July 26, 2024 13:17 GMT

Moderate Consumption Continues As Real Income Growth Stays Soft

US DATA

DataHomepagemarkets-real-timeFixed Income BulletsData BulletBulletMarketsEmerging Market NewsForeign Exchange Bullets

Personal income and spending growth was mixed versus expectations in June, though spending especially remained relatively solid overall in 2Q when considering upward revisions to prior months.

- Personal income grew by 0.2% M/M, below the 0.4% expected and with downward revisions to the prior two months (May 0.4% and April 0.2%, each revised down 0.1pp). Disposable personal income (personal income less personal current taxes) growth figures were identical to those.

- Personal spending growth came in line with expectations at 0.3% M/M, though this marked a better-than-foreseen result given an upwardly revised May (0.4% rev from 0.2%) and April (0.2% from 0.1%).

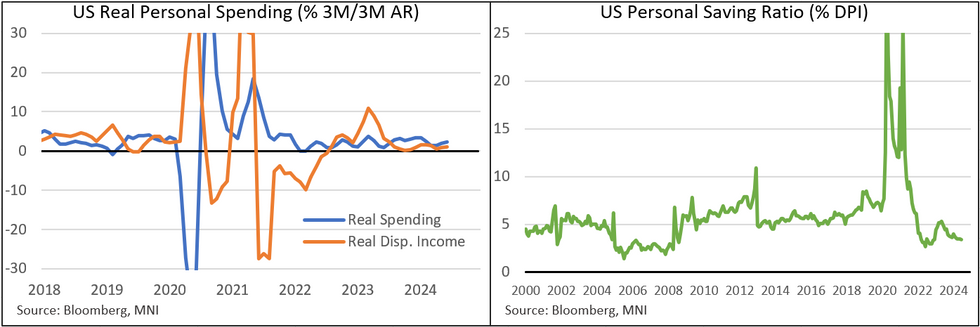

- The combination of these changes and slight upward PCE inflation revisions to prior left real disposable personal income growth at 0.1% in June, vs 0.3% in May (down rev from 0.5%) and -0.1% in April (down rev from 0.0%), and real PCE expenditure growth at 0.2% vs 0.4% M/M in May (rev from 0.3%) and -0.1% in Apr (unrev).

- The 0.2% real personal expenditure growth comprised a 0.2% rise in each of goods and services. This was a 4-month high (unrounded) for services spending, though goods pulled back sharply from +0.9% prior.

- The more-solid-than-expected real consumption figures were presaged by the prior day's release of a 2.3% Q/Q ann. real PCE growth figure in the first reading of Q2 national accounts (2.0% had been expected), which contributed the lion's share of GDP growth. Real consumption has thus improved in Q2 from 1.5% in Q1, though is cooler than the the 3.2% average in 2H23.

- Activity in the report can best be described as "moderate", but we note some slowly building cracks in the consumer story as the soft real income growth above suggests:

- The personal saving rate of 3.4% was down from 3.5% in each of the prior 3 months (May was downwardly revised from what had been a 4-month high 3.9%) and the lowest since December 2022. Total income growth is now running at 4.1% 3M/3M annualized, the slowest since January, with wages and salaries softening.

342 words