-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

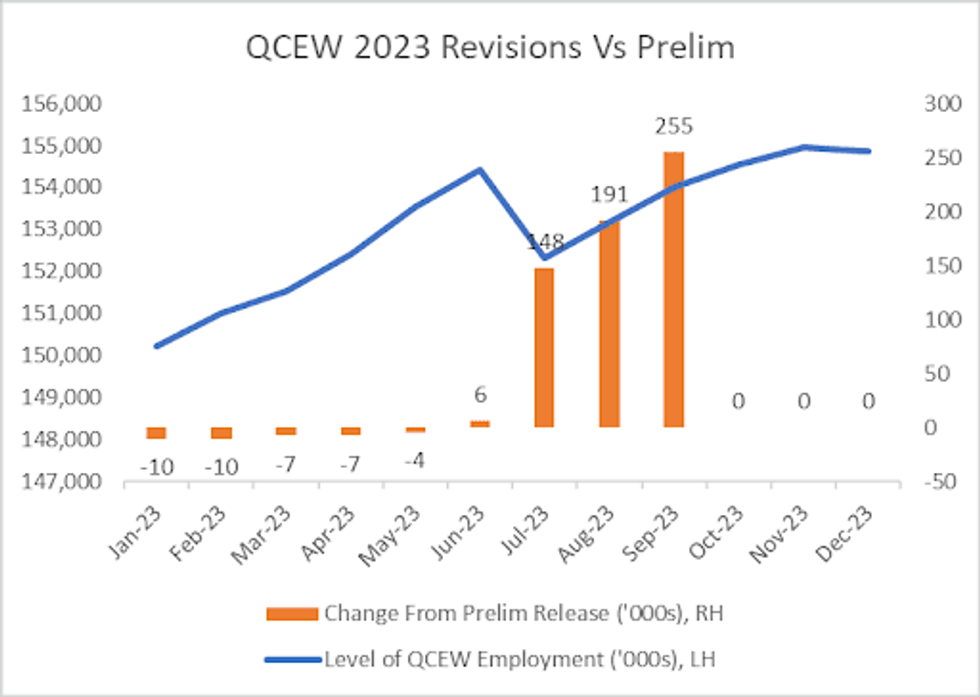

Free AccessQ3'23 QCEW Jobs Revised Up, Slightly Lower Downside NFP Revision Risks

A note on the Quarterly Census of Employment and Wages (QCEW) revisions released this morning:

- Revisions were made to Q1 through Q3 2023, but the Q4 job estimates were completely unchanged - the BLS tells MNI that Q4 will only be revised in subsequent releases. That puts attention squarely on August's release of Q1 2024 prelim data, which also provides the initial basis for the annual benchmarking of nonfarm payrolls in early 2025.

- More specifically, the level of QCEW employment in Q1 and Q2 was revised slightly lower, with Q3 revised sharply higher (255k more employed in Sept 2023 at 154.028m vs an original 153.773m estimate), but then Oct/Nov/Dec are unchanged, with Dec levels staying at 154.848m.

- Put another way, the overall end-2023 numbers remain the same: QCEW job gains through 2023 as a whole were 2.323m (unrevised), compared with overall NFP gains of 3.013m, or a 193.5k monthly pace vs 251.1k pace.

- It stands to reason that the Jul-Sep upward revisions suggest that QCEW presents less of a downside risk to the Establishment survey payrolls numbers when they are revised, if they translate into a higher end-2023 QCEW level overall. But we will have to wait a few more months to find out.

- For what it's worth, there have been upward revisions to the level of employment in September in each of the last 6 years in the 1st to 2nd reading. and each time, the 2nd reading of Q4 employment has subsequently been revised up. (In 2022, Q3 was revised up by 258k, with the subsequent Q4 revision being +207k).

- So it seems likely from this standpoint that that there will be an upward revision to the Q4 estimate - which should reduce the gap with the nonfarm payrolls reading.

Source: BLS, MNI Calculations

Source: BLS, MNI Calculations

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.