August 01, 2024 09:21 GMT

Swiss July CPI Preview - Expected Below SNB Q3 Projections

SWITZERLAND DATA

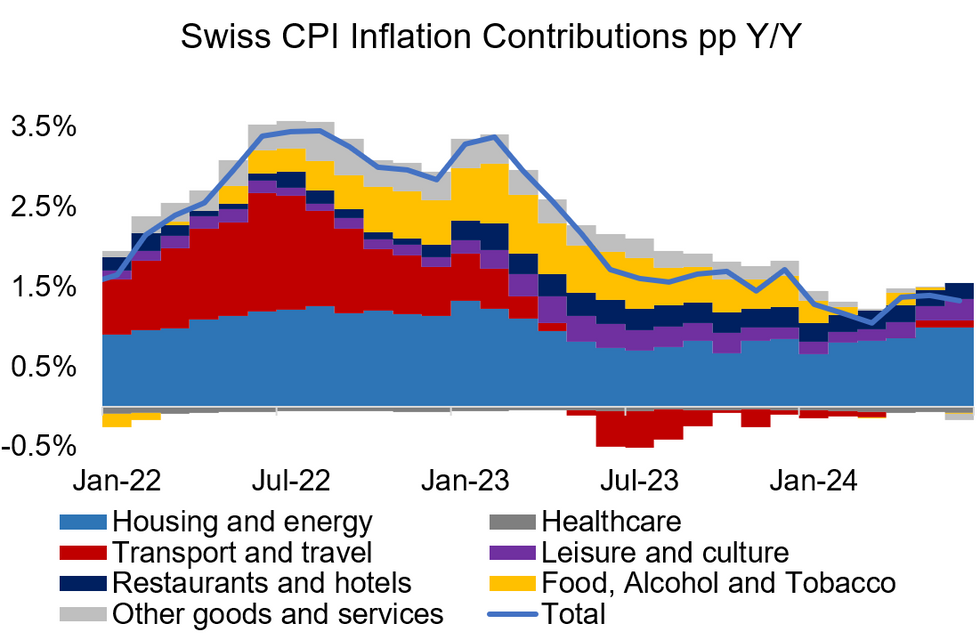

Swiss headline inflation (released 0730 BST/0830 CET Aug 2) is expected to have remained steady on a Y/Y basis in July after a slight drop in June. Consensus looks for unchanged at +1.3% Y/Y and -0.2% M/M (Prev. 0.0%). Core CPI is expected to also have kept a steady pace - consensus stands at +1.1% Y/Y (Prev. +1.1%).

- A print in line with consensus would start off Q3 inflation significantly below the SNB's projection of 1.5% Y/Y for this quarter, and might solidify expectations for another rate cut at the September meeting - pricing currently stands at ~20bps of easing priced.

- Rental prices, one of the main upside drivers of Swiss inflation in recent quarters, will not see their quarterly update this month (which might bring inflation closer to the SNB projections when that is due in August). So, the print will again shed light on underlying price pressures and second-round effects within non-housing services - which SNB president Jordan flagged in the last policy meeting press conference when discussing their rationale for the policy rate cut.

- Jordan mentioned tourism services specifically in this context - which overall remained elevated despite an overall below-consensus inflation print in June ('Closer Look at Inflation Data Confirms View of Overall Mixed Print' - MNI, July 4).

- The range of estimates submitted on Bloomberg is quite large this month: Out of 18 projections for headline CPI, 4 see 1.2% Y/Y, 12 see 1.3%, and 1.4% / 1.5% are seen by one analyst each.

- Nomura project 1.3% Y/Y headline and 1.2% core and see "a small decline in fuel prices" and "underlying inflation momentum to be weak".

MNI, SECO

MNI, SECO

282 words