-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Closing FI Analysis, Rates Lose Early Support

US TSY FLOWS: Second Half Sag Combination of stronger equities, two tailed note auctions and larger than exp'd corporate issuance hedging tied to ATT 5pt jumbo borrowing another $11B after securing $12.5B in May, reversed first half support, futures extending session lows after the close. Yld curves see-sawed on session, finish steeper.

The 2-Yr yield is up 0.4bps at 0.1514%, 5-Yr is up 1bps at 0.2852%, 10-Yr is up 2.6bps at 0.6151%, and 30-Yr is up 3.3bps at 1.2626%

US 10YR FUTURE TECHS: (U0) All Eyes On The 139-25 Resistance

- RES 4: 140-22+ High Mar 9 and key resistance (cont)

- RES 3: 140-02 0.764 projection of Jun 5 - 11 rally from Jun 16 low

- RES 2: 140.00 High Mar 17 (cont) and psychological barrier

- RES 1: 139-25 High Mar 25 and Jul 24 and bull trigger

- PRICE: 139-21 @ 16:12 BST Jul 27

- SUP 1: 139-00+ Low Jul 13

- SUP 2: 138-23+ Low Jul 2 and key near-term support

- SUP 3: 138-07 Low Jun 16 and reversal trigger

- SUP 4: 137-22 Low Jun 10

10yr futures edged higher Friday to register a fresh high print of 139-25. The outlook remains bullish. Note that 139-25 also marks the high on Mar 25 and represents a major resistance. Attention is on this level where would confirm a resumption of the uptrend and expose 140-00, Mar 17 high (cont) and a key psychological barrier. Key support remains 138 23+, a breach would signal a reversal. Initial support is 139-00+.

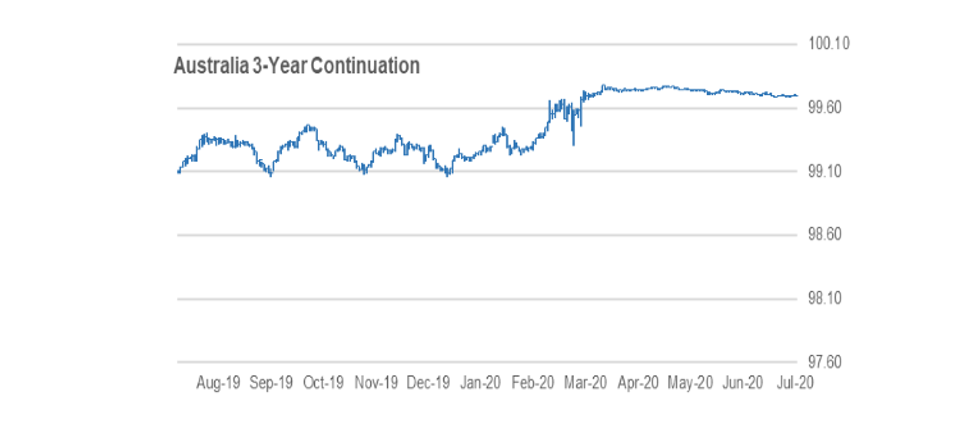

AUSSIE 3-YR TECHS: (U0) Holding Above Its Key Support

- RES 3: 99.780 - High Apr 01 and bull trigger

- RES 3: 99.750 - High May 21 and 22

- RES 1: 99.730 - Congestion highs between Jun 15 - 22

- PRICE: 99.700 @ 16:13 BST Jul 27

- SUP 1: 99.680 - Low Jun 14 / Jul 22

- SUP 2: 99.667 - 23.6% retracement of the March - April Rally

- SUP 3: 99.597 - 38.2% retracement of the Mar - Apr rally

The short-end of the Aussie bond space traded lower recently but has held aboe recent lows of 99.680, the Jul 14 low and a new low watermark. A break of this support would signal scope for an extension lower towards Fibonacci support at 99.667 and 99.597, both Fibonacci retracement levels. On the upside, the key hurdle for bulls remains the 99.730 congestion, highs between Jun 15 - 22. A break would instead open 99.780, Apr 1 high further out.

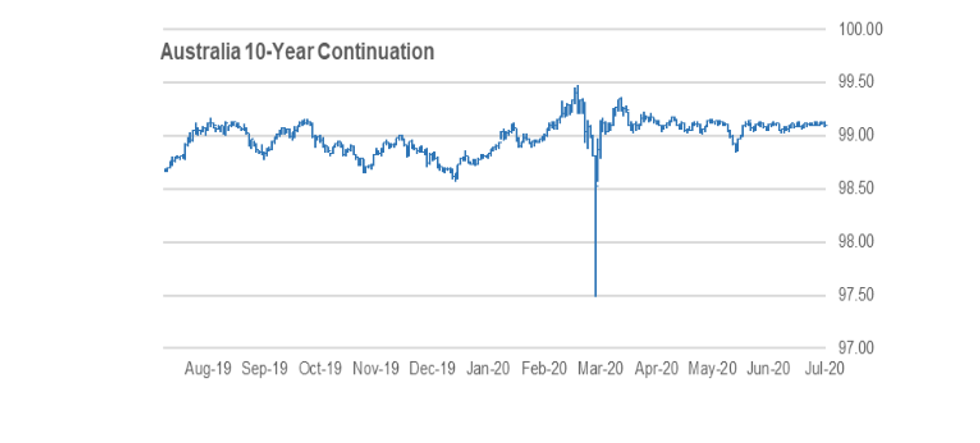

AUSSIE 10-YR TECHS: (U0) Focus Remains On Key Resistance

- RES 3: 99.3600 - High Apr 02

- RES 2: 99.2250 - High Apr 17

- RES 1: 99.1400 - High Jul 13 and the bull trigger

- PRICE: 99.1050 @ 16:15 BST, Jul 27

- SUP 1: 99.0200 - Low Jul 2 and 3

- SUP 2: 98.9750 - 50.0% retracement of the Jun 8 - Jul 13 rally

- SUP 3: 98.9361 - 61.8% retracement of the Jun 8 - Jul 13 rally

Aussie 10yr stuck within the recent range of late. Despite this price retention, a bullish focus remains intact. Attention is on the initial key resistance at 99.1400, Jul 13 high where a break would confirm the end of the current consolidation phase and open 99.2250, Apr 17 high. On the downside, initial key key support has for now been defined at 99.0200, Jul 2 / 3 low. A break would expose a deeper decline towards 98.9750 instead. a Fibonacci retracement.

JGB TECHS: (U0): Uptrend Remains Intact

- RES 3: 153.06 - High Mar 31 and key resistance

- RES 2: 152.77 - 200-dma

- RES 1: 152.50 - High Jul 17 and the bull trigger

- PRICE: 152.37 @ 16:12 BST, Jul 24

- SUP 1: 151.57 - Low Jul 2 and key support

- SUP 2: 151.26 - Jun 8 low

- SUP 3: 150.61 - Low Mar 19 and key support

JGBs are holding onto recent gains that have recently further cemented the uptrend since the early July low. The recent break of 152.29, Jun 12 and Jul 13 high confirmed a bullish price sequence of higher highs and higher lows reinforcing the current positive theme. Continued gains would pave the way for a climb towards the 200-dma at 152.77 as well as the longer-term target of 153.06. Key support has been defined at 151.57, Jul 2 low.

US TSY FUTURES CLOSE: Extend Session Lows Late Combination of stronger equities, two note auctions that tailed and larger than expected corporate issuance related hedging (ATT 5pt jumbo borrowed another $11B after securing $12.5B in May). Yld curves see-sawed on session, finish steeper. Update:

- 3M10Y +2.895, 50.877 (L: 45.254 / H: 51.041)

- 2Y10Y +1.52, 45.467 (L: 42.552 / H: 45.631)

- 2Y30Y +1.836, 109.825 (L: 106.304 / H: 109.951)

- 5Y30Y +1.488, 96.699 (L: 94.006 / H: 96.859)

- Current futures levels:

- Sep 2Y down 0.5/32 at 110-12.875 (L: 110-12.875 / H: 110-13.8)

- Sep 5Y down 2/32 at 125-23.75 (L: 125-23.5 / H: 125-28)

- Sep 10Y down 4.5/32 at 139-14 (L: 139-14 / H: 139-24)

- Sep 30Y down 18/32 at 180-17 (L: 180-17 / H: 181-21)

- Sep Ultra 30Y down 21/32 at 225-3 (L: 225-01 / H: 227-05)

US EURODLR FUTURES CLOSE: Weaker, Session Lows On Close After trading mildly higher in the first half, futures slipped to session lows in late trade, lead quarterly steady after 3M LIBOR set +0.0228 to 0.2696% (-0.0246 last wk).

- Sep 20 steady at 99.760

- Dec 20 -0.005 at 99.705

- Mar 21 -0.010 at 99.790

- Jun 21 -0.010 at 99.810

- Red Pack (Sep 21-Jun 22) -0.015 to -0.01

- Green Pack (Sep 22-Jun 23) -0.02 to -0.015

- Blue Pack (Sep 23-Jun 24) -0.02 to -0.015

- Gold Pack (Sep 24-Jun 25) -0.025 to -0.02

Updated purchase schedule for next couple weeks:

- Tue 07/28 1010-1030ET: Tsy 0-2.25Y, appr $12.825B

- Thu 07/30 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 07/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 08/04 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 08/05 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 08/06 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Mon 08/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 08/11 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 08/12 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

PIPELINE: Kinder Morgan, Prosus Priced

Kinder Morgan, Prosus priced, ATT likely to price after close

Date $MM Issuer/Rating/Desc/Maturity/Yld; Priced *; Launch #

- 07/27 $11B #ATT $2.25B 7.5Y +120, $2.5B 11.5Y +165,

- $2.5B 22.5Y +185, $2.25B 31.5Y +205, $1.5B 40.5Y +225

- 07/27 $2.6B #UBS $1.3B Each 4NC3 +83, 6.5NC5.5 +108

- 07/27 $1.25B *Kinder Morgan $750M 10Y +150. $500M 30Y +210

- 07/27 $1B *Prosus 30Y+280

- 28-Jul 0855 25-Jul Redbook retail sales m/m (1.9%, --)

- 28-Jul 0900 May Case-Shiller Home Price Index (0.33%, 0.30%)

- 28-Jul 1000 Q2 housing vacancies rate (6.6%, --)

- 28-Jul 1000 Jul Conference Board confidence (98.1, 94.7)

- 28-Jul 1000 Jul Richmond Fed Mfg Index (0, 5)

- 28-Jul 1030 Jul Dallas Fed services index

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.