-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

Opposition Short Of Supermajority Only Bright Spot For Yoon & PPP

Seat totals from the 10 April legislative election show the main opposition liberal Democratic Party of Korea (DPK) and its allies have maintained their majority in the National Assembly, but even with outside support will fall short of the 200-seat 'supermajority' that would have given it sweeping powers in overriding presidential vetos and beginning impeachment proceedings.

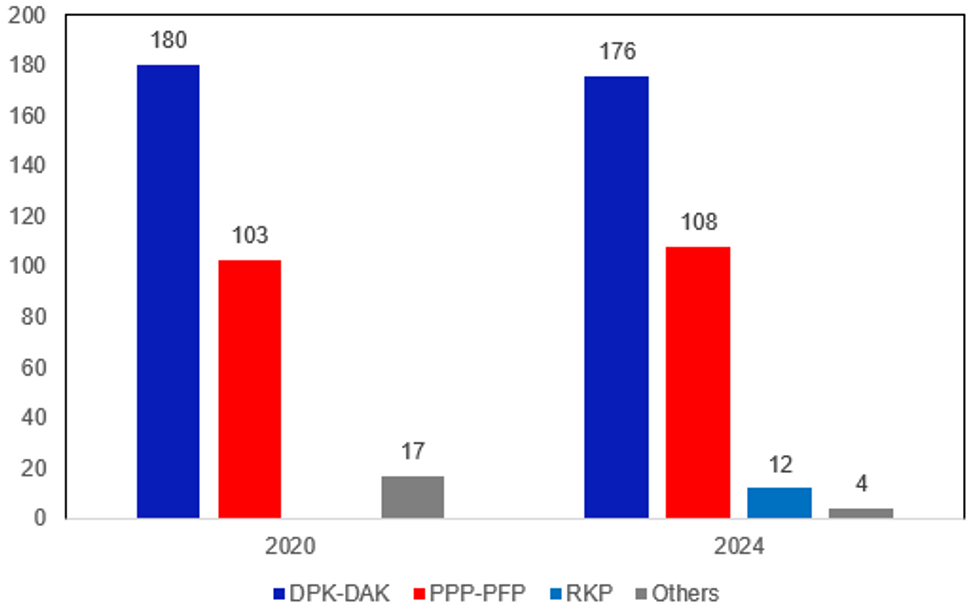

- The DPK-DAK has won 176 out of the 300 seats, down from 180 in the 2020 election. The conservative People Power Party (PPP), supportive of President Yoon Suk-yeol, won 108 seats, up from 103 in 2020. While the PPP numbers may appear to have improved from the last election, a small rump of minor party/independent lawmakers that usually aligned with the PPP has lost out.

- Instead 12 seats have been won by the liberal Rebuilding Korea Party (RKP) of former Justice Minister Cho Kuk. An agreement between the DPK and RKP would push the joint total above the 180-seat margin. This number is important as it would allow the opposition to overcome parliamentary filibusters from the PPP, speeding up the legislative process in their favour.

- Since the results came through, PM Han Duck-soo and all senior advisers to Yoon have offered their resignations, although it is yet to be confirmed whether the president has accepted the offer.

- The DPK falling short of a supermajority is the only bright spot for Yoon and the PPP. The president now faces a hostile legislature for the remainder of his presidential term running to 2027, limiting the prospect of any notable legislative 'wins' in areas such as tax cuts, reducing business regulation and expanding family support.

Source: KBS, NEC. DPK-DAK total includes Progressive Party and New Progressive Alliance seats.

Source: KBS, NEC. DPK-DAK total includes Progressive Party and New Progressive Alliance seats.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.