-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

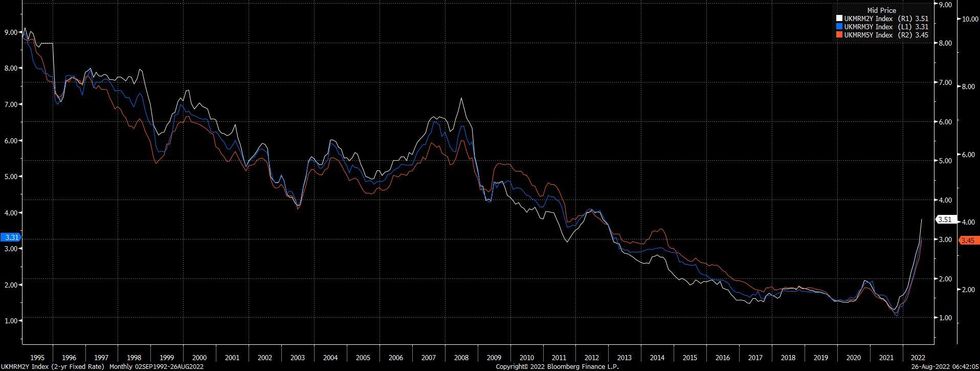

Free AccessUK Mortgage Rates Set To Add To Inflation Burden

Inflation isn’t the only headwind facing UK households at present. The swift round of repricing of the BoE hiking cycle and resultant move in swap rates has seen UK mortgage rates double since the turn of the year (based on BoE data covering the period through the end of July), with more pain set to come on this front (note that some industry analysts have flagged that the average 2-Year fixed mortgage rate has now topped 4% for the first time since ’13).

- This, coupled with the UK’s well documented inflation problem poses further upside risk to swap rates creating potential headwinds for the UK property market, adding to the burden of crimped spending power as wage growth lags inflation. Note that some industry participants remain a little more upbeat.

- The BoE doesn’t comment on the wealth effect of house prices with as much frequency as the likes of the RBA, but soaring inflation, higher mortgage payments and the potential for lower housing valuations (albeit from a starting point which equates to record highs) paints a very downbeat picture for the UK economy, with the BoE already projecting a bleak immediate economic scenario.

- Soaring gas prices (the updated UK energy price cap that we discussed earlier this week, will be released at 07:00 London on Friday) already pose a clear upside risk to the BoE’s only recently-released inflation forecasts and could force the terminal rate of the current hiking cycle even higher (with OIS markets currently pointing to a terminal rate of a little over 4% during Q224).

- Also note that an added layer of flows and fixing demand will become evident throughout the next year or so as those who rushed out to buy houses after the initial round of COVID lockdowns were relaxed will start to roll their mortgages (assuming initial 2- to 3-Year fixing periods and that some level of outstanding mortgage remains).

Fig. 1: UK 2-, 3- & 5-Year Fixed Mortgage Rates (%)

Source: MNI - Market News/Bank of England/Bloomberg

Source: MNI - Market News/Bank of England/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.