June 13, 2024 08:23 GMT

Wage Growth Expectations Unsurprisingly Revised Higher

NORWAY

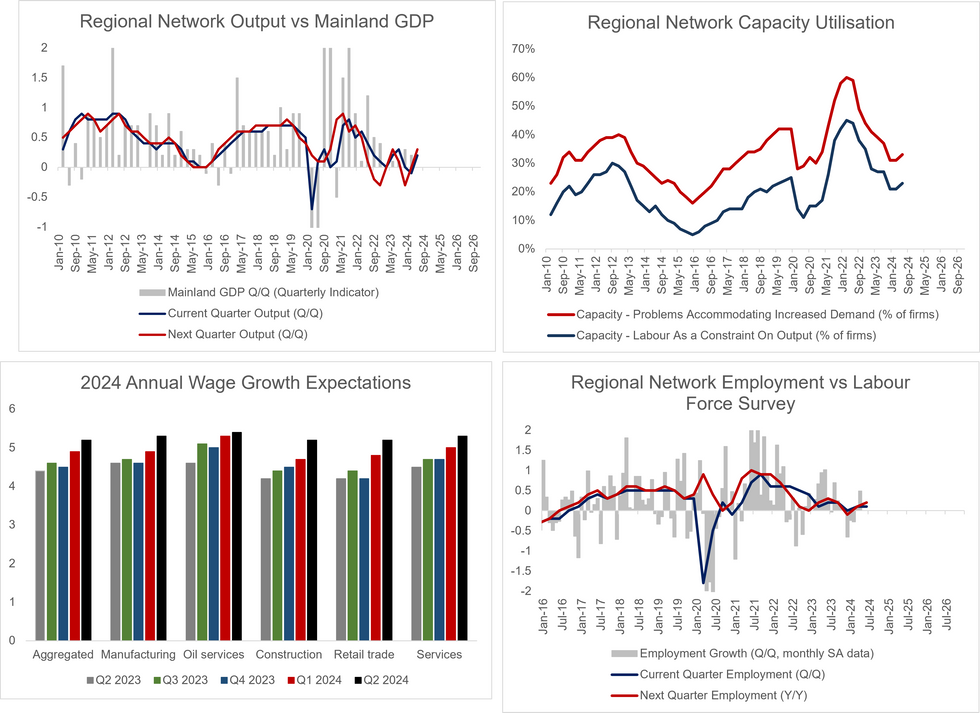

The Norges Bank’s Q2 Regional Network Survey saw respondents revise annual wage growth expectations higher (as expected). This should lock-in an upward revision to Norges Bank’s wage forecasts at next week’s monetary policy meeting, which features an updated MPR and rate path.

- Overall, the report should justify the Norges Bank’s hawkish stance, with wage growth estimates revised higher and a brighter activity outlook in sight.

- Wage growth was seen at 5.2% Y/Y in 2024 (vs 4.9% in the prior survey and in the Norges Bank’s March MPR). This estimate is consistent with the agreement struck by industrial unions in April (which tends to serve as an anchor for other union’s agreements).

- All industries saw upward revisions to wage growth versus the previous survey.

- Output expectations for Q2 were 0.2% Q/Q (versus a 0.0% estimate in the Q1 survey). However, this once again masks large divergences between industries, with the oil sector still outperforming and construction struggling.

- Q3 expectations are for 0.3% Q/Q output growth, with similar industry divergences.

- Investment expectations were revised upwards across industries, but most notably in oil services. On 2025 oil investment, the report notes that “a number of contacts report investment plans in new vessels that can be used in both oil and offshore wind industries”.

- Capacity utilisation saw minor improvements, while employment growth is expected in all industries other than construction and retail trade.

239 words