-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessRecessionary Report, But Services Prices Still Look Stubborn (3/3)

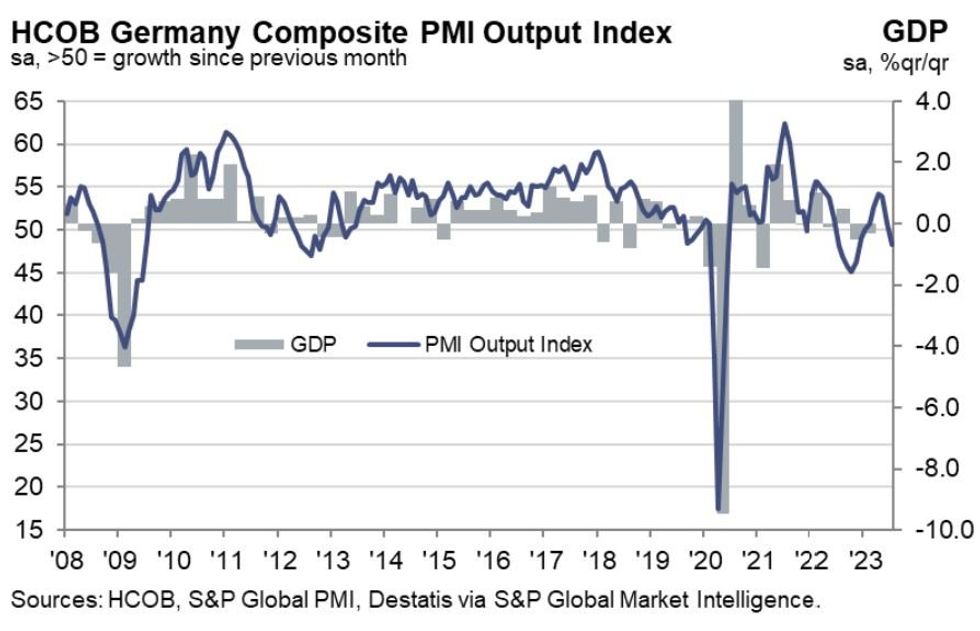

German Manufacturing activity contracted sharply per the July flash PMI reading of 38.8, which was well below the 41.0 expected and the 40.6 prior. Services also decelerated to 52.0 vs 53.1 expected (and 54.1 prior), with composite well into sub-50 territory at 48.3 vs 50.6 prior.

- While the Composite reading was merely an 8-month low, and Services a 5-month low, Manufacturing's slump represented a 38-month low with production falling at the fastest rate since May 2020 "amid rapidly declining demand for goods" (per the HCOB / S&P Global report).

- The Services outlook wasn't positive either: new business fell for the first time in 6 months and overall composite new orders posted the worst reading in 3 years amid a range of demand-hampering factors including " customer hesitancy, destocking, high inflation and rising interest rates".

- With backlogs declining quickly, expectations toward future activity were the worst since December 2022, and employment growth slowed to the joint-weakest in 2.5 years (Services hiring slowed, while manufacturing jobs dropped outright for the first time since January 2021).

- The "good" news was a continued deceleration in price pressures. The bad news is that there is a divergence here between manufacturers and the services sector. Overall costs were the lowest in nearly 3 years, but this was due entirely to a sharp drop for manufacturing prices (both input and output), vs service sector costs accelerating vs June (again, both input and output).

- This is a recessionary set of data, with the report noting that “over the last few months, we have seen a jaw dropping fall in both new orders and backlogs of work, which are now declining at their fastest rates since the initial Covid wave at the start of 2020. This doesn’t bode well for the rest of the year".

- The wrinkle here is that services inflation looks more stubborn than that of goods, which somewhat complicates the ECB's assessment of the overall inflation dynamics amid a clearly weakening demand picture.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.