-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGLOBAL WEEK AHEAD: Eyes on Eurozone Prelim CPIs

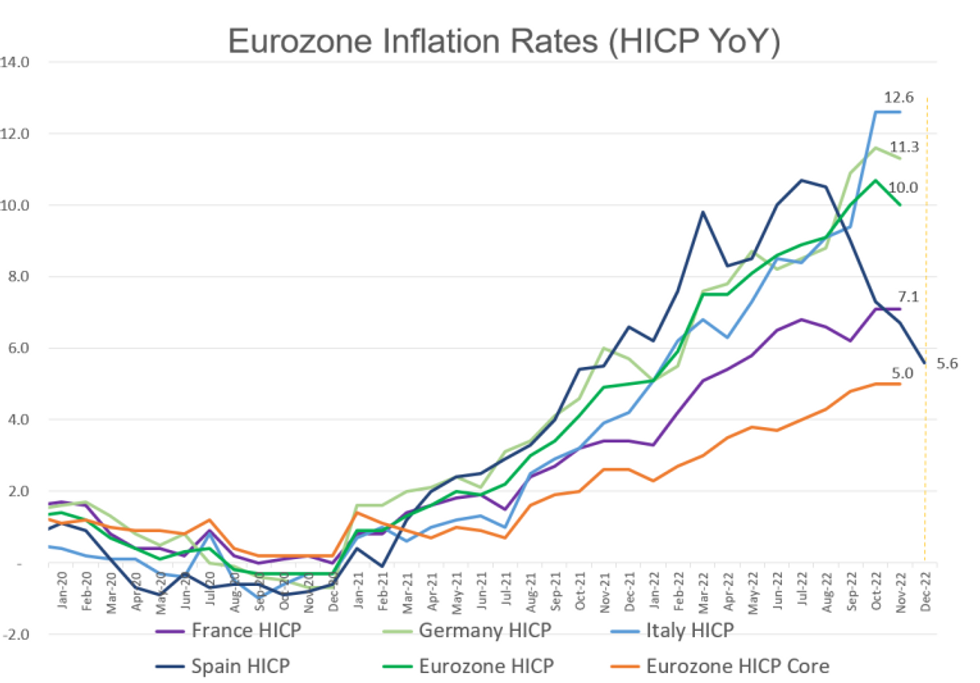

The main focus for the upcoming week will be euro-area preliminary December inflation prints. Headline annualised inflation is largely expected to cool, with tail risks of Italy and France going against the trend.

MONDAY

Final Eurozone Manufacturing PMIs: French, German and Eurozone final PMIs should largely confirm flash estimates, implying modest improvements to signal shallower contractions for the eurozone in December. Manufacturing PMIs are due Monday, and Services on Wednesday. The December PMIs, albeit improved, remained in contractive territory, extending the downturn into the sixth consecutive month. First and final prints are due for Spain and Italy, for which consensus is expecting marginally worse PMIs for Spain, yet Services remaining above the crucial break-even point of 50. Italy is expected to see both manufacturing and services hold at November levels, which signals soft downturns.

TUESDAY

Germany Labour Report: The German December labour data is expected to continue to show unemployment unchanged at 5.6% and a modest 15K uptick in unemployed persons. This is largely in line with levels since September. The German labour market remains very tight, a concern for the ECB as wage pressures grow. The German Statistic Bureau posted a +2.3% y/y rise in nominal earnings in Q3, implying a -5.7% y/y fall in real earnings. Q4 data will not be posted until well into Q1 next year and will uncover the extent to which inflation is becoming entrenched in wage negotiations.

Germany CPI: Following the morning slew of state data, German inflation is anticipated to cool by 0.9pp to +9.1% y/y in the national print, and by 0.8pp to +10.5% y/y in the harmonised reading. Month-on-month CPI is expected to be deflationary, at -0.7% m/m following -0.5% m/m in the November national data.

WEDNESDAY

Switzerland CPI: Swiss inflation is set to cool marginally by -0.1% m/m in December, leaving the annualised CPI rate steady at the October level of +3.0% y/y. This is 0.5pp softer than the August peak. In December the SNB raised its policy rate to 1% from 0.5% and slightly boosted its medium-term inflation forecast, signalling also that it could hike more if necessary and remains willing to use the exchange rate as necessary to counter price pressures. Average inflation is expected to reach 2.9% this year.

France CPI / Consumer Sentiment: French HICP is seen little changed from November, at +0.4% m/m again and edging up by 0.1pp to +7.2% y/y -- a fresh euro-era peak. Focus will be on whether fiscal support manages to bring down energy costs, which recorded only a marginal deceleration on the year in November.

Consumer confidence will likely edge up another point to 84, distancing further from the September dip to 80, which was only one point above the euro-debt crisis of 2013 low.

US ISM Manufacturing PMI: The ISM manufacturing PMI is projected to weaken by half a point to 48.5 in December, weakening for the fourth consecutive month and signalling a second month of contraction for the sector.

THURSDAY

Eurozone PPI: Factory-gate inflation is set to continue to slow across the bloc, albeit at a slightly softer pace of -0.5% m/m in November after the -2.9% m/m decrease in PPI in October. This should see PPI soften to +27.5% y/y, firmly below the August peak of +43.4% y/y.

Italy CPI: Italian inflation is hoping to see some relief in December, after holding steady at the alarming +12.6% y/y (HICP) and +11.8% y/y (CPI) pace in November. This CPI level is a 37-year high, boosted by a continued acceleration in energy and food prices.

FRIDAY

Germany Industrial Orders/Retail Sales: November data will likely paint a negative picture for German demand across both factory orders and the retail sector Retail sales should see some improvement, to expand by around +1.5% m/m, whilst remaining firmly contractionary at -5.9% y/y as the high cost of living and looming recessionary fears eat into consumer spending appetite. Factory orders are projected to contract by -0.5% m/m and -5.9% y/y, worsening into November as demand subsides.

Eurozone CPI: Eurozone CPI is seen softening for a second month running, cooling to +9.6% y/y in the December flash due next Friday.

Yet all attention will be on the core print, and whether it shifts from +5.0% y/y. The latest Spanish core jump provides evidence for an upside surprise. At the December meeting the ECB opted for a 50bp hike combined with significantly hawkish messaging. The ECB made clear that the slowdown to 50bp was not a pivot and that policy rates would be pushed beyond the neutral rate in order to dampen inflation.

Eurozone Sentiment: In line with individual national data, economic sentiment is expected to improve in December for the bloc, as outlooks continue to stabilise. Economic confidence should tick up to 94.5, from 93.7 in November.

US Nonfarm Payrolls: No major surprises are expected in the December non-farm payrolls data, with the unemployment rate to hold steady at 3.7%, only 0.2pp above the July/September low. Payrolls are expected to expand by around 200k, slowing from 263k recorded in November. The US labour market is showing signs of nearing peak tightness and the December forecast would imply the softest payrolls since the Omicron wave which saw a contraction.

US ISM Services PMI: The ISM services index should remain firmly in expansive territory in December, despite the expected 1.5-point moderation to 55.0 anticipated. Services have remained strongly expansive despite contractive manufacturing PMI data according to ISM, underpinned by a prolonged post-Covid re-opening boost.

Source: MNI/Bloomberg

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/01/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/01/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 03/01/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 03/01/2023 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/01/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 03/01/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 03/01/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/01/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 03/01/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 03/01/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/01/2023 | 1500/1000 | * |  | US | Construction Spending |

| 03/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 04/01/2023 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 04/01/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 04/01/2023 | 0730/0830 | *** |  | CH | CPI |

| 04/01/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 04/01/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 04/01/2023 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/01/2023 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/01/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/01/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/01/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 04/01/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/01/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 04/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/01/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 05/01/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/01/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/01/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 05/01/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/01/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/01/2023 | 0930/0930 |  | UK | BOE Dec DMP Survey | |

| 05/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/01/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 05/01/2023 | 1000/1100 | ** |  | EU | PPI |

| 05/01/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 05/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 05/01/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 05/01/2023 | 1420/0920 |  | US | Atlanta Fed President Raphael Bostic | |

| 05/01/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 05/01/2023 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 05/01/2023 | 1820/1320 |  | US | St. Louis Fed's James Bullard | |

| 06/01/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 06/01/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/01/2023 | 0730/0830 | ** |  | CH | retail sales |

| 06/01/2023 | 0745/0845 | ** |  | FR | Consumer Spending |

| 06/01/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/01/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 06/01/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 06/01/2023 | 1000/1100 | ** |  | EU | retail sales |

| 06/01/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 06/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/01/2023 | 1330/0830 | *** |  | US | Employment Report |

| 06/01/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/01/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/01/2023 | 1500/1000 | ** |  | US | factory new orders |

| 06/01/2023 | 1615/1115 |  | US | Atlanta Fed President Raphael Bostic | |

| 06/01/2023 | 1615/1115 |  | US | Fed Governor Lisa Cook | |

| 06/01/2023 | 1715/1215 |  | US | Richmond Fed President Tom Barkin | |

| 06/01/2023 | 1730/1230 |  | US | Kansas City Fed's Esther George | |

| 06/01/2023 | 2030/1530 |  | US | Atlanta Fed President Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.