June 03, 2024 18:59 GMT

MNI UST Issuance Deep Dive: June 2024

May saw the long-awaited Treasury buyback program unveiled, as well as weak auctions of short-end coupon instruments.

EXECUTIVE SUMMARY:

May Refunding Review: Coupon Sizes Steady; Buybacks Begin

- Treasury’s Quarterly Refunding process for the May-Jul quarter brought limited surprises, with borrowing estimates on the high side of expectations, but nominal coupon sizes left unchanged. The key highlight was the long-awaited unveiling of buybacks for liquidity and cash management purposes.

- Treasury conducted its first buyback operation at the end of May. MNI will now review Treasury's buyback operations of the previous month in our Deep Dives, along with a schedule of upcoming operations.

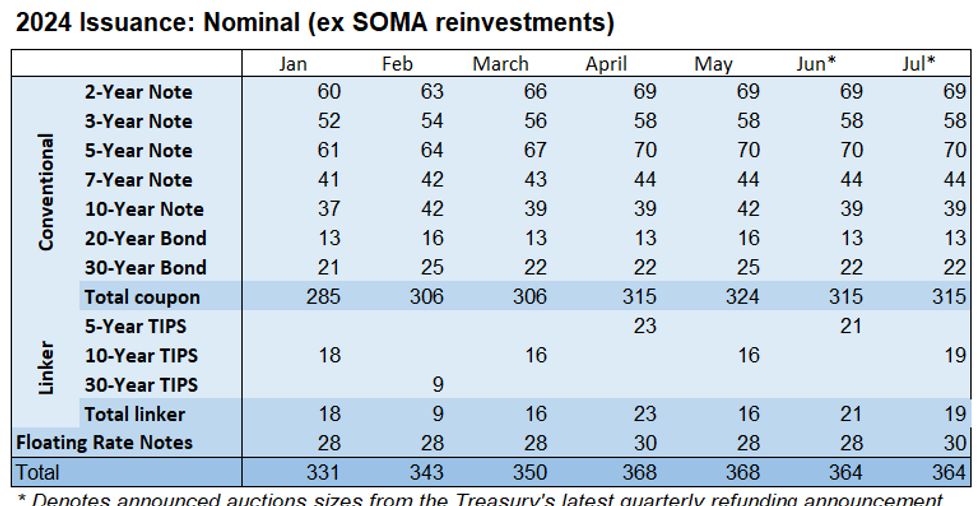

- June is projected to see $315B in nominal Treasury coupon sales, in addition to $21B 5Y TIPS and $28B FRN for a total of $364B (Apr/May: $368B, Jul: $364B expected).

- This month’s coupon auctions begin on June 10 with $58B (expected) of 3Y Note. MNI’s Treasury / Bill issuance calendar is regularly updated at this link.

- May’s coupon auctions were particularly weak for instruments at the short end of the curve, per MNI's Relative Strength Indicator.

Please see PDF for full analysis:

MNI_US_DeepDive_Issuance_2024_05.pdf

184 words