-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Yields Rise With Biden Set To Unveil Stimulus

EXECUTIVE SUMMARY:

- BIDEN SET TO UNVEIL STIMULUS PACKAGE THURSDAY "IN BALLPARK OF $2TRN" (CNN)

- MCCONNELL HOLDS TRUMP'S FATE AS IMPEACHMENT HEADS TO SENATE

- ITALY'S CONTE FIGHTS TO RETAIN POWER AFTER JUNIOR ALLY QUITS

- GERMANY'S ECONOMY CONTRACTS 5.0% IN 2020

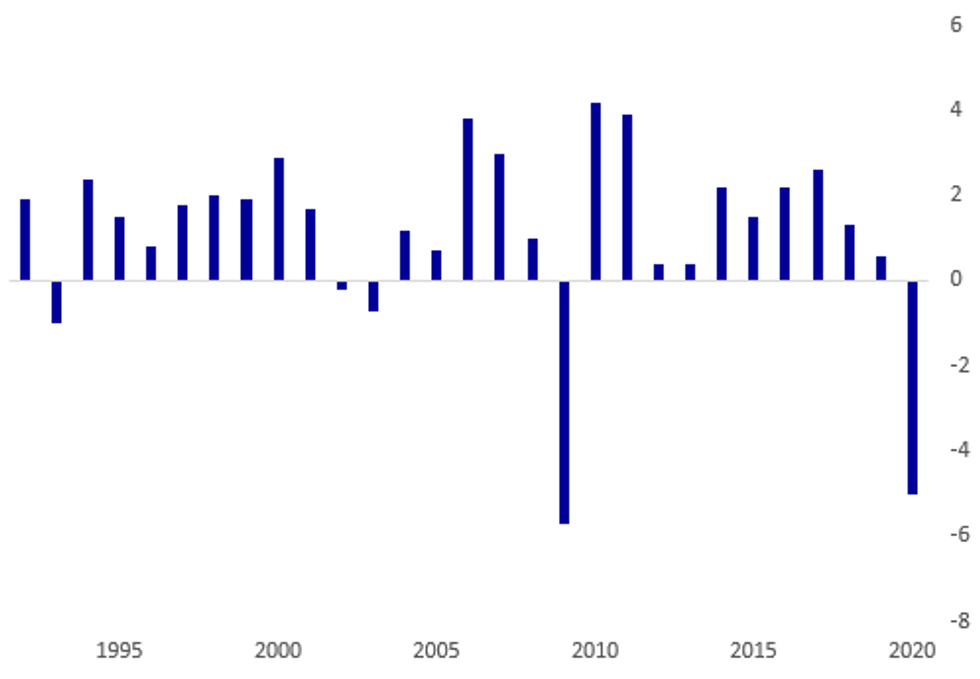

Fig. 1: Bad Year For German Economy (GDP % Chg)

BBG, MNI

BBG, MNI

NEWS:

U.S. (CNN): President-elect Joe Biden is expected to unveil a major Covid-19 relief package on Thursday and his advisers have recently told allies in Congress to expect a price tag in the ballpark of $2 trillion, according to two people briefed on the deliberations. The Biden team is taking a "shoot for the moon" approach with the package, one lawmaker in close contact with them told CNN, though they added that the price tag could still change. The proposal will include sizable direct payments to American families, significant state and local funding -- including for coronavirus vaccine distribution and other emergency spending measures -- to help those struggling during the pandemic. Biden is set to announce the details of his plan in Wilmington, Delaware, Thursday evening.

U.S. (BBG): President Donald Trump's unprecedented second impeachment heads to the Senate, where his fate rests with Republican leader Mitch McConnell, who now has more leverage than ever over the president in his final week in office. McConnell told Republican colleagues in a letter Wednesday he would block starting an impeachment trial before Joe Biden takes office Jan. 20 and control of the Senate shifts to Democrats.But he also said he has not yet made up his mind on whether to vote to convict Trump of inciting an insurrection that left five dead and damaged the Capitol, including the Senate chamber where he has spent much of the past 36 years.

ITALY (BBG): Italian Prime Minister Giuseppe Conte is struggling to hold onto power after a junior partner in his coalition pulled out, robbing him of his majority in parliament.Former Premier Matteo Renzi said Wednesday night that ministers from his Italy Alive party would quit the cabinet, attacking Conte for failing to do enough to tackle the country's problems. Though the party is tiny, Conte relied on it to maintain his majority. Conte may seek a confidence vote in parliament next week, newspapers including la Repubblica reported.

FED (MNI EXCLUSIVE, REPEAT INTERVIEW FROM LATE WEDS): Federal Reserve Bank of Philadelphia President Patrick Harker wants to see inflation heading above 2% before possibly dialing back asset purchases, calling for patience as the economic rebound from the coronavirus pandemic accelerates this year, he told MNI in an interview Wednesday. For full article contact sales@marketnews.com

GERMANY: The Covid-19 crisis led to a sharp contraction of Germany's economy in 2020, declining by 5.0% on an annual basis. After 10 years of expansion the pandemic triggered a decline in GDP almost as sharp as seen during the financial crisis of 2008/2009, when the economy contracted 5.7% in 2009, data showed. Destatis, the German stats office, noted that the industrial sector, which accounts for just over a quarter of the total economy, saw output fall by 9.7% on an annual basis. The industrial sector was particularly affected by the pandemic in H1.

U.K. (BBG): First Minister Nicola Sturgeon's Scottish National Party is set to win a majority at May's election to Scotland's devolved parliament in Edinburgh, according to a Savanta Comres poll for The Scotsman newspaper. Support for Scottish independence largely unchanged at 51% when undecided voters are included, poll shows.

EUROZONE DATA: House prices rose in Q3 on an annualized basis, rising 5.2% y/y the latest House Price index from Eurostat shows. Across the eurozone, prices rose 4.9% y/y, just shy of the 5.1% growth seen in Q1, largely ignoring any economic damage from the Covid-19 pandemic.

CHINA: Preparation for and ratification of the Regional Comprehensive Economic Partnership (RCEP), the trade deal recently signed with 15 countries in Asia Pacific, will be concluded in six months, China's Ministry of Commerce said Thursday. China started the ratifying process in December, Gao Feng, a spokesman for the ministry, said on Thursday at the regular briefing, noting it was now an ongoing process.

DATA:

No key data released in the European morning.

FIXED INCOME: US stimulus and Italian politics the talking points

US fiscal stimulus and the Italian political situation remain the biggest talking points in markets.

- Treasuries saw a decent pullback yesterday on the back of a CNN report that stimulus could be as much as USD2trn. However, we have since drifted a bit higher and remain above the levels seen at this time yesterday.

- Renzi has pulled the support of his party from the Italian government. As our political risk team have pointed out, this doesn't necessarily mean there will be snap elections soon. However, the risk of elections has clearly increased and we have seen BTPs react accordingly.

- TY1 futures are down -0-4+ today at 136-20 with 10y UST yields up 2.7bp at 1.111% and 2y yields up 0.3bp at 0.148%.

- Bund futures are up 0.06 today at 177.42 with 10y Bund yields down -0.7bp at -0.530% and Schatz yields down -0.5bp at -0.715%.

- Gilt futures are down -0.02 today at 134.19 with 10y yields up 0.1bp at 0.307% and 2y yields down -0.2bp at -0.117%.

FOREX: JPY Offered as Stimulus Plans in View

JPY's comfortable the poorest performer across G10 early Thursday, with markets selling haven currencies in response to reports that President-Elect Biden could table a fresh stimulus package amounting to as much as $2trl. Attention now shifts to a speech due Thursday evening for more details on his "shoot for the moon" approach to policy-making.

The greenback initially benefited from the stimulus news, but has been sold since, although yesterday's lows are still a way off from here.

SEK is retracing the Wednesday losses to outperform most others, while AUD and NZD are also seeing decent strength.

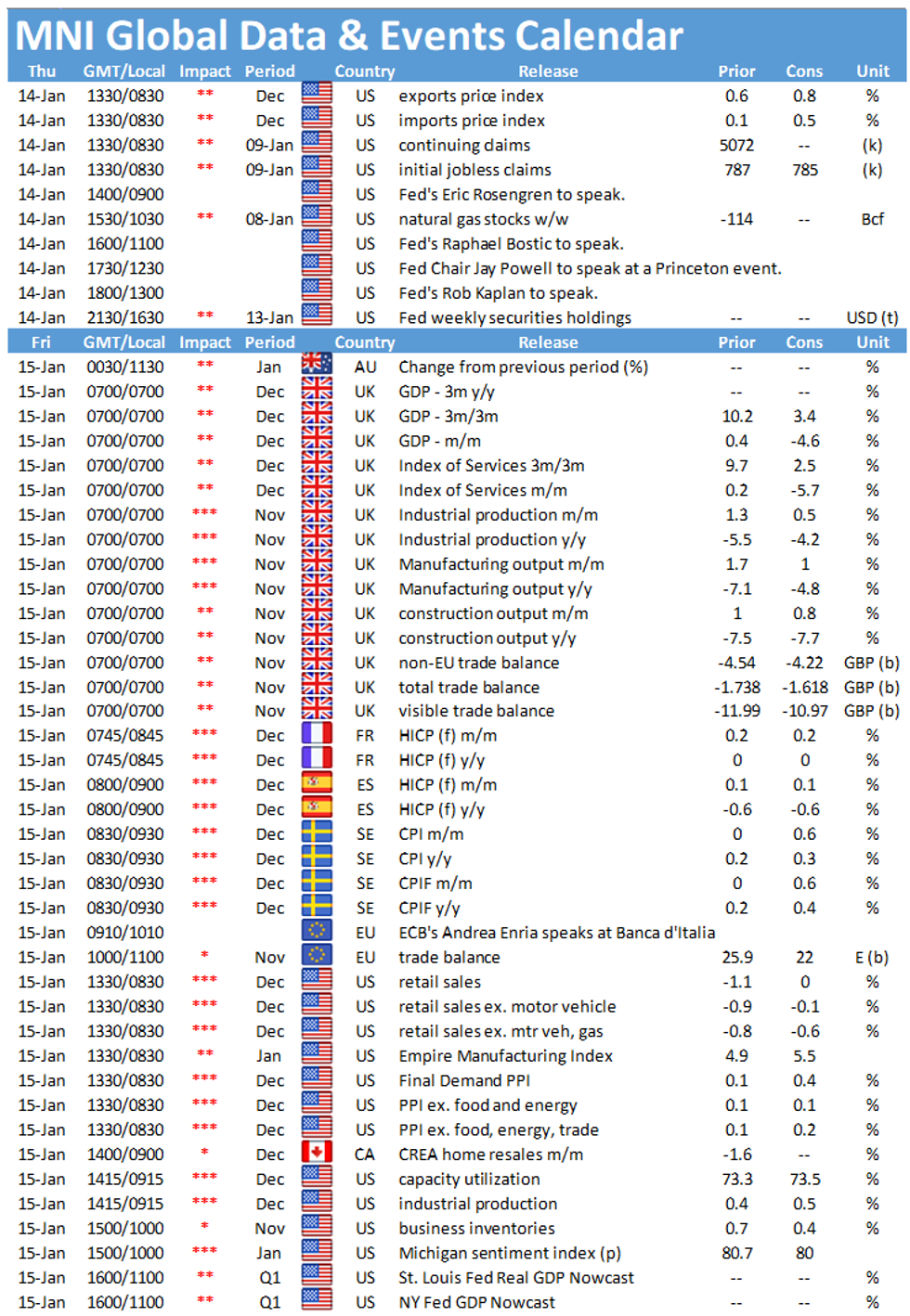

Weekly jobless claims data and import/export price indices are the data highlight. Speakers include Fed's Rosengren, Bostic, Powell and Kaplan all due to cross later today.

EQUITIES: Tech Lagging Broader Gains

- Asian stocks closed mixed, with Japan's NIKKEI up 241.67 pts or +0.85% at 28698.26 and the TOPIX up 8.88 pts or +0.48% at 1873.28. China's SHANGHAI closed down 32.747 pts or -0.91% at 3565.905 and the HANG SENG ended 261.26 pts higher or +0.93% at 28496.86.

- European equities are higher, with the German Dax up 71.28 pts or +0.51% at 13980.96, FTSE 100 up 43.96 pts or +0.65% at 6765.6, CAC 40 up 26.4 pts or +0.47% at 5670.6 and Euro Stoxx 50 up 21.78 pts or +0.6% at 3631.79.

- U.S. futures are mixed, with the Dow Jones mini up 109 pts or +0.35% at 31068, S&P 500 mini up 7.5 pts or +0.2% at 3811.25, NASDAQ mini down 28.5 pts or -0.22% at 12943.5.

COMMODITIES: Metals Mixed As Dollar Weakens

- WTI Crude down $0.03 or -0.06% at $53.1

- Natural Gas up $0.04 or +1.36% at $2.771

- Gold spot down $5.2 or -0.28% at $1841.8

- Copper up $0.6 or +0.17% at $361.85

- Silver down $0.08 or -0.33% at $25.2681

- Platinum up $11.96 or +1.09% at $1105.26

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.