May 31, 2024 12:58 GMT

Core PCE In Line With Consensus In May, 3-month Run Rate Eases

US DATA

DataEM BulletHomepagemarkets-real-timeCommoditiesEmerging Market NewsMetals bulletEnergy BulletsData BulletBulletMarketsFixed Income BulletsForeign Exchange Bullets

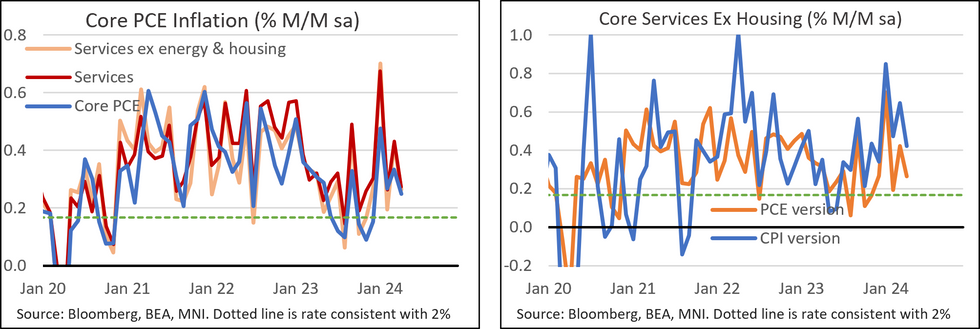

- Core PCE inflation came in at 0.249% in May, just about rounding down to a 0.2% M/M to bring it in line with the Bloomberg consensus. The unrounded figure prints squarely in line with the 0.24-0.25% sell-side consensus reported by MNI.

- The in line reading has nonetheless allowed core FI to rally following the release, with the ‘low’ 2.8% Y/Y likely helping there (unrounded 2.754%).

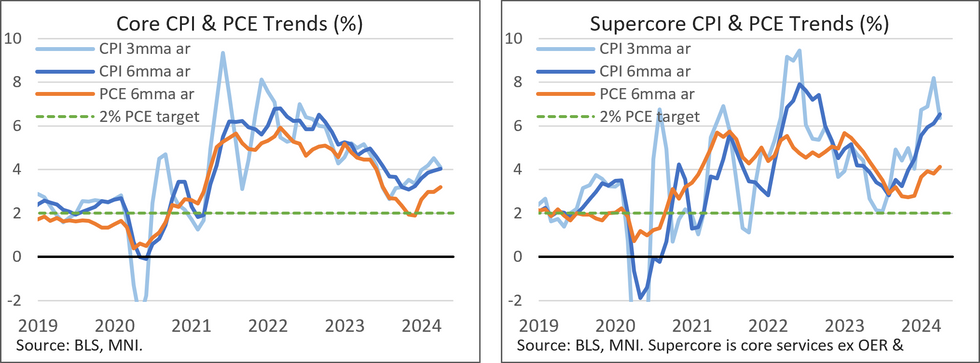

- The 3mma ar run rate of core PCE thus moderates to 3.5% (vs 4.4% prior), while the 6mma run rate ticks up to 3.2% (vs 3.0% prior).

- Looking at core services ex-housing (“Supercore”): The 0.264% M/M print comes after 0.422% in April. Similar to core PCE, the 3mma ar run rate moderated to 3.6% Y/Y (vs 5.4% prior) while the 6mma ar rate ticked up to 4.1% Y/Y (vs 3.8% prior).

- Yesterday’s downward revision of the Q1 core PCE index to 3.65% (vs 3.73% prior) was accounted for by January, where core PCE was revised 2.6bps lower to 0.476% M/M.

- With many of the dynamics at least partially telegraphed coming into the release, this shouldn’t change much for the Fed ahead of its June 12 meeting, with next week’s NFP release now in view.

219 words