May 31, 2024 11:35 GMT

Fall In Core Inflation Momentum Conceals Services Persistence

EUROPEAN INFLATION

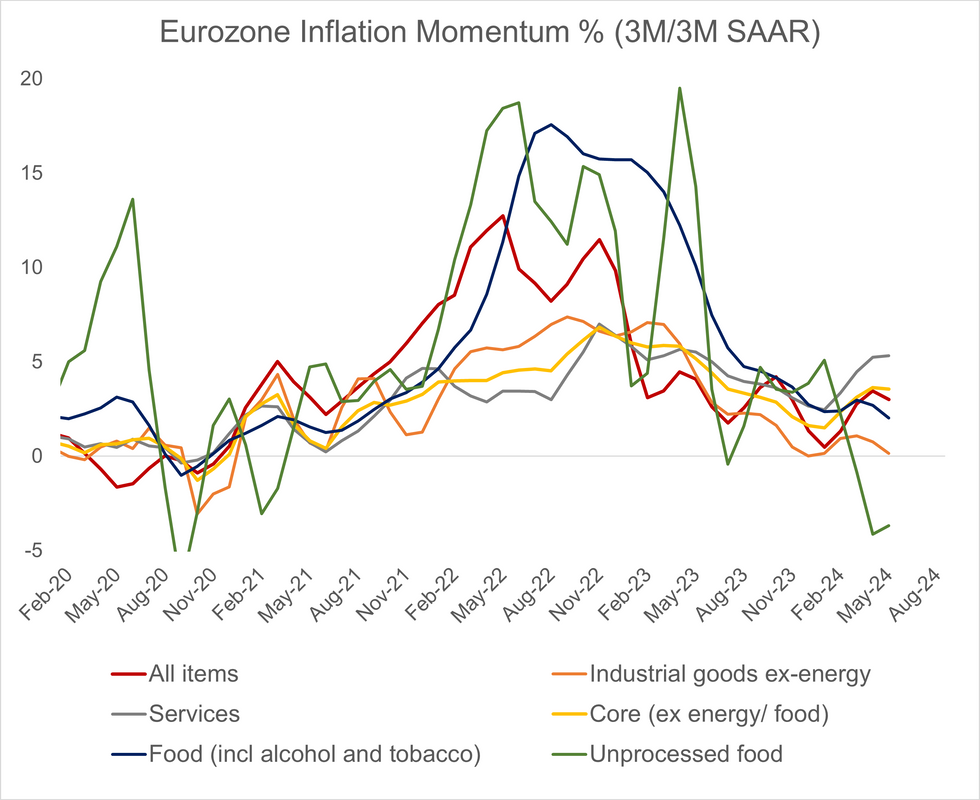

The ECB’s seasonally adjusted HICP data indicates that core inflation momentum moderated slightly in May to 3.55% 3m/3m SAAR (vs 3.62% prior).

- However, details show that this was driven by a sharp fall in core goods momentum (0.14% vs 0.75% prior), with services momentum accelerating for the fourth consecutive month to 5.32% (vs 5.25% prior).

- On a sequential basis, core inflation rose 0.35% M/M SA in May (vs 0.19% prior), with services prices rising 0.53% (vs 0.23% prior) and core goods just 0.04% (vs -0.04% prior).

- This suggests that services inflation remains a persistent force, which should dissuade the ECB from cutting rates at its July meeting after the well-telegraphed June cut next week.

- This is supported by our Policy Team’s latest ECB sources piece, and market pricing.

- A reminder that the ECB’s closely watched underlying measures will be released on June 18, after the June 6 meeting.

158 words