-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBaht Shows Relative Vulnerability To Fed Rate Hike, Trimming Weekly Gain

Spot USD/THB deals +0.235 at THB37.810 after Wednesday's monetary policy decision from the Fed, which was accompanying by mixed messaging, although Chair Powell ultimately reaffirmed hawkish bias and pointed to higher terminal rate expectations.

- Technically, the rate is forming a descending channel, drawn off Oct 20 high. A break above the ceiling of that channel (THB37.900) would shift focus to recent cyclical highs (THB38.465). Bears look for a dip through channel floor/50-DMA at THB37.290/37.285 before targeting Oct 6 low of THB37.125.

- The baht is the worst performer in emerging Asia, losing 0.62% versus the greenback so far. Its outsized reaction to another 75bp rate hike from the Fed could be attributed to the BoT's status as a latecomer to the global tightening campaign and its commitment to raising interest rates in a gradual manner.

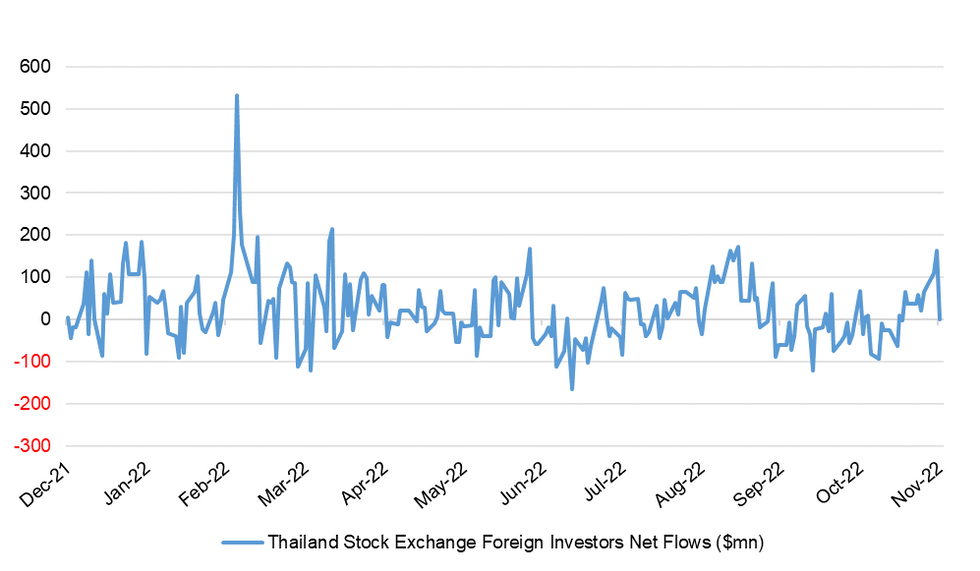

- Today's drop reduces the baht's since the end of play last Friday, although it remains the best performer in emerging Asia on a weekly basis. Pre-Fed strength was supported by a decent recovery in foreign equity inflows and hopes for quicker recovery of the local tourism industry.

- Net equity flows subsided Wednesday, albeit they stayed positive, just. Foreign investors snapped up just $0.70mn in Thai stocks, with daily flows faltering below their 15-DMA. The SET index rejected resistance from its 200-DMA before trimming gains.

- PM Prayuth speaks at the Thailand-China Investment Forum this morning. FinMin Arkhom will deliver an address at Export-Import Bank fair later in the day.

Fig. 1: Thailand Stock Exchange Foreign Investors Net Flows ($mn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.