-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

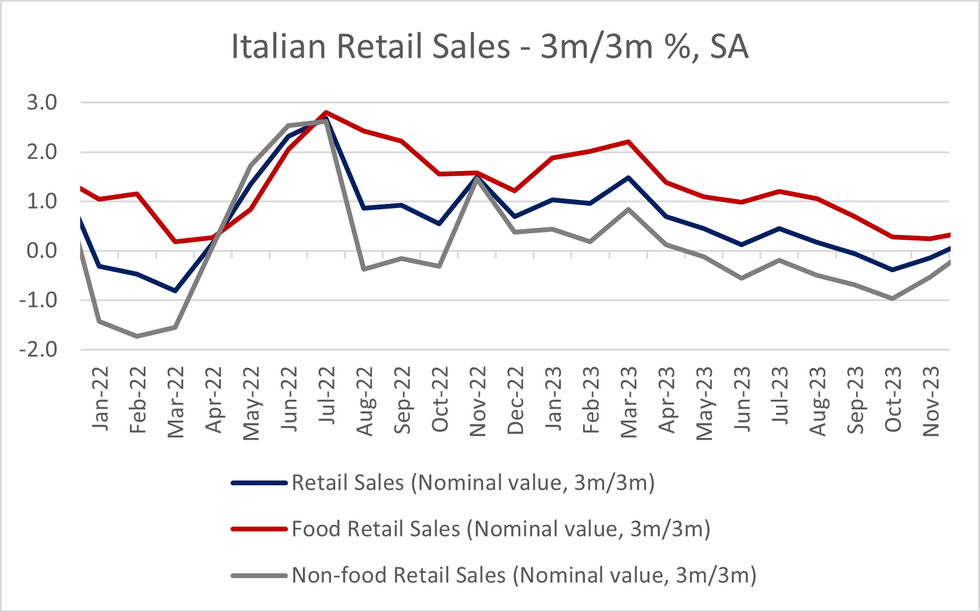

Free AccessRetail Sales Soften In December, But Surveys Point To Gradual Improvement Ahead

Italian retail sales (in nominal value terms) softened in December, falling -0.1% M/M SA (vs a -0.1pp downwardly revised +0.3% prior) and rising +0.3% Y/Y NSA (vs a -0.1pp downwardly revised +1.4% prior).

- However, the less volatile 3m/3m measure showed a third consecutive increase in nominal retail sales, to +0.21% 3m/3m SA (vs -0.15% in November and -0.38% in October).

- Measured in real volume terms, sales fell -0.21% 3m/3m SA (though have risen for a fourth consecutive month from -1.20% in September. The volume series is adjusted using the HICP index.

- The outlook for the Italian retail sector has shown tentative signs of improvement in recent surveys. The EC's retail trade confidence metric reached its highest level since April '23 in January (at 14.5 vs 11.3 prior).

- Additionally, consumer confidence in both the EC and ISTAT surveys rose in January. However, both remain in contractionary territory, with the EC measure at -16.0 (vs -16.1 prior) in January and ISTAT's at 96.4 (vs 95.8 prior).

- A reminder that in the flash Q4 GDP release (where Q4 GDP was estimated at +0.2% Q/Q and +0.5% Y/Y), ISTAT noted that domestic demand was a negative contributor, offset by a rise in net exports.

The combined real NSA volume of sales in November and December 2023 was -2.9% lower than the same months in 2022. This combination allows for a cleaner comparison of sales during the Black Friday/Christmas periods, where discounting etc. can lead to volatile monthly prints.

- Looking at the components of today's release, food sales in nominal value terms fell -0.2% M/M while non-food sales were flat. Compared to December 2022, food sales rose +2.2% Y/Y (vs +4.0% prior) and non-food sales fell -1.1% Y/Y (vs -0.5% prior). This was the 5th consecutive month that the annual rate for non-food sales was negative.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.