-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: US$ Tops Pandemic Peak

US TSYS: Tsy Turn Weaker Late, US$ Tops Pandemic Peak, Earnings Continue

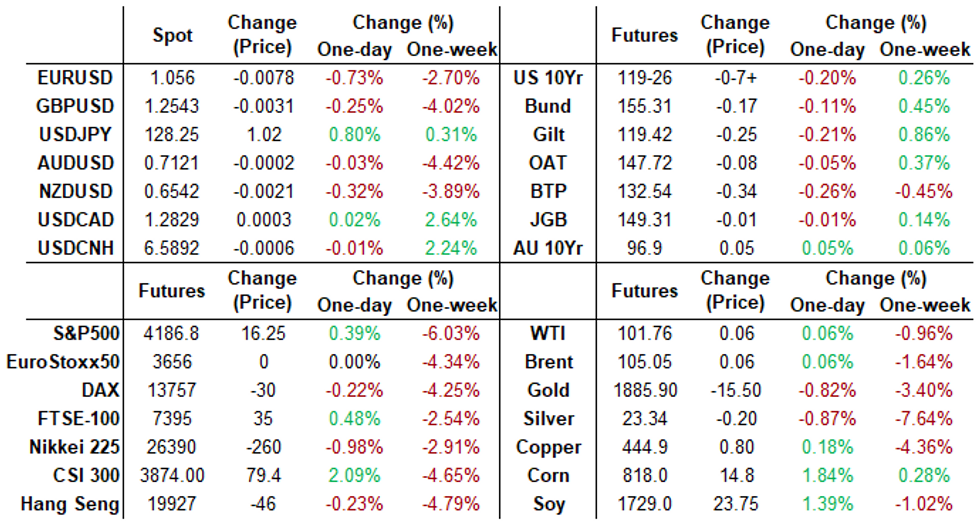

Rates trade weaker across the board after the bell -- short end support evaporating late as broader markets watch the surge in US$ strength, DXY $ index +.684 at 102.986 vs. 103.282 high -- 5-year highs as it breached pandemic peak of around 102.992 earlier.

- Confluence of likely drivers: ongoing adjustment in Fed tightening cycle - rush to neutral, safe haven, month-end, and knock on efforts from PBoC to counter CNY strength/promote domestic growth all amid lack of market depth.

- FI futures had traded firmer after huge miss in March goods trade balance this morning: record deficit of -125.3B vs -106.3B expected. While exports climbed 7.2%, imports surged 11.5% MoM.

- Curve steepening had already been underway prior to the mildly weak 5Y auction (2.785% high yld vs. 2.777 WI), primary dealer take-up of 16.52% said to "soften the sting" of drop in bid-to-cover from 2.53x to 2.41x.

- Late focus turned to slew of new earnings after the close: Invitation Homes (INVH), Raymond James (RJF), Qualcomm (QCOM), Amgen (AMGN), Ford (F), Meta (FB), PayPal (PYPL) to name a few.

- On tap for Thursday: Weekly Claims, GDP, KC Fed Mfg index and $44B 7Y Note Sale.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00528 to 0.32486% (-0.00157/wk)

- 1M +0.01500 to 0.76371% (+0.06028/wk)

- 3M +0.00072 to 1.23886% (+0.02515/wk) ** Record Low 0.11413% on 9/12/21

- 6M -0.00142 to 1.82629% (+0.00258/wk)

- 12M -0.00215 to 2.54414% (-0.06257/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $73B

- Daily Overnight Bank Funding Rate: 0.32% volume: $261B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $897B

- Broad General Collateral Rate (BGCR): 0.30%, $338B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $326B

- (rate, volume levels reflect prior session)

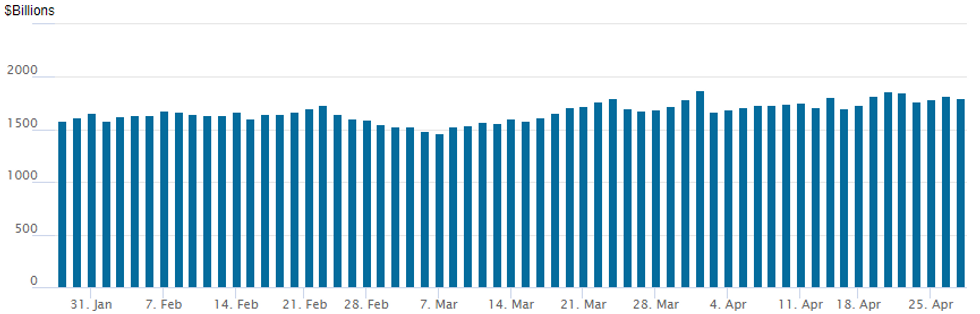

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to 1,803.162B w/ 82 counterparties from prior session 1,819.343B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option volumes were not overwhelming Wednesday, but fairly consistent with better buying of low delta puts and put structures, particularly in 10Y Treasury options as the burgeoning bid in rates that saw 30YY fall to 2.819% overnight evaporates.

Curve steepening had already been underway prior to the mildly weak 5Y auction (2.785% high yld vs. 2.777 WI) as support for bonds ebbed into midday, put buyers looking for the primary downtrend to continue.

- Update, total -7,000 SFRM2 98.12/98.37 2x1 put spds, 2.25-2.5

- +3,000 Sep 96.87/97.50 2x1 put spds, 10.0

- Update, +15,400 short Jun 97.93 calls, 1.0

- Block, 10,000 Sep 97.50 combos, 0.25 calls over vs. 97.50/100%

- +1,200 short May 96.50/96.75/96.87 1x3x2 call flys, 5.0/wings over

- 1,500 Dec 97.25/97.50 call spds

- -4,000 Dec 96.00 puts, 15.5 ref: 96.925

- +3,000 Dec 97.68/short Dec 97.50 call spds, 2.5 cr

- 2,000 Dec 97.00/97.18 put spds vs. 97.75/98.37 call spds

- 2,600 short May 96.75/97.12 call spds vs. short Jun 96.75/97.75 call spds

- 2,000 short May 96.50/96.62 put spds vs. 96.81 calls

- 5,000 TYM 119.5/120 put spds, 10

- Update, over -19,000 TYM 117/121 call over risk reversals, 31

- 5,000 wk2 TY 117.5/118 put spds

- -8,500 TYM 117/121 call over risk reversals, 31

- +6,000 TYM 118.5 puts, 29 ref 120-01

- +6,000 TYM 118.5/120 put spds 0.0 over TYM 121.5 calls ref 120-07.5

- +3,000 TYM 116.5/118 put spds, 12 ref 120-00

- 2,000 TYN 112/115/118 put flys

EGBs-GILTS CASH CLOSE: Peripheries Underperform

Periphery EGB spreads widened Wednesday as Bunds strengthened on a continued flight to safety. The UK curve was mixed, with the short end stronger but 10+ year segment slightly weaker.

- The bigger moves Wednesday were in the currency market, with EUR and GBP weakening sharply against the USD (in accordance with the risk-off theme).

- Greek spreads widened sharply amid a 5Y GGB tap via syndication, while BTP/Bunds had widest closing level since June 2020.

- German inflation data takes focus Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4.9bps at 0.1%, 5-Yr is down 4.7bps at 0.529%, 10-Yr is down 1.4bps at 0.801%, and 30-Yr is up 1.9bps at 0.974%.

- UK: The 2-Yr yield is down 1.1bps at 1.489%, 5-Yr is down 0.2bps at 1.575%, 10-Yr is up 1.6bps at 1.812%, and 30-Yr is up 3.3bps at 1.937%.

- Italian BTP spread up 3.2bps at 177.2bps / Greek up 5.6bps at 223.4bps

EGB Options: Euribor Calls Prevalent

Wednesday's Europe rates / bond options flow included:

- RXM2 156.00 puts sold at 197.5 in 3k

- OEM2 128.00/127.00/126.00p ladder, sold at 23 in 2k

- OEM2 128.50/129.50cs 1x2, bought for 6.5 in 2.5k

- ERM2 100.25/100.375cs sold at 5.25 in 2.5k

- 0RZ2 98.75/99.00/99.25c fly, bought for 2.75 in 20k

- 2RU2 99.00/99.25 cs bought for 5.5 in 10k

FOREX: US Dollar Reigns Supreme, USD Index Rises To 5-Year High

- Gas flows across eastern Europe were the early focus of trade following reports late yesterday that Poland and Bulgaria had been cut off from Russian gas supply. The news continued to add headwinds for the Euro, with overall greenback strength exacerbating the EURUSD downward momentum.

- A continuation lower was evident throughout Wednesday following the breach of the 2020 low at 1.0636 and then 1.0577, the lower band of a moving average envelope. The low print of 1.0515 came within close proximity of the next support at 1.0494, Low Feb 22, 2017.

- After trading sharply lower on Tuesday, GBPUSD is also extending the current downtrend. The pair has cleared 1.2676 last printed in September 2020. Today’s low of 1.2503 provided firm support ahead of the psychological level and 1.2495, a Fibonacci retracement.

- In a reversal of yesterday's outperformance, JPY is the poorest performing currency in G10, helping USD/JPY climb back above the Y128.00 level. USDJPY remains in an overarching consolidation phase as bulls pause after the recent rally. This sideways activity highlights the formation of a bull flag, reinforcing bullish conditions with the uptrend still intact.

- Broad greenback strength saw the DXY (+0.55%) break above the 2020 peak to reach the best level since January 2017. However, a firmer day for equity/commodity indices saw the likes of AUD and CAD relatively outperform.

- Focus on the Bank of Japan meeting/decision overnight. Given the BoJ’s continued (and understandable) insistence that current inflationary pressures are cost-push not demand-pull related, markets expect the Bank to leave its monetary policy settings unchanged at the end of its April monetary policy meeting.

- Tomorrow brings flash April CPI estimates from Germany and Spain. The US data calendar will feature Q1 Advance GDP.

Late Equity Roundup: Bid But Wary Of Latest Earnings

SPX eminis gaining in late FI trade, upper half session range as markets get ready fora slew of new earnings after the close: Invitation Homes (INVH), Raymond James (RJF), Qualcomm (QCOM), Amgen (AMGN), Ford (F), Meta (FB), PayPal (PYPL) to name a few.

- Despite the bounce, fresh short-term lows confirm a resumption of the current downtrend and signal scope for a continuation of this theme. ESM2 trading +25.25 (0.61%) at 4196.25 well above key short term support of 4136.75 (Low Apr 26). Initial upside resistance: 4303.50/4355.50 High Apr 26 / Low Apr 18.

- SPX leading/lagging sectors: Materials (+2.43%) outpaces Information Technology (+2.34%) lead by software and services: Visa (V) +7.39%, MSFT +6.49%.

- Laggers: Communication Services (-2.19%) weighed interactive media ands services, in particular Meta (FB) -4.86%, Alphabet (GOOG) -3.31%).

- Meanwhile, Dow Industrials currently trades +209.95 points (0.63%) at 33448.76, Nasdaq +55.3 points (0.4%) at 12547.21.

- Dow Industrials Leaders/Laggers: Salesforce Inc +6.38 at 176.46, United Health +5.39 at 519.17. Boeing extends losses on heavy volume (-14.13 at 152.91), Johnson & Johnson (-1.55 at 183.13).

- RES 4: 4631.00 High Mar 29 and key resistance

- RES 3: 4588.75 High Apr 5

- RES 2: 4509.00 High Apr 21 and a key short-term resistance

- RES 1: 4303.50/4355.50 High Apr 26 / Low Apr 18

- PRICE: 4182.00 @ 14:31 BST Apr 27

- SUP 1: 4136.75 Low Apr 26

- SUP 2: 4129.50 Low Mar 15 and a key support

- SUP 3: 4094.25 Low Feb 24 and a bear trigger

- SUP 4: 4063.24 1.618 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis remain bearish. The contract traded lower again on Tuesday, reinforcing current bearish conditions. Fresh short-term lows confirm a resumption of the current downtrend and signal scope for a continuation of this theme. This has opened 4129.50, the Mar 15 low. Key short-term resistance has been defined at 4509.00, Apr 21 high. Initial resistance though is seen at yesterday’s high of 4303.50.

COMMODITIES: Oil Prices Nudge Higher But Gold Clears Bear Trigger

- Oil prices are modestly higher on the day as Germany is ready to back an EU ban on Russian oil if it’s gradual.

- TTF gas prices increased a further 4% following Russia’s decision to halt gas supplies to Poland and Bulgaria. The EU has warned companies not to meet demands to pay for gas in rubles but Italy’s ENI prepares to open accounts regardless (adding to earlier stories that four European gas buyers have already paid in rubles and ten have opened gazprom accounts).

- France will hold a meeting of EU energy ministers in May to discuss how to deal with Russia’s decision to halt gas supplies to Poland and Bulgaria.

- WTI is +0.5% at $102.2 with an almost parallel shift across the curve 1y out.

- It’s at the top end of yesterday’s range and not troubling technical ranges with resistance at $105.42 (Apr 21 high) and support at $95.28 (Apr 25 low).

- Brent is +0.5% at $105.6, with resistance at $109.8 (Apr 21 high) and support at $99.48 (Apr 25 low).

- Gold is -1.0% at $1887.2 as further USD strength sees a resumption of gold weakness after pausing yesterday. It clears the bear trigger of $1890.2, a clear break opening support at the $1878.4 Feb 24 low from the first day of the war in Ukraine.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/04/2022 | 0130/1130 | ** |  | AU | Trade price indexes |

| 28/04/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/04/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/04/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/04/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/04/2022 | 0700/0900 |  | EU | ECB de Guindos Presents Annual Report 2021 | |

| 28/04/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 28/04/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/04/2022 | 0800/1000 |  | EU | ECB publishes May economic bulletin | |

| 28/04/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/04/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/04/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/04/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 28/04/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/04/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/04/2022 | 1400/1600 |  | EU | ECB Elderson Panels ECOSOC UN Forum | |

| 28/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 28/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.