-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessTax Take Spikes, Funding Pressures Limited, Bill Issuance Impact Eyed

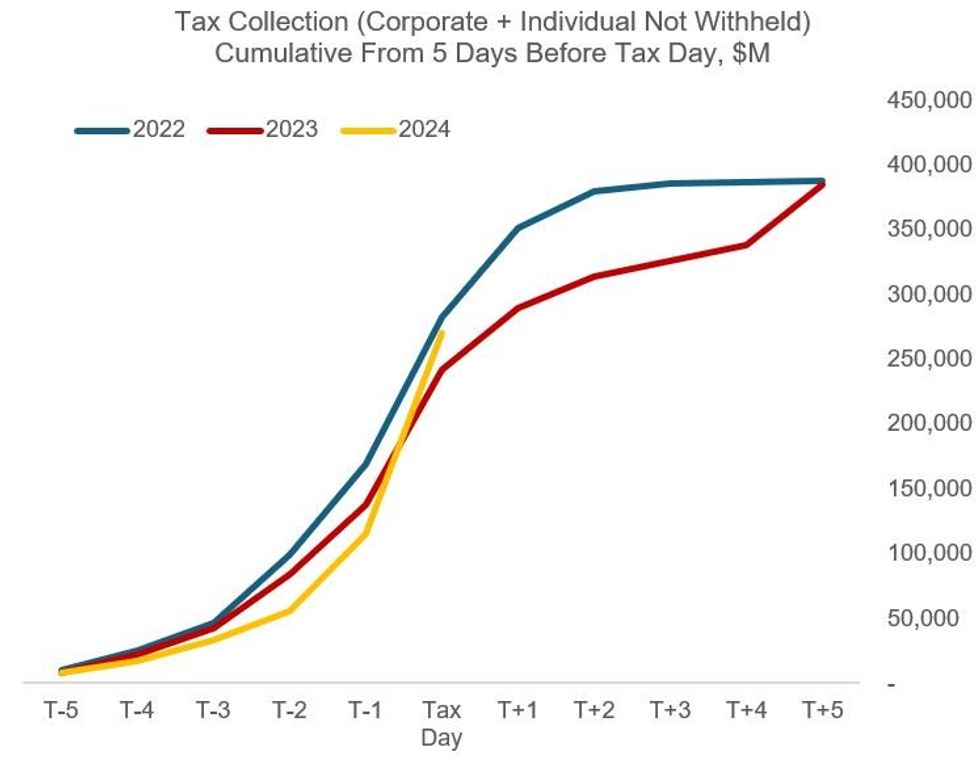

The April 15 tax deadline brought in substantial revenues to the U.S. Treasury, including $63.5B in corporate income taxes and $86.6B in individual electronically-filed taxes. When added to $4.7B in non-electronically filed individual taxes, the tax day haul totalled $155B, up from $105B in 2023 and $114B in 2022.

- This brought the past 6 days' total to $270B, narrowing the gap with the equivalent period of 2022 ($283B) and exceeding 2023 ($242B) - see chart below.

- Even so, once again, there was little evidence of funding market pressure for the session, as observed in SOFR (only ticking higher 1bp on Monday before retracing that move Tuesday) and other rates, as well as Federal funds market volumes.

- Tuesday's data will be released at 1600ET/2100UK Wednesday - while the total receipts will undoubtedly retreat from Monday, they are likely to reflect stronger non-electronic individual submissions sent over the weekend.

- If tax collection continues to run at a healthy pace, it could reduce Treasury's financing requirement via bills.

- The overall net increase in Treasury's cash holdings on April 15 was $172B, bringing the Treasury General Account to $897B - the highest level since May 2022.

- Wrightson ICAP writes that "the risks in the daily tax receipt data are clearly skewed to the high side of our forecast [Monday's increase in the TGA was $21B more than they anticipated], but the surprises in the coming days may not be quite as large as those we have seen thus far. We have not made any further reductions in our bill offering forecasts in light of the positive cash balance surprises so far this week. We will almost certainly adjust our bill forecasts to assume additional gross offering size reductions in May, but we will wait for at least another day or two of tax data before overhauling our auction projections yet again."

Source: MNI based on Daily Treasury Statement

Source: MNI based on Daily Treasury Statement

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.