-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

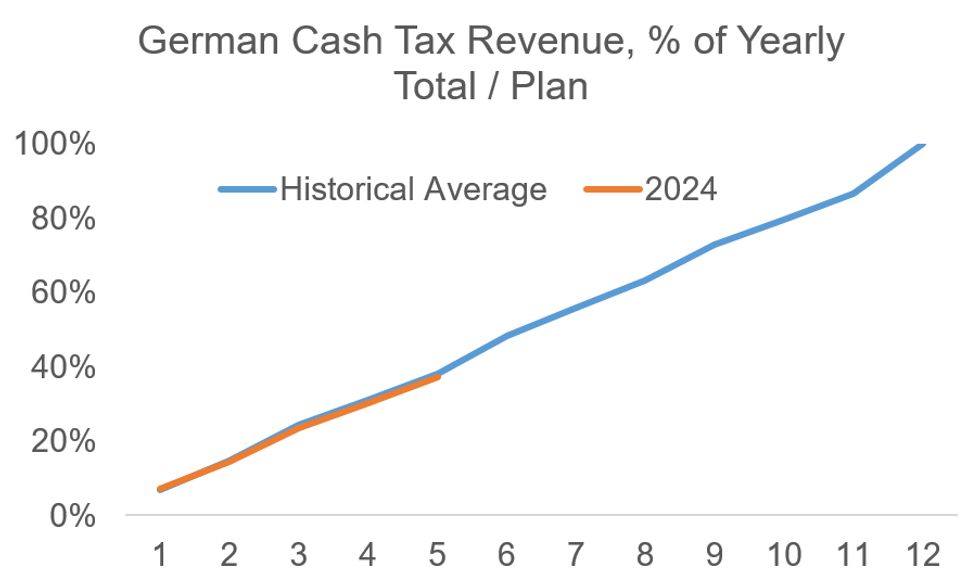

Free AccessGerman Tax Revenues Largely in Line W/ Plan in May

German tax revenue excl. municipality taxes increased 2.6% Y/Y to E61.2bln in May and remains 2.9% higher YTD (+2.9% April).

- Despite being higher than last year in simple cash terms, as a proportion of total expected revenue for the year, revenues still appear to be disappointing ('Further Downside Risks to Downwardly Revised Tax Estimates' - MNI, May 17). For example May YTD revenues are 36.7% of forecast 2024 total revenues, whereas a normal historical average sees 37.3% of total year revenues received in the period Jan-May. So this suggests revenues overall may be below forecast - a similar story to last month.

- This follows April's revenues tracking at 30.2% vs 31.1% hist avg 2017 - 2023, showing a slight catch-up, however, so the May revenue by itself appears to be largely in line.

- Income taxes saw slightly less growth in May after a strong April at +4.1% Y/Y (vs 5.5% Apr). Comparatively strong upticks would be expected here after strong nominal wage upticks in Q1, and these do not show in full in the revenue data yet, the Ministry of Finance adds.

- Capital gains revenues continue to print way above recent historical standards, at +186.3% YTD Y/Y in May, and 47.6% of 2024 plan vs 49.6% hist as the revenue targets were significantly upwardly revised here. Data confirms that this is driven by higher interest income, MoF noted, helped by significantly larger retail investor holdings of "deposits with an agreed term of up to 2 years" with the banking sector (as opposed to shorter-maturity holdings).

- Taxes on revenue (VAT/import VAT) meanwhile rose a mere 1.3% YTD Y/Y after a very weak -5.2% Y/Y May. The Ministry of Finance attributes the recent decline to some non-unusual volatility in the category, and says underlying developments seem largely in line with expectations on a sequential comparison vs April.

MNI, Ministry of Finance

MNI, Ministry of Finance

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.