-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessStresses Intensifying On Economic Lynch Pin #1

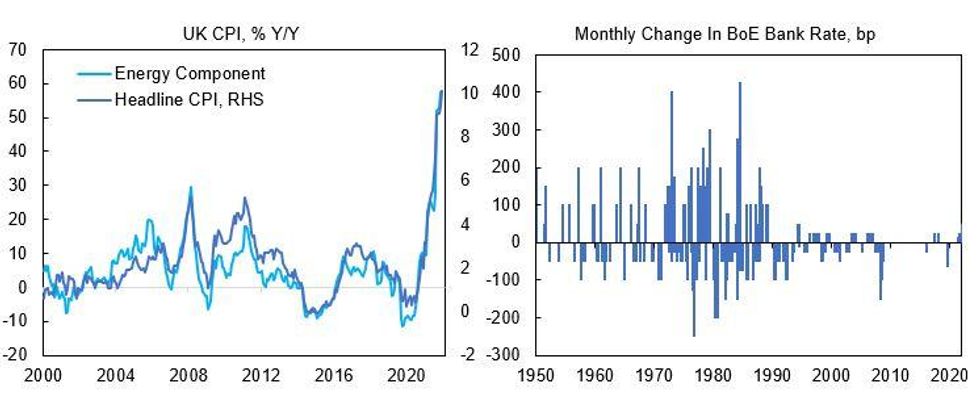

Data published this morning show UK inflation breaching into double-digit territory for the first time in around 40-years. Evidence is starting to mount that inflation is eroding incomes and purchasing power, which is particularly problematic for the UK's consumption-orientated economy and poses a dilemma for the Bank of England. We gathered together some charts which are indicative of how these processes are playing out.

- Inflation itself shows no signs of slowing down, despite the BoE recently upping the ante and delivering its first 50bp hike in over 25-years.

- The separate energy component of the CPI basket has continued to push higher, reaching 57.8% Y/Y in July. While fuel use has a relatively small weighting in the basket, the large surge in prices is having an outsized impact on headline inflation. Higher energy prices also have indirect impacts on prices of goods and services through transport costs and material input prices (e.g. plastics).

- It is widely expected that the average annual energy bill for UK households will push above £4,000 next year from closer to £1,000 before the energy price shock. This would impact lower income earners the hardest, who have also stockpiled the least amount of savings during the pandemic and have a high propensity to consume out of income. With the government still in the middle of a leadership election, and with stiff resistance in some sections of the Conservative party to either a windfall tax on energy companies, or energy bill support measures for households, any official intervention is likely to fall short of the mark. As such, the hit to purchasing power will be a heavy drag on economic activity in the coming quarters.

- The BoE's approach to reining in inflation has been relatively timid so far with bank rate adjustments more reminiscent of the 'great moderation' period, rather than the high inflation period of the 1970s and 1980s, which the current inflation readings more closely resemble. The BoE will need to make a judgement call on whether economic headwinds will be sufficient to override the supply-side shock. If not, the central bank could find itself upping the ante again with further 50bp+ rate hikes going into an economic downturn.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.