-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessResend - MNI EUROPEAN OPEN: Renewed China Property Concerns Weighs on Risk Appetite

*Updated for correct ACGBs Bullet

EXECUTIVE SUMMARY

- ECB’s VILLEROY SAYS FUEL WON’T AFFECT 2% INFLATION IN 2025 - FRANCE INTER RADIO

- EU TO PUSH FAIR TRADE RELATIONSHIP WITH CHINA - MNI BRIEF

- ROOM FOR FURTHER EASING LIMITED - PBOC’S LIU - MNI BRIEF

- WILDCARD DATA RAISES CHANCES OF RBNZ NOV HIKE - EX STAFF - MNI

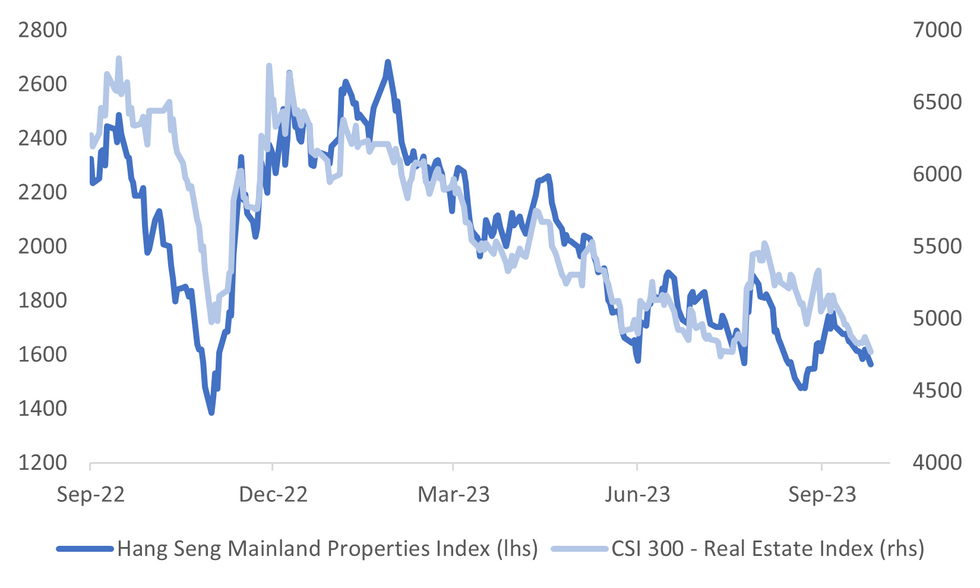

Fig. 1: China Property Stocks Remain Under Pressure

Source: MNI - Market News/Bloomberg

EUROPE:

ECB: The recent increase in oil prices won’t derail the European Central Bank’s fight to tame inflation, according to Governing Council member Francois Villeroy de Galhau. “We’re very attentive, but doesn’t put into doubt the underlying disinflation,” he told France Inter radio on Saturday. “Our outlook and engagement is to bring inflation to around 2% in 2025.” (FRANCE INTER RADIO)

EU/CHINA: The European Union will pursue “free and fair” trade relations with China, but it has no intention to decouple, said Valdis Dombrovskis, executive vice president at the European Commission on Saturday at the 2023 Bund Summit in Shanghai. “The EU needs to protect itself in situations when its openness is abused,” the EU trade chief said, noting the “unbalance” in the bilateral trade with China due to the €400 billion trade deficit last year. (MNI BRIEF)

GERMANY: The German government will put on indefinite hold plans to require more stringent building insulation standards, environment minister Robert Habeck told Reuters, an effort to help prop up the ailing building industry. The about-face from the German government comes ahead of a closely watched meeting between the building industry and government leaders with Chancellor Olaf Scholz on Monday to address a major slump in the sector. (RTRS)

FRANCE: France’s conservative Republicains and its allies were poised to retain a majority in Senate elections, indicating the political balance between President Emmanuel Macron and parliament won’t shift. Almost half of the chamber, or 170 seats, were up for grab. The Republicains said they expected to hold 143 or 144 seats, compared with 145 previously, Agence France-Presse reported. (BBG)

U.S.

GOVERNMENT: With just a week before Washington runs out of money to keep the federal government fully operating, warring factions within the Republican Party in the U.S. Congress on Sunday showed no signs of coming together to pass a stopgap funding bill. Congress so far has failed to finish any of the 12 regular spending bills to fund federal agency programs in the fiscal year starting on Oct. 1. (RTRS)

LABOR: Ford Motor (F.N) said on Sunday that despite progress in some areas, it still has "significant gaps to close" on key economic issues before it can reach a new labor agreement with the United Auto Workers union. The "issues are interconnected and must work within an overall agreement that supports our mutual success," it said in a late evening statement after talks over the weekend. (RTRS)

LABOR: Striking Hollywood screenwriters reached a tentative new labor agreement with studios including Walt Disney Co. and Netflix Inc. The Writers Guild of America, which represents more than 11,500 Hollywood scribes, said Sunday it had reached the deal with the Alliance of Motion Picture & Television Producers, the studios’ bargaining group. The agreement, if approved by the guild members, will end a strike that began on May 2. (BBG)

OTHER

JAPAN: Japan’s government will implement policies to boost take-home pay amount for some part-time workers as it tackles the labor shortage, the Yomiuri newspaper reports Sunday without saying where it obtained the information. (Yomiuri)

HONG KONG: Hong Kong is relaxing its mortgage rules for homes under construction, as the government takes further steps to support the city’s property market that’s been weighed by high borrowing costs. Eligible first-time home buyers can now pay just 10% down payment for properties under construction with values of up to HK$10 million ($1.3 million), Hong Kong Mortgage Corp. subsidiary said in a statement late Friday. Previously, buyers of such properties valued over HK$6 million could only obtain 70% loan-to-value ratio, resulting in higher down payment requirements. (BBG)

AUSTRALIA: The impact of a deeper economic deterioration in China will be mainly felt in Australia through weaker trade and reduced risk appetite in financial markets, Australian regulators said in a quarterly statement. “A sharp slowdown in China, were it to materialize, would principally transmit to Australia through trade channels and through an increase in risk aversion in global financial markets,” the Council of Financial Regulators said Monday. (BBG)

NEW ZEALAND: Stronger-than-expected employment or CPI data in October alongside Thursday’s solid GDP and elevated levels of government spending could force the Reserve Bank of New Zealand to raise its Official Cash Rate from 5.5% as soon as November, former Reserve officials told MNI. John McDermott, executive director at Motu Economic and Public Policy Research and former RBNZ assistant governor, said the central bank had failed to contain non-tradable inflation, while oil price spikes could again cause tradable and goods prices to rise. (MNI)

CHINA

TECH: Chinese President Xi Jinping called for enhancing the nation’s manufacturing sector with digital and information technologies to achieve high-quality development for “new industrialization,” Xinhua News Agency reports. (XINHUA)

PROPERTY: China Evergrande Group is running out of time to get what would be one of the nation’s biggest-ever restructurings back on track, after setbacks in recent days that raise the risk of liquidation. The string of surprise developments include scrapping key creditor meetings at the last minute, saying it must revisit its restructuring plan, detention of money management unit staff and an inability to meet regulator qualifications to issue new bonds. (BBG)

PROPERTY: A Chinese property investor that has struggled with several US projects faces court-ordered liquidation as a Bermuda court issued a winding-up order against the firm. China Oceanwide Holdings Ltd. disclosed the order in a Monday filing with Hong Kong’s stock exchange. Liquidators have been appointed and the company’s shares listed in the city have been suspended. The winding-up petition was filed in June 2022 and involved $175 million of loan principal that the petitioner said wasn’t paid, Oceanwide said at the time. The financing involves a pledged New York property and secured shares. (BBG)

POLICY: The economy has less room for further expansionary monetary and fiscal policies as M2 has largely outpaced GDP growth and fiscal pressure from local governments has increased, said Liu Shijin, member of the monetary policy committee at the People’s Bank of China on Sunday at 2023 bund Summit in Shanghai. (MNI BRIEF)

CONSUMPTION: China will move to ease regulation that hinders consumption to boost the economy as some controls in big cities have restricted demand for house and car purchases, said Ning Jizhe, a former vice head at the National Development and Reform Commission (NDRC) on Saturday at the 2023 Bund Summit in Shanghai. (MNI BRIEF)

GREEN TARGET: China should not set overly aggressive carbon emission reduction goals at the initial stage of its net-zero campaign to balance green-transition targets, GDP expansion and employment, while monetary authorities must do further research on the introduction of medium and long-term tools for net-zero growth, said Wang Xin, head of the research bureau at the People’s Bank, on Saturday during 2023 Bund Summit in Shanghai. (MNI BRIEF)

MORTGAGES: Chinese commercial banks will lower the existing mortgage rate for first-home buyers in batches on Sept 25, with an average reduction of 80bp nationwide. Lenders will not have to make any application and the new interest rate level will take effect on Monday. (YICAI)

YUAN: The yuan still has support to remain stable with the Chinese economy continuing to recover, though a likely strong U.S. dollar could tame any significant appreciation. A stronger central parity quotation of the yuan shows regulators’ determination to stabilise the currency, while offshore yuan liquidity continues to tighten with major Chinese banks absorbing USD from the swaps market and release them in the domestic spot market, said an unnamed foreign exchange trader. (CSJ)

ECONOMY: China can avoid a Japan-style balance-sheet recession by developing new growth drivers, according to Liu Shijin, former deputy director at the Development Research Center of the State Council. Speaking at the Bund Financial Summit, Liu said policymakers should implement supply-side measures to upgrade the value chain of existing industries and develop future industries driven by new technology. (YICAI)

CHINA MARKETS

PBOC Injects Net 135 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY319 billion via 14-day repo on Monday, with the rate unchanged at 1.95%. The operation has led to a net injection of CNY135 billion after offsetting the maturity of CNY184 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9735% at 09:28am local time from the close of 2.1957% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 43 on Friday, compared with the close of 47 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1727 Monday Vs 7.1729 Friday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1727 on Monday, compared with 7.1729 set on Friday. The fixing was estimated at 7.2977 by Bloomberg survey today.

MARKETS

US TSYS: Slightly Weaker In Asia-Pac Dealings, Narrow Ranges, Light News flow

TYZ3 is currently trading at 108-19+, -0-02+ from NY closing levels in early Asia-Pac dealings.

- Cash tsys are dealing flat to 2bp cheaper across major benchmarks beyond the 1-year. Newsflow has been light, with narrow ranges observed.

- Later today sees Chicago Fed Nat and Dallas Fed Manf. Activity Indices, along with Fedspeak from Kashkari.

JGBS: Futures At Tokyo Session Highs In the Afternoon Session, 40Y Supply Tomorrow

In the Tokyo afternoon session, JGB futures are sitting at a session high, +20 compared to settlement levels.

- Today the local calendar has been light, with Department Sales data due later. However, BOJ’s Governor Ueda will give a speech in Osaka at about 0830 BST, and Uchida will speak around an hour earlier.

- Local participants have ignored the slight cheapening in US tsys in the Asia-Pac session today, possibly focusing on the message contained in the BOJ’s ‘dovish hold’ on Friday ahead of today’s BOJ-speak. Cash US tsys are dealing flat to 3bps cheaper across major benchmarks.

- Cash JGBs are mixed, with yields 1.1bps lower (7-year) to 1.0bps higher (40-year). The benchmark 10-year yield is 1.1bps lower at 0.735% versus the cycle high of 0.756% set ahead of the BOJ policy decision on Friday. 40-year supply is due tomorrow.

- The swaps curve is richer out to the 20-year, with rates 0.7bp to 1.1bp lower. Swap spreads are generally tighter.

- Tomorrow the local calendar sees PPI Services data.

AUSSIE BONDS: Slightly Richer, Narrow Ranges, Light Local Calendar Until CPI Monthly On Wednesday

ACGBs (YM +2.0 & XM +2.5) are slightly richer, after dealing in relatively narrow ranges in the Sydney session. With the local calendar light today, local participants have likely sought direction from US tsys. Cash US tsys are dealing flat to 2bps cheaper across major benchmarks in Asia-Pac trade.

- Cash ACGBs are 3bps richer, with the AU-US 10-year yield differential unchanged at -15bps.

- Swap rates are 2-3bps lower.

- Bills pricing is +1 to +4 across the strip.

- RBA-dated OIS pricing is 2-4bbps softer for ’24 meetings.

- (Bloomberg) Australia is considering a “broader definition” of full employment. Monday’s white paper follows an independent review of the Reserve Bank that recommended the central bank give equal consideration to price stability and full employment in its decision-making. (See link)

- (AFR) Chris Richardson believes tax cuts will keep RBA on interest rate sidelines for longer. Noting that in less than 10 months’ time there is A$21 billion of personal tax cuts coming due. (See link)

- Today sees panel participation by RBA Assistant Governor Jones at a Conference on Financial Technology and Climate Change (0700 BST).

- The local calendar is light until the release of the CPI Monthly for August on Wednesday.

NZGBS: Closed On Session Bests, NZ-US 10Y Spread Unchanged

NZGBs closed at session bests, with benchmark yields 5bps lower. With the domestic calendar empty until ANZ Business Confidence on Thursday, the local market has tracked the performance of US tsys and ACGBs. NZ-US and NZ-AU 10-year yield differentials are unchanged versus the NZ close on Friday.

- Swap rates are 3-4bps lower, with the short-end implied swap spread wider.

- RBNZ dated OIS pricing is little changed, with terminal OCR expectations at 5.76%.

- Stronger-than-expected employment or CPI data in October alongside Thursday’s solid GDP and elevated levels of government spending could force the RBNZ to raise its Official Cash Rate from 5.5% as soon as November, former Reserve officials told MNI. John McDermott, executive director at Motu Economic and Public Policy Research and former RBNZ assistant governor, said the central bank had failed to contain non-tradable inflation, while oil price spikes could again cause tradable and goods prices to rise. (See link)

- Tomorrow the local calendar is empty.

- Later today sees Chicago Fed Nat and Dallas Fed Manf. Activity Indices, along with Fedspeak from Kashkari

EQUITIES: HK Shares Lower On Renewed China Property Woes, US Futures Tracking Higher

Regional Asia Pacific equity markets are mixed to start the week. Downside has been evident in terms of Hong Kong and China shares, amid renewed China property woes. This unwinds some of Friday's positive momentum in these markets. Some positive trends are evident elsewhere, most notably for Japan stocks. US equity futures are tracking higher at this stage, with Eminis +0.27% to 4373. With lows from late last week, sub 4360 intact. Nasdaq futures are slightly outperforming, +0.35%.

- A tentative agreement to end the Hollywood strike may be aiding US equity sentiment, although the auto strike continues, while US yields have recouped some of Friday's losses.

- Hong Kong equities opened flat, but this quickly gave way to renewed weakness. The HSI down 1.24%. A Bloomberg property sector gauge is down 6%, the most since Dec last year. Among the headwinds have been property developer Evergrande scraping a creditors meeting and revisiting its restructuring plan. China Oceanwide, which also has operations in real estate, will reportedly be wound up.

- China's CSI 300 is also lower, down -0.51% at the break. The real estate sub index down 2.13%. It is back close to July lows in index terms.

- Japan stocks are outperforming, the Nikkei +0.80% at this stage. The positive US futures backdrop little helping. The Taiex is +0.80%, likely helped by a better SOX trend from Friday US trade.

- South Korean shares are weaker though, the Kospi off by 0.55% at this stage.

- The ASX 200 is down slightly, while Malaysia and Thailand shares are weaker in SEA. Indonesia is around flat.

FOREX: USD Dips Supported, AUD and NZD Down On Weaker HK/China Equities

The BBDXY ranges have been relatively tight to start the week. We got to lows of 1257.21, but we now sit slightly higher for the session, last near 1258.33. AUD and NZD have underperformers, as Hong Kong and China equities have seen renewed weakness on property developer concerns.

- Helping the USD at the margin has been a slightly offered tone to USTs, with yields recouping some of Friday's losses. The 10yr sits +2bps higher to 4.455%, while the 2yr is down a touch.

- US equity futures have firmed as well, +0.28% for Eminis.

- This hasn't helped AUD or NZD a great deal though, with the weaker HK/China equity performance outweighing. Iron ore is also down. AUD/USD last tracked near 0.6425, -0.25% versus NY closing levels from Friday. NZD/USD is down to 0.5950, off by a similar amount.

- USD/JPY got to fresh highs near 148.50 in early trade, but had no follow through. We are back at 148.40 now. BoJ Governor Ueda will reportedly talk soon, followed by Deputy Governor Uchida. Ueda will be speaking in Osaka.

- Looking further ahead, the German IFO is tap, while Lagarde also speaks. In the US the Dallas Fed survey is due, while we also here from the Fed's Kashkari.

OIL: Little Changed in Asia-Pac After A Small Gain On Friday

Oil is little changed in the Asia-Pac session, after closing 0.4% higher on Friday. However, crude did relinquish some of the gains seen earlier in the day. The Baker Hughes’ rig count data showed rig numbers fall for the first time in three weeks to offer some upside (630, -11, of which oil 507, -8). Despite a mid-week spike, crude was down compared to the previous Friday, with WTI falling by around 80 cents/bbl.

- The US Coordinator for MENA Brett McGurk and Senior Advisor to the President for Energy and Investment Amos Hochstein emphasised the urgency of reopening the Iraq-Turkey pipeline as soon as possible, according to a White House e-mailed statement.

- Onshore crude inventories in China have been drawn down over the past three weeks to the lowest since mid-June according to data tracked by satellite firm Ursa Space Systems.

- Russia’s government expects the average price of its crude grades to average $71.30/bbl in 2024, up from an average of $63.40/bbl so far in 2023.

GOLD: Bullion Proved Resilient Despite A Higher USD, US Yields Lower

Gold is slightly weaker in the Asia-Pac session, after closing +0.25% at $1925.23 on Friday. Bullion proved resilient despite the climb in the USD, with the precious metal supported by a rally in US Treasuries.

- Traders slightly unwound bets on another rate hike this year on Friday, with key US inflation data due this week (PCE deflator on Thursday) set to show a deceleration.

- US Treasuries closed the week with a relief rally. Cash US Treasuries finished 3-6bps richer, with the belly outperforming. The 10-year yield touched a new 16-year high of 4.5064% before finishing 6ps lower at 4.43%. Friday's better close came despite ‘higher for longer’ messaging from Fedspeak, which reinforced the Fed’s "hawkish hold" earlier in the week. US Treasuries drew support after Flash PMI data came out mixed.

- Hedge funds boosted their bullish bets on gold to a six-week high, the latest CFTC data on futures and options show, further underscoring bets on a rate hike pause.

- According to MNI’s technicals team, resistance remains a way off at $1947.5 (Sep 20 high), the high shortly before the FOMC decision.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/09/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/09/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/09/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/09/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Lagarde speaks at ECON Hearing | |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Schnabel speaks at JHvT Lecture | |

| 25/09/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/09/2023 | 2200/1800 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.