-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUpdates on Container Shipping Names

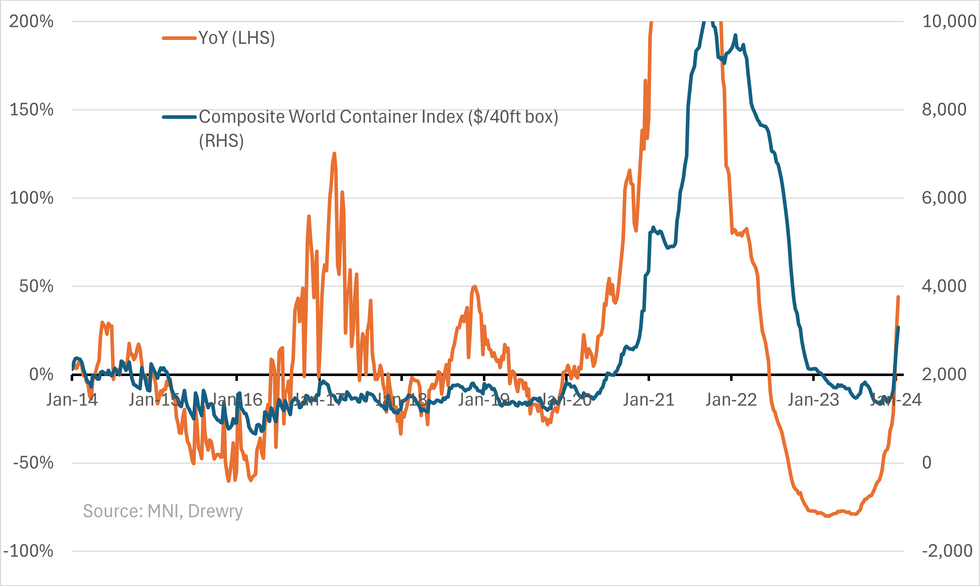

- Hapag equitiues best performer among €HY eqv. equity names after Iran earlier today seized the St Nikolas oil tanker, Iran semi-officials quoted on bbg that it was with a court order to retaliate for the "oil theft" by the US last year. Maersk Chief executive Vincent Clerc was on FT today that "at this time when inflation is a big issue, it’s putting inflationary pressure on our costs, on our customers, and ultimately on consumers in Europe and the US...in the short run, it could cause significant disruptions at the end of January, February and into March". It is reportedly facing 50% higher fuel costs due to the longer route. Hapag 2.5% 28's {BO802504 Corp} (Ba3 Pos, BB+ Stable) have continued rallying (mid's) +$0.2 today & a YTD ~40bp rally in spread vs. €HY's -15bp move.

- Bloomberg analyst reiterating their view today that they see structural weakness in rates once temporary red sea disruptions ease; "This is temporarily masking the longer-term structural challenges facing the liner industry. Supply growth could outpace demand by 340 bps in 2024 and 210 bps in 2025, according to Clarksons." Drewry reported World Container Index rates jumped 15% to $3,072 this week - not much detail from them outside of; "Drewry anticipates East-West spot rates to increase in the coming weeks, due to the Red Sea/Suez situation." Europe to US rates & Shanghai to LA/NY largely ~unch - i.e. no pass through to broader routes yet in data.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.