-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

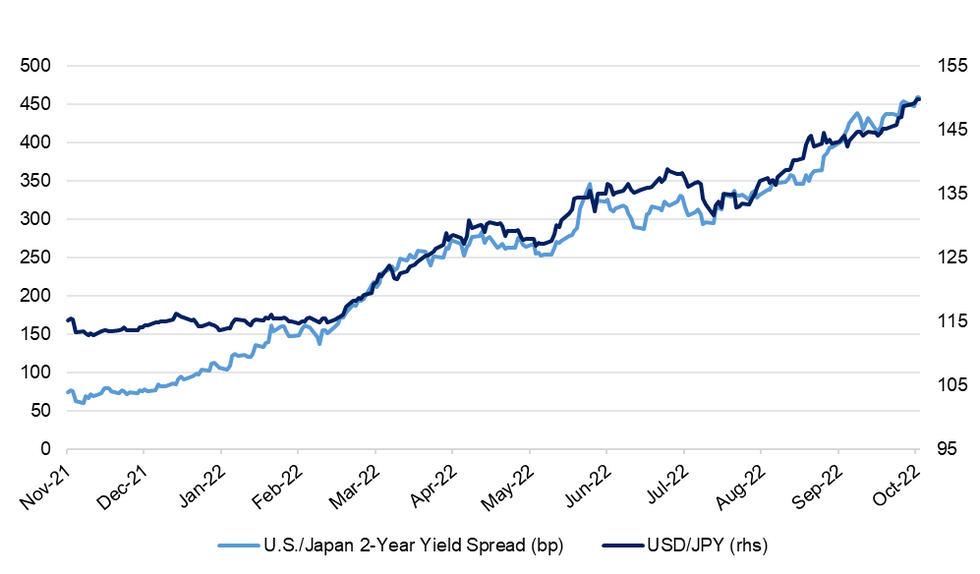

Free AccessWidening Yield Spreads Push USD/JPY Further Towards Psychological Y150 Mark

Renewed widening of U.S./Japan yields spreads pushed USD/JPY higher Wednesday. The pair topped out just shy of the psychologically significant Y150 threshold, with participants waiting agog for signs of an intervention by Japanese officials.

- Strong inflation prints across the UK and Canada coupled with a weak 20-Year U.S. Tsy offering pushed core bond yields higher. 10-Year. With Tsys losing altitude after Asia hours, U.S./Japan 2-year yield differential expanded by 10.9bp & 10-Year gap was 12.6bp wider.

- JGBs cheapened past the BoJ's tolerance threshold, as the market tests the central bank's dovish resolve. This raises the prospect of the BoJ stepping up YCC enforcement measures.

- Broader risk aversion allowed the yen to fare better than most of its G10 peers, albeit the greenback outperformed. Most equity benchmarks faltered post-Asia, while the VIX index added 0.85%.

- Intervention talk continued to do the rounds as Japanese officials echoed their familiar stance on FX. While they flagged volatility as a potential trigger, the Y150.00 round figure is still considered an important psychological threshold.

- Spot USD/JPY trades -8 pips at Y149.82. Trendline resistance drawn off Apr 28 peak gave way and the Y150.00 provides the next topside target, followed by the 3.618 proj of the Aug 2 - 8 - 11 price swing at Y150.45. Bears look for losses towards Oct 5 low of Y143.53.

- Japan's trade report hits at the bottom of the hour.

Fig. 1: U.S./Japan 2-Year Yield Spread vs. USD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.