-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

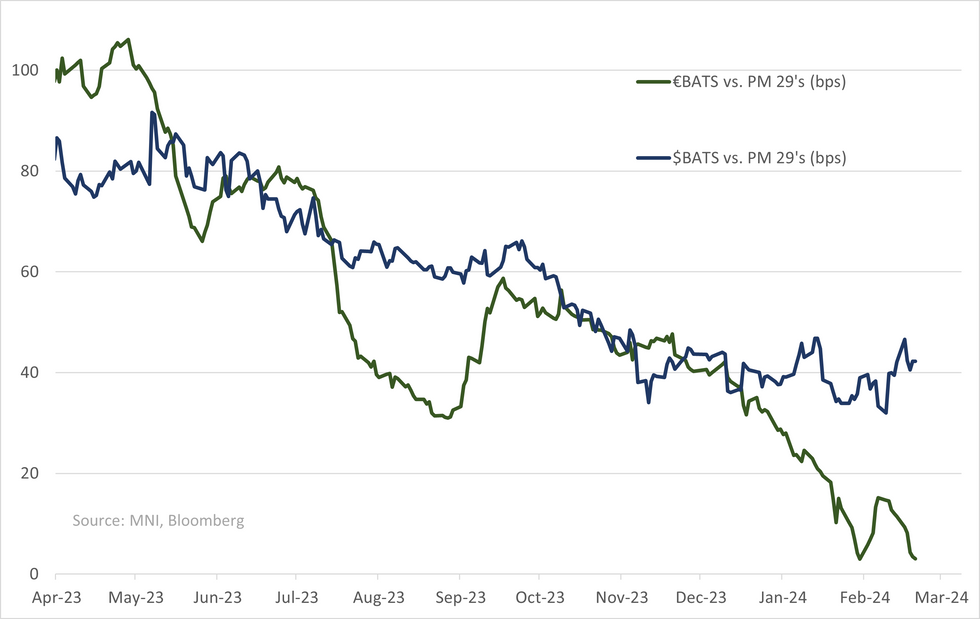

BAT resumes its compression towards PM

- BAT's decision to restart buybacks (£700m this yr) on the 3.5% ITC stake sale (totalling £1.5b) was not unexpected for us but lowering leverage target by ~0.25* to 2-2.5* (its at 2.6* right now) was. At the midpoint (2.25*) that's another ~£4b reduction in net debt (on FY24/25 EBITDA consensus).

- Its hard to doubt mgmt on the new target - over the last 5yrs its avg'd £2-3b in debt repayments taking leverage down by -1*. Healthy FCF generation has allowed it to keep dividend yield at a now est. 9.9% (!) but offset for equity returns is a share price that's traded flat.

- Its rated (Baa2 Pos, BBB+ S, BBB Pos) - S&P the highest and most timely (its only one to come since FY earnings changing outlook from neg. to stable). We don't see upward rating action from it on the new targets - it needs leverage close to 2* for that (vs. current S&P adj. 2.9*/company reported 2.6*) & needs strong operating performance.

- Phillip Morris which has now entered its phase of deleveraging (-0.3*-0.5* this yr) & has better headline growth prospects (EBITDA expected to grow in high single digits yoy vs. BAT flat) continues to trade tight to BAT (a € not $ dynamic).

- We take off the firm view for BAT to underperform/widen now - but with it unlikely to get its uplift into A (to match PM) even on new targets, we still see BAT weakness as the likely on spread sell-offs. As we've highlighted before historical broader tobacco discount has also come in on this spread rally.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.