-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessNZGBS: Firmer Post-CPI, Although Curve Steepens As Day Wears On

Q4 CPI (in both headline and the underlying non-tradables form) undershot RBNZ expectations, allowing NZGBs to add to the early richening that was derived from moves in wider core global FI markets. The RBNZ’s own sectoral factor model inflation print ticked higher.

- All 3 of the Y/Y metrics outlined above remain comfortably above the RBNZ’s inflation target.

- Firmer than expected Australian inflation crossed in the time between the domestic inflation prints, which introduced some trans-Tasman impetus and meant that it wasn’t a one-way session, with a steepening bias developing on the curve.

- The major cash NZGB benchmarks finished. Little changed to 7bp richer, with the longer end finishing over 10bp off richest levels.

- Swap rates were 2-13bp lower, also steepening, with 2-Year swap rates hovering just above YtD lows.

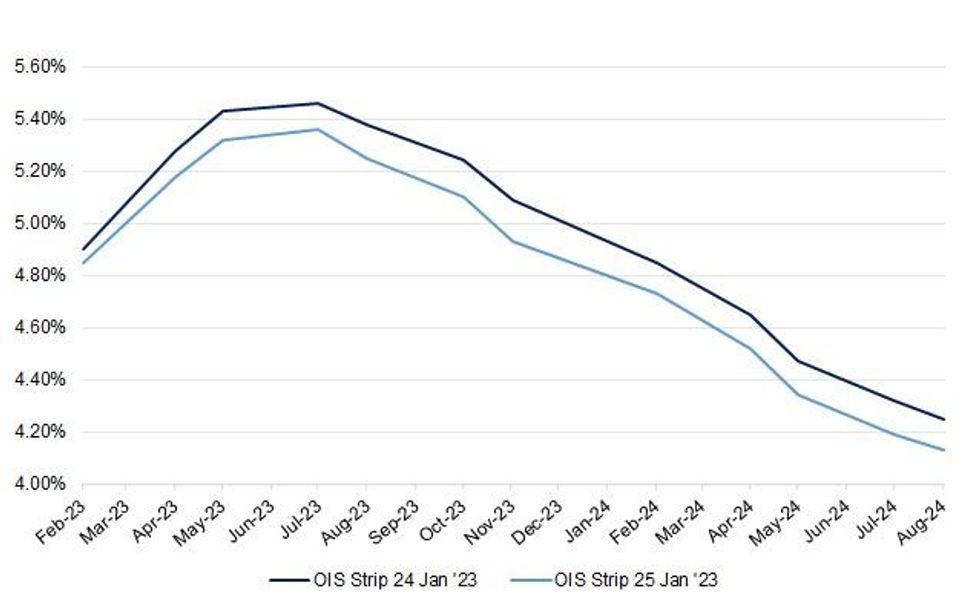

- RBNZ dated OIS initially shifted lower on NZ CPI data, before pulling off session lows in the wake of the Australian data (see the chart below for the intraday change observed on the strip).

- When it comes to the “Big 4,” ANZ & Westpac now look for a 50bp OCR hike next month (from 75bp prev.), while ASB & BNZ still look for a 75bp step (they acknowledge the chance of a 50bp move). The OIS strip prices in 60bp of tightening for next month’s meeting.

- Looking ahead, tomorrow’s local docket is headlined by the weekly NZGB auctions, covering NZGB-27, -33 & -51.

Fig. 1: Change In RBNZ Dated OIS Strip Around NZ Q4 CPI Data

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.