-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free Access/STIR/GBP: Gilts & SONIA Rally, GBP Sold As BoE Decision Was "Finely Balanced" For Some Of MPC

Gilts hold almost all of the initial post-BoE rally after the minutes of the meeting revealed that the decision to hold rates steady was “finely balanced” for some BoE members.

- Furthermore, a BBC journalist has suggested that “the BoE decision was “finely balanced” for 3 holds, probably including Governor, which mean it was a close run thing not to cut - Those 3 members playing down sticky services inflation - August cut very much on.”

- While this cannot be verified in the post-decision communique, it will be factoring into the dovish market reaction.

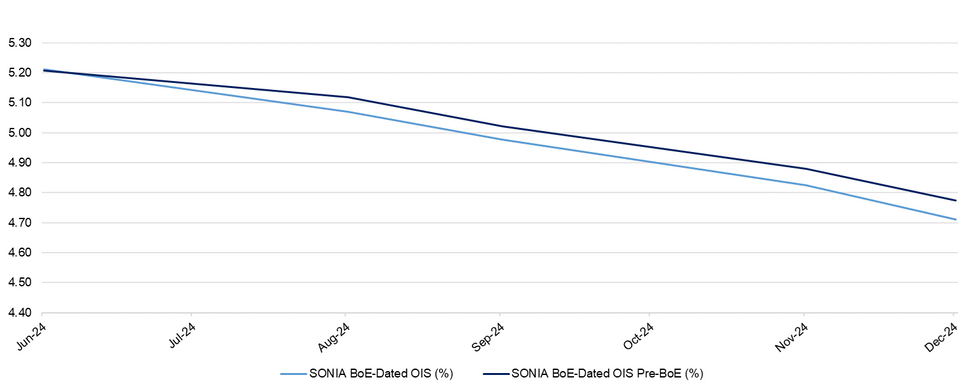

- BoE-dated OIS moves to price ~49bp of cuts through year end vs. ~43bp heading into the decision, with ~90% odds of a cut through the Sep MPC now priced vs. 70% odds pre-decision.

- Pricing covering the August MPC decision now shows 50/50 odds of a cut.

- SONIA futures rally to fresh session highs, last 3.0-7.5 firmer on the day.

- Gilt futures had already corrected from lows ahead of the decision. Next resistance in that contract is seen at 99.05.

- March lows in 2-Year yields are ~5bp below current levels, with prior June lows breached in that contract.

- Broader gilt yields are 2-6bp lower on the day, with the curve bull steepening.

- 2s10s is still below ’24 highs.

- On the FX side, GBP/USD shed around 25 pips on the dovish repricing in rates, putting the pair at new daily lows of 1.2680 before recovering, with nearby support at 1.2657 untroubled for now.

- GBP/NOK printed new multi-week lows, with key support at 13.3228, compounding the initial move that followed the hawkish Norges Bank.

| BoE Meeting | SONIA BoE-Dated OIS (%) | Difference Vs. Current Effective SONIA Rate (bp) |

| Aug-24 | 5.071 | -12.9 |

| Sep-24 | 4.977 | -22.3 |

| Nov-24 | 4.826 | -37.4 |

| Dec-24 | 4.712 | -48.8 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.