-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

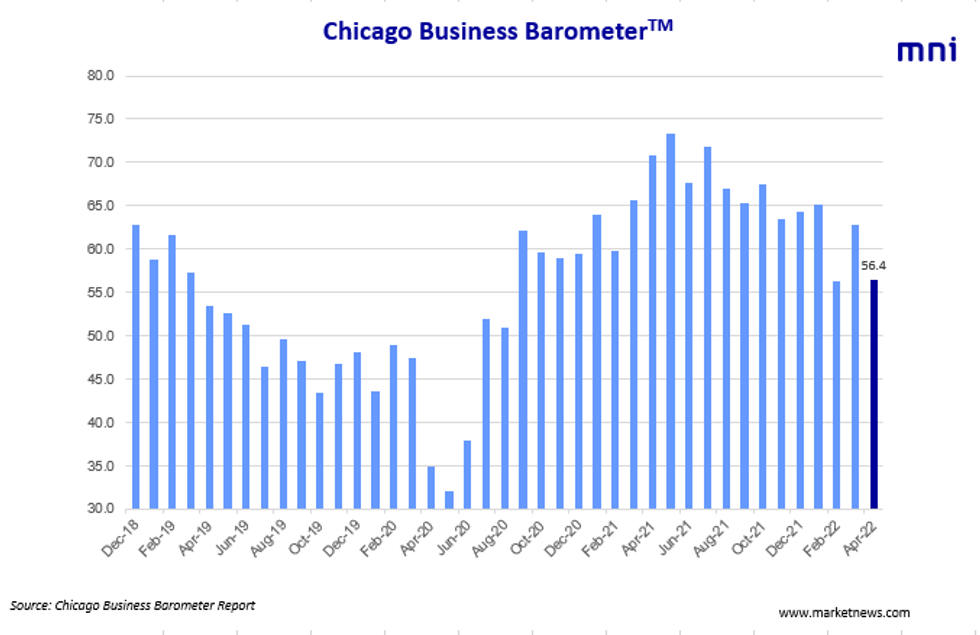

Free AccessChicago Business Barometer™ – Dipped to 56.4 in April

Key Points – April 2022 Report

The Chicago Business Barometer™, produced with MNI, fell to 56.4 in April, reversing last month’s gain to 62.9.

All main indicators decreased except for Prices Paid, with both Production and New Orders now at the lowest level since Summer 2020.

- New Orders saw the largest decline, dropping 10.8points to 51.1, a post June-2020 low, with almost half of firms seeing no increase.

- Production slumped 9.1 points to 50.9, over 10 points below the 12-month average. Firms cited key part shortages as particularly acute in April, with supply chain delays dragging on production capabilities.

- Order Backlogs slipped 0.9 points to 63.4 remainingpersistently high.

- Employment waned 2.6 points to 45.5, following the March recovery to 48.1. Highly competitive labour market conditions continued to make staff retention challenging.

- Supplier Deliveries dipped 3.8 points through April to74.5, the lowest in 14 months. Half of firms saw slowdowns from March.

- Inventories declined for the first time in three months, down 4.1 points to 64.6, following the near 50-year high in March. Some relief was seen as suppliers began to catch up, allowing firms to build some stock.

- Prices Paid ticked up a modest 0.4 points to 86.1 withover three-quarters of firms citing higher prices this month. The Ukraine war was cited as inflating steel, plastics and lumber costs.

SPECIAL QUESTION

This month we again asked firms whether they have revisited their supply base to map multiple supplier tiers by country and/or alternative suppliers. A total 67.5% said key suppliers only, whilst 17.5% were remapping country-specific suppliers. Approximately 10% were including alternative suppliers, whilst only 5% were revisiting tier two and tier three suppliers.

Click below for the full press release:

MNI_Chicago_Press_Release_2022-04.pdf

For full database history and full report on the Chicago Business Barometer™, please contact:sales@marketnews.com

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.