-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Trudeau To Keep Working As Opposition Seeks Ouster

Trudeau Gov't On Thin Ice After NDP Withdraws From C&S Agreement

Canada faces the increased likelihood of a snap general election after Jagmeet Singh, head of the left-wing New Democratic Party (NDP), said on 4 Sep that he would be pulling his party's support from a confidence-and-supply agreement. The NDP's withdrawal leaves Prime Minister Justin Trudeau's minority centre-left Liberal Party (LPC) gov't in the vulnerable scenario of relying on cobbling together support to pass legislation on a bill-by-bill basis.

- The NDP's withdrawal does not automatically trigger a general election (due in Oct 2025 at the latest), and Singh has not confirmed that he will instruct his party to vote against the gov't in any confidence vote.

- Main opposition centre-right Conservative Party (CPC) leader Pierre Poilievre has called on Singh to "commit today to voting for a carbon tax election at the earliest confidence vote". The NDP offered the statement that "Voting non-confidence will be on the table with each and every confidence measure,"

- Without the NDP's 24 seats, the LPC holds 154 seats in the House of Commons. The combined total of the CPC, Quebec-interest Bloc Quebecois, environmentalist Greens and independents sits at 156.

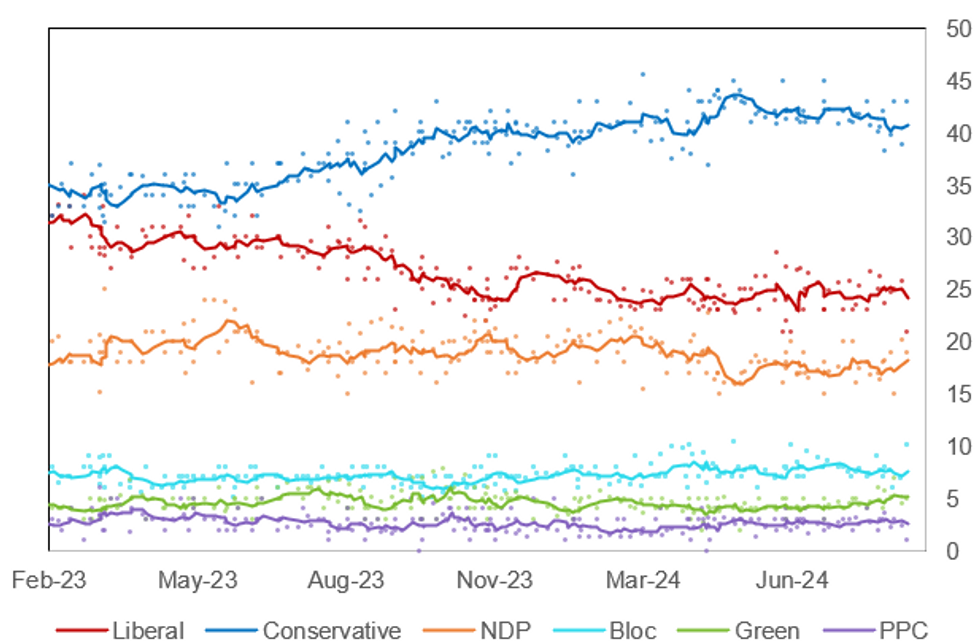

- Polling shows the Conservatives with a large and consistent lead of ~15-20% over the LPC. If reflected in an election this would almost certainly translate into a sizeable CPC majority.

- Poilievre garnered market interest when running for the CPC leadership in 2022 by threatening to remove BoC Governor Tiff Macklem for being an "ATM" for Trudeau's deficit spending. He has been quieter on the prospect recently, but any snap election campaign could bring the issue back into focus.

Chart 1. General Election Opinion Polling, % and 6-Poll Moving Average

Source: Angus Reid, Nanos Research, Leger, EKOS, Abacus Data, Mainstreet Research, MNI

Source: Angus Reid, Nanos Research, Leger, EKOS, Abacus Data, Mainstreet Research, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.