-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEurozone Issuance Deep Dive: May 2021

The full document is available via the link below:

May Outlook

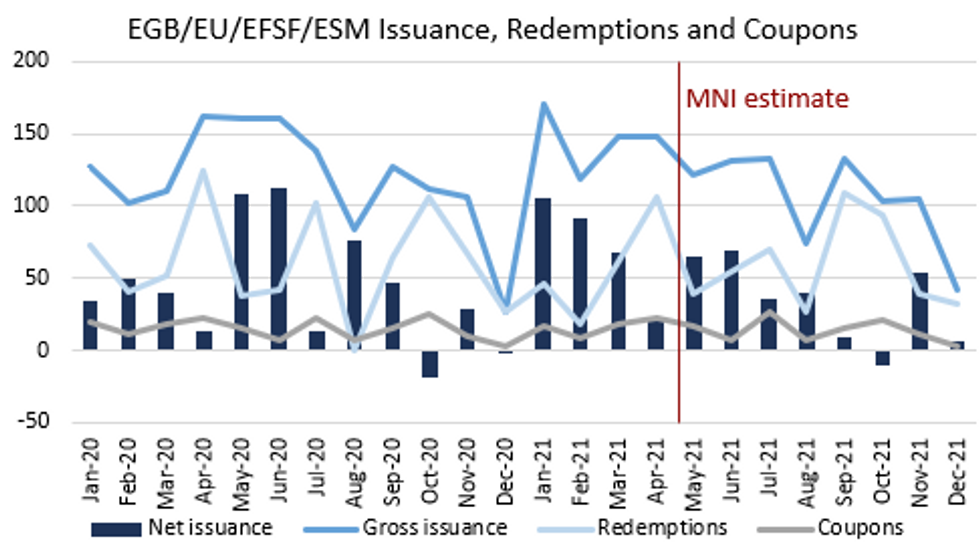

- The MNI Markets team expects gross issuance to be around E24bln lower in May than in April. We look for E122bln of issuance, down from E148bln in April.

- However, May will see much lower redemption and coupon payments, leaving net issuance substantially higher at E65bln. This is up from E20.0bln in April but broadly in line with March's E68bln.

- We think there will probably less fewer syndications in May than April. We look for transactions from Finland (either 10y RFGB or USD bond), Germany (new 30y Green Bund), Italy and the EFSF. We also see a good chance of the EU via its SURE programme and possibly Spain.

Contents

- See page 2 for a comparison of issuance with last year for both April and YTD.

- See pages 3-12 for country-by-country overviews of issuance so far this year, plans for the rest of the fiscal year and MNI's expectations of May issuance for each country.

- See pages 13-14 for overviews of the 2021 calendar year in comparison to 2020.

- See page 15-22 for bond and T-bill auction calendars for 2021.

- See page 23-25 for a schedule of coupons and redemptions by country for 2021.

April Review

- A total of E148bln of EGB and EU issuance took place in April 2021, marginally lower than the E153.0bln of April 2020.

- There was heavy issuance in the 11-21-year area of the curve, with the Netherlands, Spain, EU and Slovakia all issuing new 15-year benchmarks via syndication while Italy launched a 16-year retail-only BTP Futura.

- Note that after the heavy issuance of ultra-long bonds in January and February, there were no bonds issued with a longer than 30-year maturity in March.

- Spanish, Irish and Belgium issuance was notably less in April 2021 than in April 2020, as was issuance from the smaller Eurozone countries (after a glut of syndications by smaller countries to issue during the first phase of the pandemic in April 2020).

- Italy and the Netherlands saw the largest increases in issuance relative to last April.

Year-to-date Review

- Issuance through the first four months of the year has been around E90bln higher in 2021 than 2020, with cash raised this year at E580bln.

- The EU accounts for over E40bln of the increase, Italy over E35blln, Germany E23bln and the Netherlands and France both over E10bln.

- Issuance is notably lower in Spain, Belgium, Portugal, Finland and the smallest Eurozone countries.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.