-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGlobal COVID-19 Tracker – September 9

by Tom Lake

COVID-19 Trends and Developments

- Argentina's COVID-19 caseload increased by a record 12,027 on September 9. This pushed the country's total number of COVID-19 cases registered so far above the half million mark. The virus has now spread from the capital Buenos Aires to other more rural provinces where the health systems are less able to cope with a widespread outbreak of the disease. Argentina also recorded the highest number of COVID-19 fatalities per capita worldwide on September 8.

- The UK recorded its third consecutive day of new coronavirus cases in excess of 2,000. This is the first such occurence of three 2k+ cases in a day since May 22. The rise in cases has sparked the UK government to ban meetings of more than six people in social settings from September 14 onwards, despite an ongoing drive to encourage individuals to return to their place of work and support the economy.

- The average number of COVID-19 fatalities per day across the past week in Mexico stands at its lowest level since June 3, but in the context of deaths from the disease in Mexico on September 8 remaining in the top 10 most severely hit countries worldwide. The average number of new cases registered per day has remained relatively steady around 5,000-5,500 per day since mid-August.

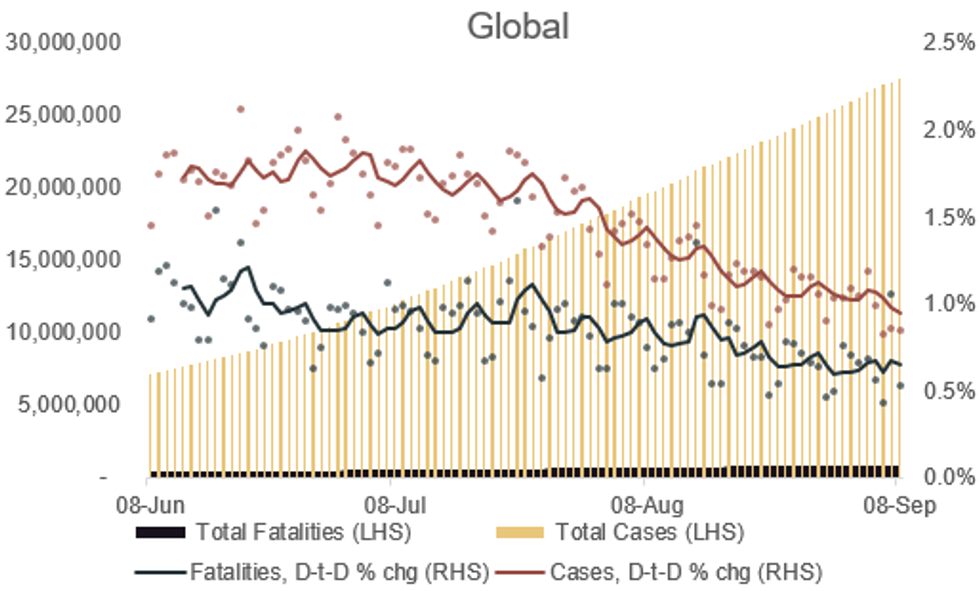

Chart 1. COVID-19 Cases and Fatalities, Nominal and % Chg Day-to-Day (5dma)

Source: JHU, MNI. As of 0600BST September 9. N.b. Each dot represents a single day's figures, data for past three months

Source: JHU, MNI. As of 0600BST September 9. N.b. Each dot represents a single day's figures, data for past three months

Full article PDF attached below:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.