-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

£IG moves tighter YTD; strong compression in £HY continues

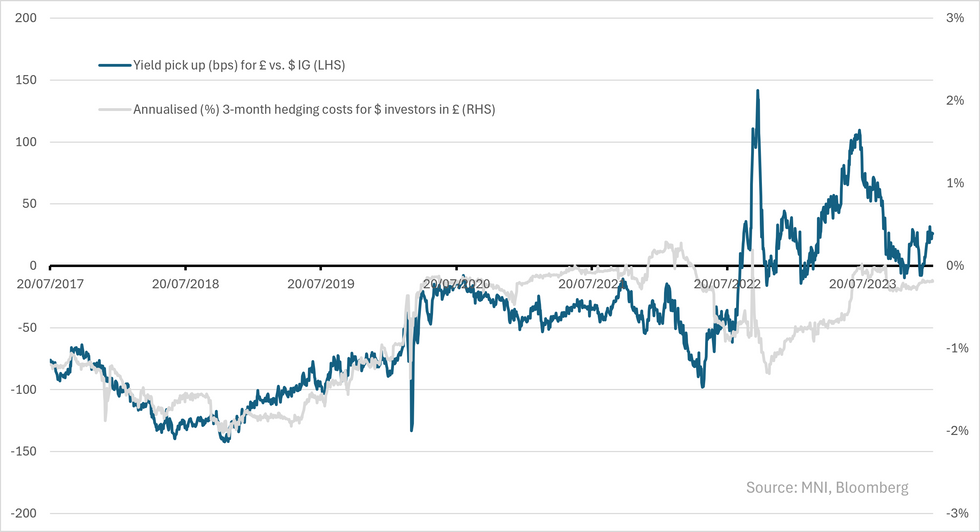

£IG has finally moved tighter YTD after lagging $/€ after its short-end priced out ~50bps of easing YTD - a sell-off that was passed in full to the 10yr giving a tailwind for credit yields that pushed another +25bps higher vs. $/€ YTD- $/£IG yields were at parity to the start year. As we mentioned yesterday the moves in yields haven't provided support for spreads - we saw some signs of that reversing yesterday with £IG/HY moving -1.8/-10bps tighter - a move that came in the face of rates that finished +4 higher (+7 intraday peaks). Spreads against $ still remain elevated vs. pre-covid avg's at +44bps but are well below historical avg's in € - at the headline level hard to explain these moves - hedging costs are higher for € investors vs. that period (were referencing 3-month forwards) & for $ investors FX points have been volatile but generally cheaper than now. More fundamental measures don't provide much clarity either - we see a pick up in weighted index leverage but median leverage in the index (less volatile) has held flat & below pre-covid Avg's.

Perhaps more interesting is aggressive compression in £HY despite rising rates alongside a still -40bp 2s10s inverted yield curve that's implying shifting inflation expectations not growth. IG/HY was spread at +400bps late last yr - that's narrowed that to 235bps now - we mentioned the £HY index is smaller (97 bonds/£40b outstanding) exposing it to idiosyncratic moves - but fundamentals we've run on indices don't explain much for the moves (median ICR's moved higher recently though from a historically low levels & weighted ICR's look flat) - though our calc's (for £) doesn't capture forward looking expectations for earnings & their impact.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.