June 17, 2024 13:17 GMT

OI Points To Sizeable Jump In Net Shorts In OAT Futures Last Week

OAT

A quick look at open interest data covering OAT futures shows a near 100K jump in OI last week, with the measure moving from a little below 412K to a little above 509K.

- ~91% (~89K) of last week’s adjustment higher in OI came on days that OAT futures settled lower (Monday, Tuesday & Thursday), with the remaining ~9% (~9K) coming on days that saw the contract settle higher (Wednesday & Friday).

- That points to a meaningful addition of net shorts on the week, with the well-documented French political uncertainty providing the key input.

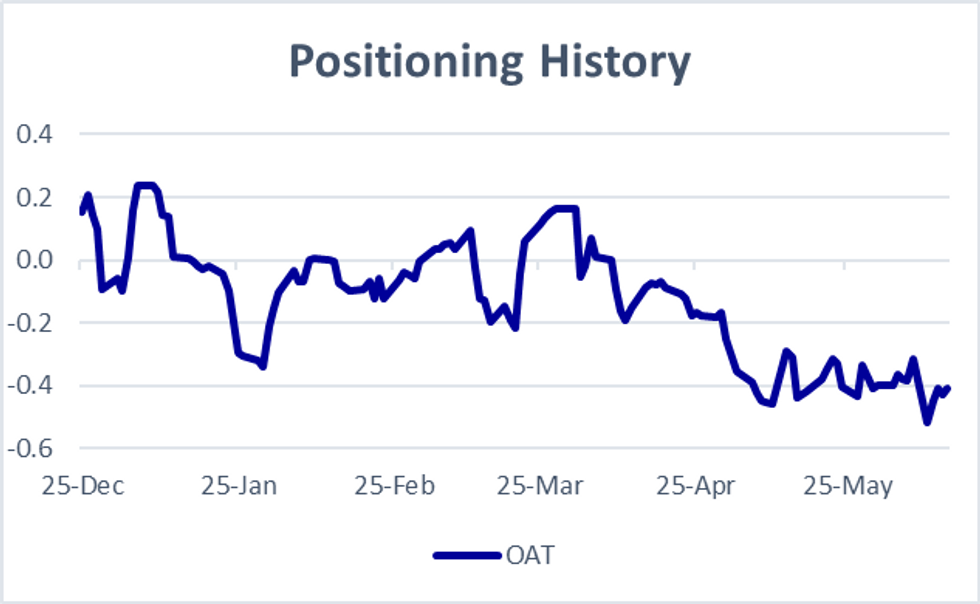

- Our positioning indicator (Pi) methodology already pointed to net short positioning in the contract, likely owing to pre-existing French fiscal worry.

- Source reports from both RTRS and BBG have played down the likelihood of ECB intervention in OATs at this juncture.

- Since then, ECB Executive Board members (Lagarde, de Guindos & Lane) have noted they are attentive when it comes to the situation, stressing that the market move is not viewed as disorderly at this stage.

- In effect, this shows that the ECB doesn’t like to meddle in market moves derived from domestic political matters and will only be willing to deploy its TPI mechanism if market moves are deemed to prevent the implementation of its monetary policy.

- If such disorderly moves did become apparent, the French fiscal situation would likely promote some differences in views within the ECB when it comes to deploying the TPI, especially with the EC likely to launch excessive deficit procedures against France later this week.

Fig. 1: MNI OAT Futures Positioning Indicator (Pi)

Source: MNI - Market News/Eurex/Bloomberg

Source: MNI - Market News/Eurex/Bloomberg

282 words