-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessChina GDP Downgrades Point To High Water Mark For Global Growth Forecasts

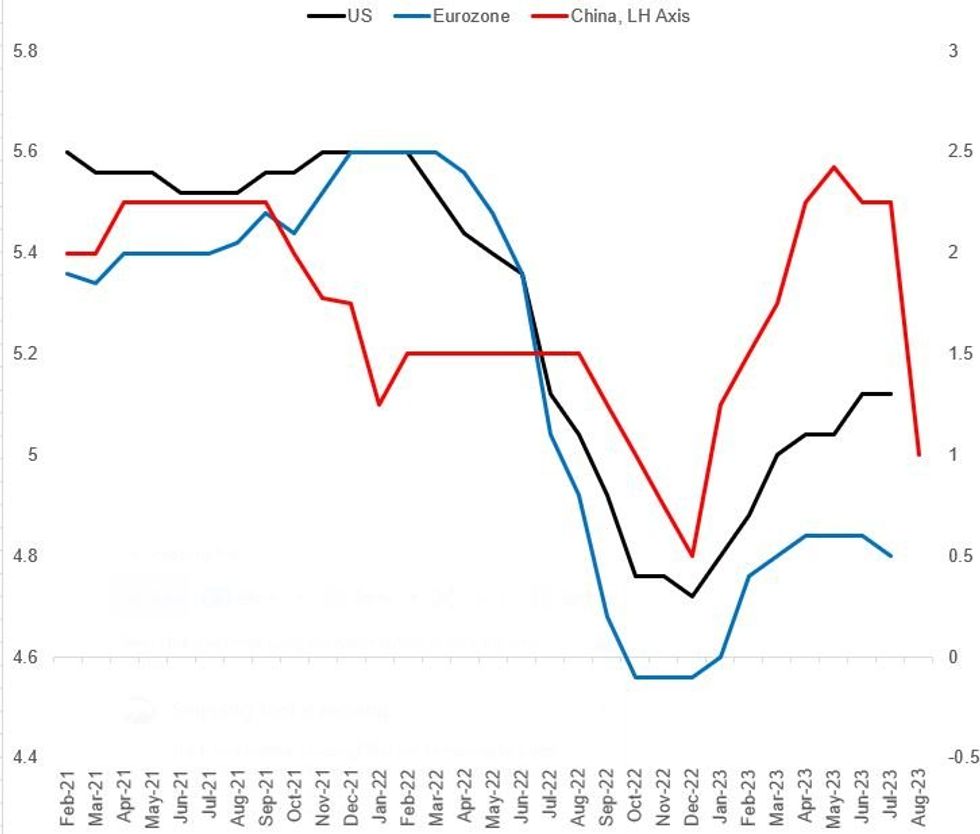

MNI (London) - The downgrades we have seen to China 2023 GDP forecasts today are largely marking to market what already appeared to be a softening of activity in Q2 (putting the Y/Y base effects aside, the quarter saw a sequential downshift in growth to 0.8% Q/Q SA vs 2.2% prior).

- Our Asia-Pac team's note on the China GDP numbers overnight pointed out the divergence in the 2023 growth consensus and ongoing downside surprises (available here). GDP growth consensus for 2023 had remained at 5.5% despite clear downside economic surprises in the quarter.

- We've seen several analysts downgrade their outlooks today from 5.5% to closer to 5.0% for the year after the Q2 figures. Some examples: Morgan Stanley cut theirs to 5% from 5.7%; SocGen to 5% from 5.5%; UOB to 5.0% from 5.6%. Goldman's maintained theirs at 5.4%, Nomura at 5.1%.

- The chart below shows economists' median consensus 2023 real GDP growth forecast to the start of July, with a drop in the China line reflecting the 5% level that looks like it could anchor the new consensus in the August surveys (and corresponding with the official growth target).

- Global GDP forecasts are likely to be marked to market lower in coming months as well, with the 2.6% BBG median world projection (up from 2.1% in January) in July's survey now looking like the high water mark, especially as Eurozone growth upgrades have petered out following a surprisingly good start to the year.

- At the outset of 2023, China's ongoing reopening was expected to be a potential upside risk to global growth (with the US and Europe seen entering recession), the main question around which was how bumpy the reopening would be. The focus now is on official Chinese stimulus, and how quickly and effectively it jumpstarts activity (see MNI: Weak Credit Demand Limits PBOC Easing, Fiscal Move Needed).

2023 Real GDP Forecast Median (%) - 5% illustrative update for China after Q2 GDPSource: BBG, MNI

2023 Real GDP Forecast Median (%) - 5% illustrative update for China after Q2 GDPSource: BBG, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.