-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessFirmer Than Expected Tokyo CPI After Futures Rally Overnight

JGB futures ended the overnight session 25 ticks above Tokyo settlement levels, unwinding the weakness observed since Wednesday’s Tokyo close, as a bid in U.S. Tsys provided some support through the second half of post-Tokyo dealing, with global matters continuing to dominate ahead of the impending Jackson Hole symposium.

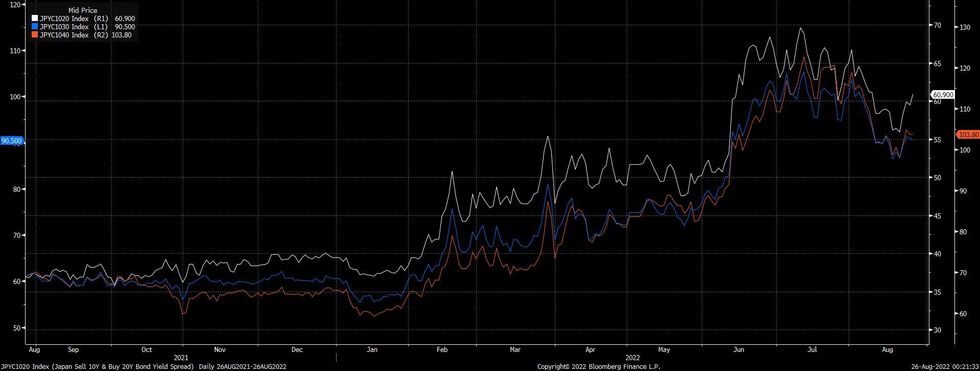

- The recent steepening of the curve may generate some fresh demand for super-long end paper given the steepening observed week-to-date. While the likes of the 10-/20-, 10-/30- & 10-/40-Year JGB curves operate comfortably off of their respective cycle steeps, continued market volatility and elevated FX-hedging costs will keep the domestic life insurers and pension fund cohort focused on any opportunities to deploy capital in the longer end of the JGB curve (as they seemingly did last week).

- Tokyo CPI data for August has been and gone, with firmer than expected releases observed across the board (headline +2.9% Y/Y vs. BBG median of +2.7% and +2.5% seen in July, ex-fresh food at +2.6% Y/Y vs. +2.5% BBG median and +2.3% seen in July and ex-fresh food and energy at +1.4% Y/Y vs. BBG median +1.3% & +1.2% seen in July). Note that the excluding fresh food and energy metric is still comfortably below the BoJ’s 2.0% target, with the Bank continuing to reaffirm its on hold stance as the current inflationary pressures are dominated by cost-push, not demand-pull factors, leaving the Bank pointing to the need for a continued and elongated extension of more notable wage growth.

- Elsewhere, 3-month bill supply is due later today.

Fig. 1: 10-/20-, 10-/30- & 10-/40-Year JGB Yield Curves (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.