

U.S. futures are also a touch lower, with the Dow Jones mini down 30 pts or -0.09% at 34537, S&P 500 mini down 0.75 pts or -0.02% at 4190.5, NASDAQ mini down 2.75 pts or -0.02% at 13527.

COMMODITIES: WTI Hovering Just Under $70 Mark

- WTI Crude up $0.33 or +0.48% at $69.18

- Natural Gas up $0.03 or +1.02% at $3.072

- Gold spot down $1.37 or -0.07% at $1873.38

- Copper up $0.55 or +0.12% at $446.45

- Silver down $0.04 or -0.15% at $27.3888

- Platinum down $7.35 or -0.63% at $1158.23

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.