-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessRUB Shines in October, Energy Inflation Causes Difficulties for Net Importers

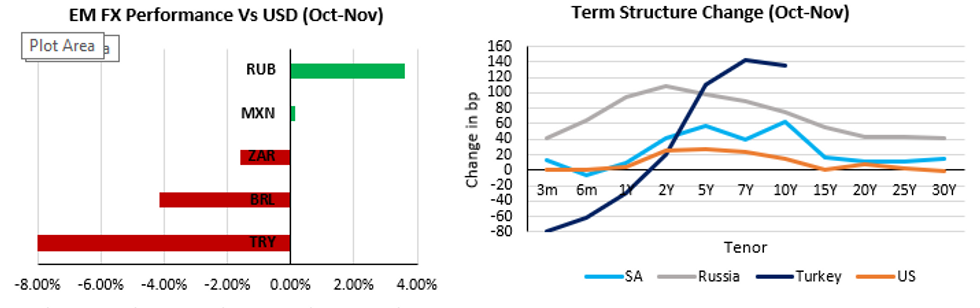

- Looking back on October, we see that RUB has (yet again) been the standout performer of the bunch – supported by high RUB denominate energy profits bolstering fiscal metrics and a notable CBR tightening cycle to combat runaway inflation. MXN has managed to eke out a small gain, while ZAR, BRL & notably TRY slide into the red.

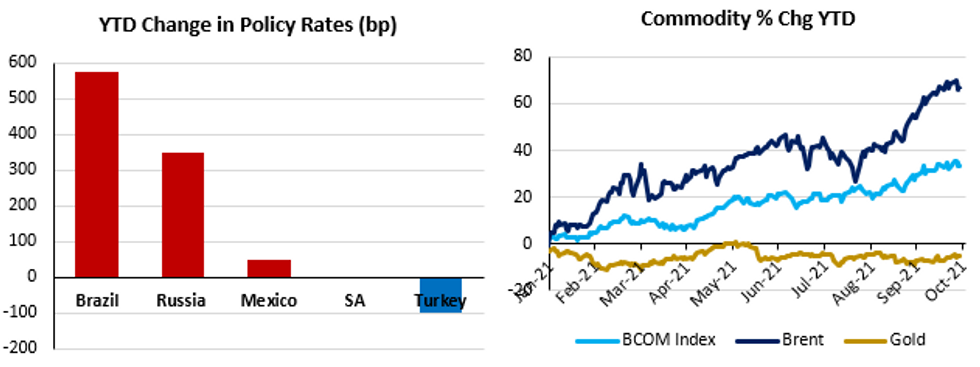

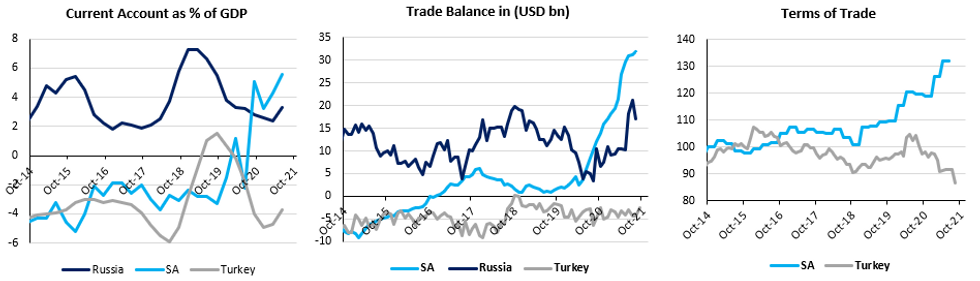

- However, rising energy prices remain a double-edged sword that, when combined with moderating growth expectations, have sent the global economy reeling into stagflationary territory continue to precipitate policy tightening pressures across the EM space. Net importers, such as ZAR, have felt the pressure with CPI & PPI data adding risks to the central bank reactively hiking rates with rising price pressures eroding both ZAR carry differentials & SA's previously attractive terms of trade. Additionally, while the combination of high energy prices and policy hikes has supported RUB, BRL has not followed the same trajectory with fiscal and political woes dampening BRL sentiment.

- In the CEMEA rates space, we see bull flattening momentum picking up steam in SA & Russia as higher pricing dynamics and expectations elevate the 2-5Y section of their local curves. Turkey, on the other hand, has seen an acute bear steepening of the curve in the 7-10Y section of the local curve as a result of the CBRT's aggressive policy easing directly into oncoming CPI headwinds.

- Forward rates across the CEMEA space depict a tightening environment with potential for a notable shift coming in SA where policy rates have remained unchanged in 2021, but have seen a build-up of +63bp in hikes priced in in recent weeks.

- From here, EM will need to negotiate the early Nov Fed meeting and the onset of QE tapering with the UST curve having bear flattened +25-30bp in 2-5Y yields since the start of October. Key local events in November are SA's local elections & MTBPS, while Turkey's next CBRT meeting will also be a vital focal point as year-end approaches.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.