June 27, 2024 08:16 GMT

External Demand An Upside Risk to Riksbank Rate Path

RIKSBANK

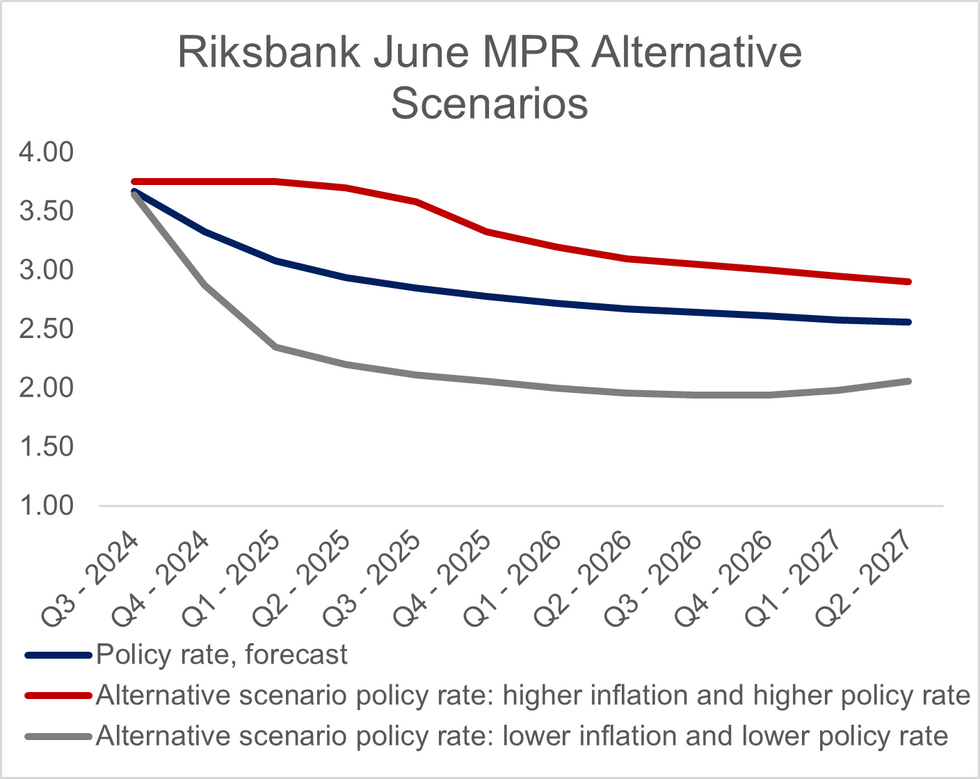

Stronger than expected external demand is cited as an upside risk to the Riksbank’s updated rate path. This scenario would see rates being held at current levels (3.75% into Q1 2025).

- The Riksbank also referenced stronger developments abroad as an upside risk in the March MPR.

- The “low inflation scenario”, which in recent quarters has been a better reflection of actual inflation developments than the main scenarios, considers the case where inflationary pressures are lower than forecasted.

- Unsurprisingly, this scenario sees more cuts in the near-term, with policy rates settling around 2% at the end of the forecast horizon.

- Rounding out the rest of the forecasts, unemployment is expected to be a little higher through the forecast horizon, while CPIF ex-energy has been revised lower.

- GDP growth is expected to be flat in Q2 2024, before rising to around 0.5% Q/Q in the second half of the year. The KIX index forecast is broadly unchanged.

165 words