February 13, 2025 14:02 GMT

US DATA: Soft PPI Details Could See Core PCE Estimates Round To 0.2%

US DATA

USEM BulletFixed Income BulletsData BulletBulletMarketsEmerging Market NewsForeign Exchange BulletsNorth America

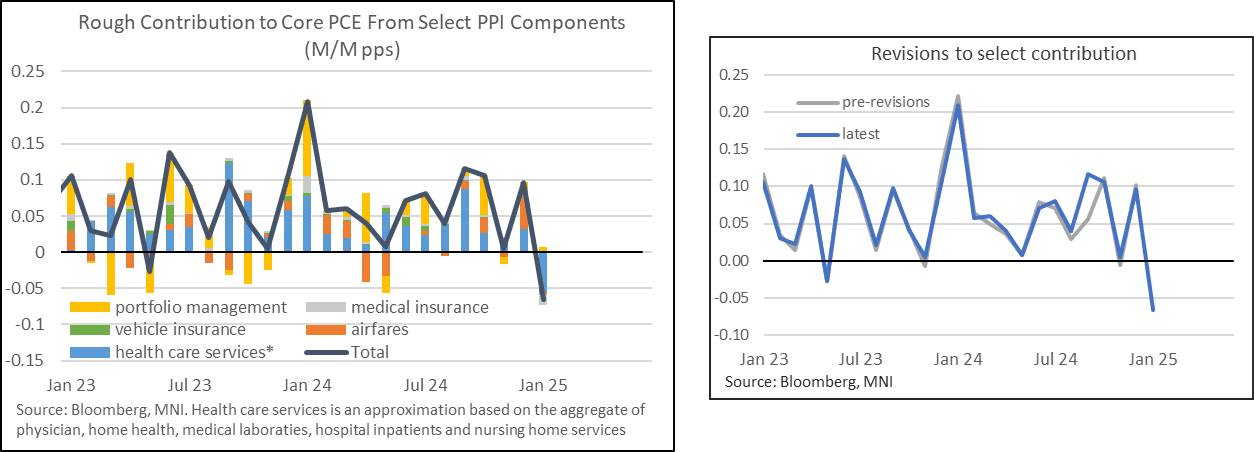

- Our proxy for core PCE relevant components sees a negative M/M contribution of -0.07pps in January for a large swing from the +0.10pp back in December.

- Recent months for this proxy are little changed after the annual revisions, with that +0.10pp coming as a smaller than first thought boost from airfares saw offset by a larger boost from portfolio management and the array of healthcare services.

- Post-CPI rough analyst consensus was for somewhere in the mid-0.30s for % M/M core PCE in January. The extent to which this will be revised lower of course depends on particular analyst assumptions for the PCE relevant components, but it’s possible these could be closer to rounding to 0.2%.

- Core PCE will be released Feb 28.

119 words