-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

New PM To Face Difficult First Month As Public Turns On Handling Of Economy

Latest opinion polling from Redfield and Wilton Strategies shows public approval of the gov'ts handling of the economy plummeting as inflationary pressures take their toll on household finances.

- Government Policy Net Approval Ratings (21 August): Coronavirus Pandemic +12% (–), Defence +2% (-2), Foreign Policy -8% (-3), Education -11% (-2), Housing -26% (-7), Immigration -26% (-2), The NHS -29% (-7), The Economy -34% (-12). Changes +/- 14 August. 2,000 respondents

- Top of the list of issues for the incoming PM will be addressing these declining ratings, with the Conservatives having previously campaigned hard on the party's claims of economic credibility.

- The new PM comes into office on 5 September succeeding Boris Johnson, who has intentionally not made any major policy moves this summer, instead stating that significant decisions will be left to the next leader.

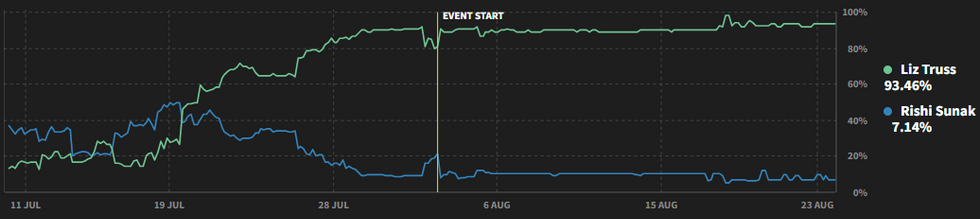

- Polling and betting markets show Foreign Secretary Liz Truss as the strong favourite to win the Conservative Party leadership contest over former Chancellor Rishi Sunak. Truss is given a 93.5% implied probability of winning according to data from Smarkets.

- The sharp decline in public approval of the gov'ts handling of the economy will likely see some form of rapid action to address the slide once the new administration arrives at 10 Downing Street. In the likely event it is Truss that becomes PM it is unclear, though, what this action could be, as during the campaign she has talked down the idea of 'handouts' to support households dealing with rising expenditures.

Source: Smarkets

Source: Smarkets

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.