-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEquity Inflows Buoyed By Outperformance Trend

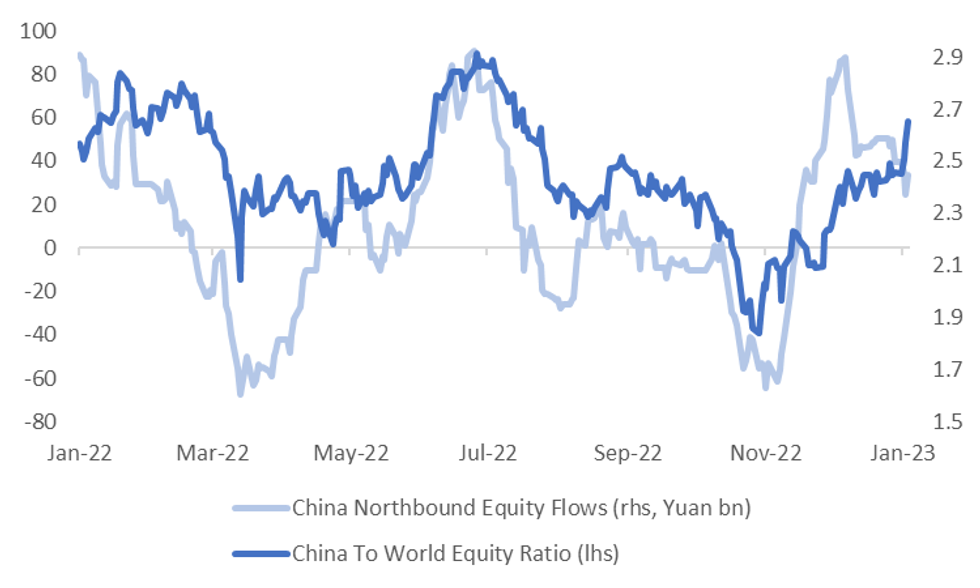

If China equities continue to outperform the rest of the world trend it should spur more inflows into local equities. The first chart plots the ratio of China equities to global equities (MSCI basis) against the rolling 1 month sum of northbound flows via the stock connect. Yesterday saw the largest daily inflow since mid November last year.

- China equities are generally on a positive footing again today, which has helped drive a further 4.6bn yuan of inflows so far via the stock connect. This follows 12.75bn yuan from yesterday.

- Sentiment has been buoyed further today by Bloomberg reports that China will wind back restrictions on the property sector (easing the so-called three red lines property rules).

Fig 1: China/World Equity Ratio & Northbound Equity Flows

Source: MNI - Market News/Bloomberg

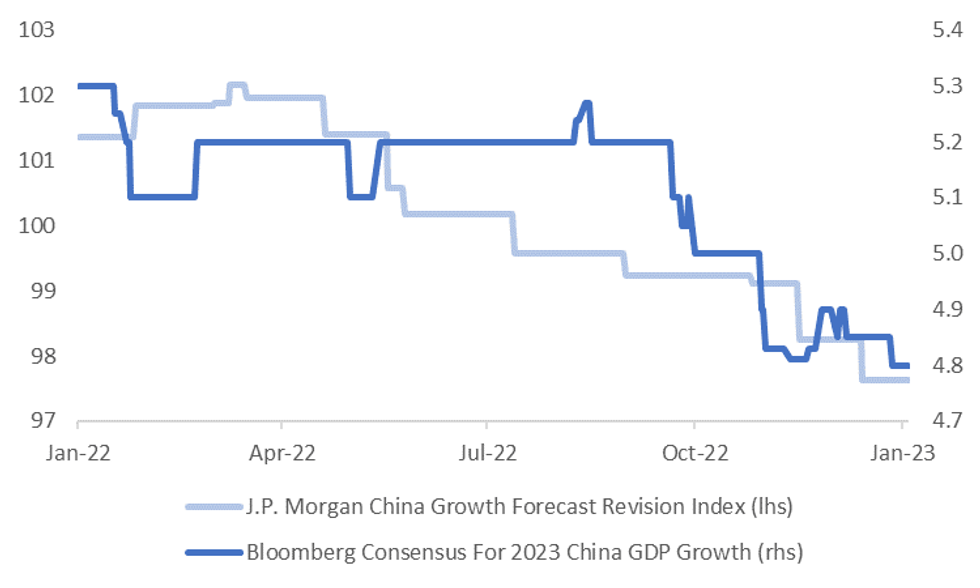

- China growth expectations have stabilized as per consensus expectations for 2023, taken from Bloomberg, and the J.P. Morgan growth forecast revision index for China, see the second chart below.

- If growth expectations turn higher, or least remain stable, it could drive the China outperformance theme further, particularly with growth forecasts for major developed economies generally sitting much lower for 2023 compared to 2022.

- The CNH has been following the relative equity trend (between China & the rest of the world) fairly closely since September last year, as we highlighted this morning (see this link).

Fig 2: J.P. Morgan China Growth FRI & Consensus 2023 China GDP Expectations

Source: J.P. Morgan/MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.