-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY99.5 Bln via OMO Friday

Strengthening Consumer Sentiment Could Add To ECB Dilemma (2/2)

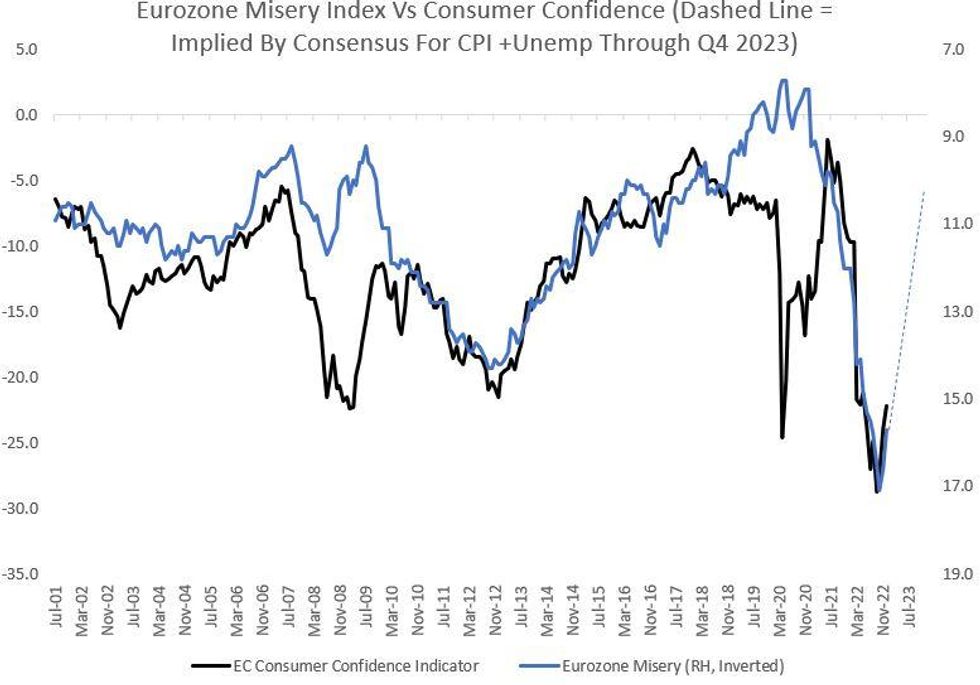

The improvement in eurozone inflation and unemployment outlooks bodes well for a further rebound in consumer confidence. Our Eurozone Misery Index (CPI Y/Y + Unemployment) remains highly correlated to consumer sentiment.

- Although eurozone core inflation continues to climb (to a record 5.2% in Dec), the upward turn in consumer sentiment is fully explained by headline CPI decelerating (10.7% in Oct to 9.2% in Dec).

- Assuming the unemployment rate doesn't rise much in the coming months (consensus has it rising 0.7pp to 7.2% in 2023), it will probably take significant further headline disinflation for a major improvement in confidence.

- But that is what's expected: CPI is seen in the BBG survey as collapsing to 3.5% by Q4, which added to the unemp rate suggests a Misery Index of between 10-11%, bringing consumer confidence closer to normal non-recessionary levels (see chart).

- The coming months will pose a dilemma for ECB policy in this regard.

- Headline inflation is set to continue falling, which bodes well for household inflation expectations remaining contained, and avoiding second-round effects. But with consensus (and the ECB's latest projections) still expecting a recession, stronger growth and consumption prospects than had been feared late last year mean consideration will have to be given to upside risks to activity and still-stubborn core inflation.

- This would give the ECB more impetus to continue hiking rates after the 100bp priced for Feb and Mar combined is delivered. MNI's ECB sources piece out Wednesday quoted a source saying "markets already assume a slowdown...we might have in the end to overshoot" on rate hikes.

- Currently, 139bp of hikes is seen to the July peak, equivalent to a depo rate just under 3.40%. That may yet prove a floor rather than a ceiling, with growth expectations likely to have bottomed, improving confidence pointing to stronger activity, and increasing focus on core rather than headline inflation.

Souce: EC, Eurostat, BBG Survey, MNI

Souce: EC, Eurostat, BBG Survey, MNI

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.