-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

Highlights From Financial System Review

- Proactive steps but some way to go: “Canada’s financial system remains resilient […] Households, businesses, banks and other financial institutions have taken proactive steps to adjust to higher interest rates and to weather economic shocks," […] "This adjustment still has some way to go and continues to present risks to financial stability.

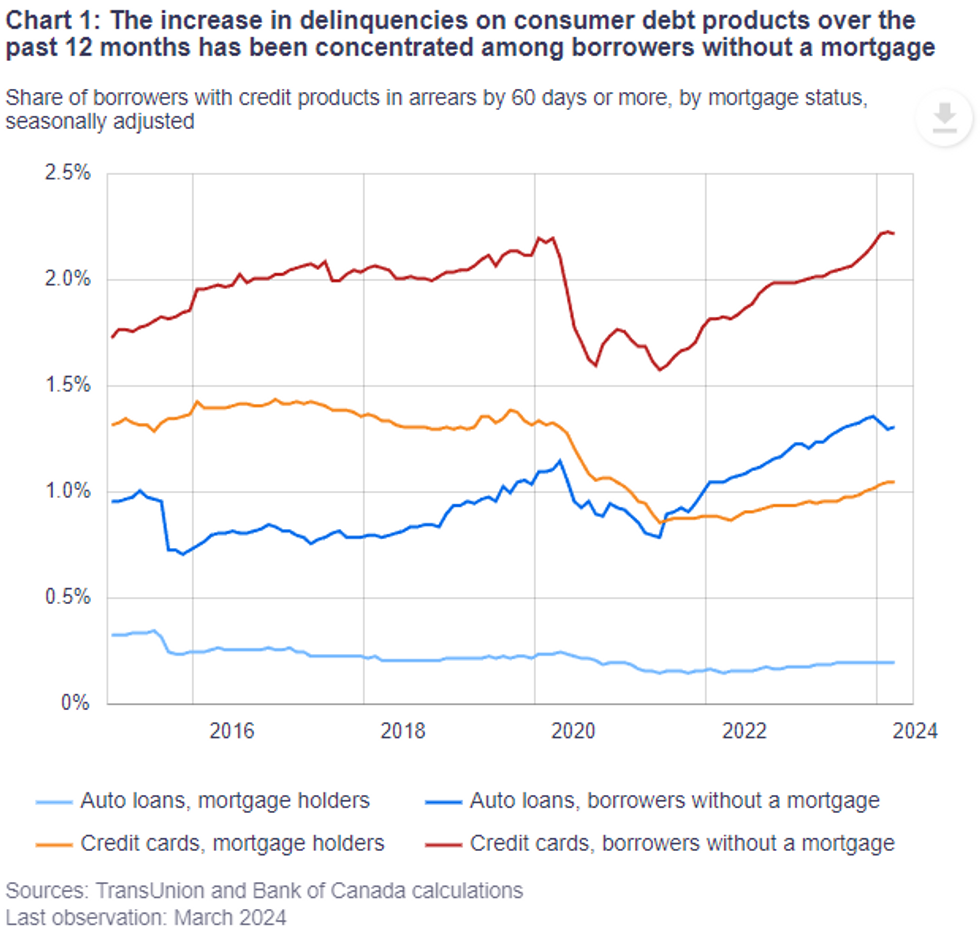

- Renters under greater pressure: “Signs of stress are concentrated primarily among households without a mortgage and survey data suggest that, of these households, renters are most affected. In contrast, indicators of stress among mortgage holders are largely unchanged, remaining at levels lower than their historical averages.”

- “Factors such as income growth, accumulated savings and reduced discretionary spending are supporting households’ ability to deal with higher debt payments.”

- Stretched valuations: “The valuations of some financial assets appear to have become stretched, which increases the risk of a sharp correction that can generate system-wide stress. The recent rise in leverage in the non-bank financial intermediation sector could amplify the effects of such a correction.”

- Increased hedge fund refinancing risks: “Leverage obtained by asset managers through borrowing in the repo market increased by around 30% in the past 12 months.” This was driven by hedge funds (75%) and pension funds (14%). Hedge funds have high refinancing risk with about 70% of repo exposure under one week. Further, the report notes that “Some individual repo positions held by hedge funds are also very large and highly concentrated—for example, in a single Government of Canada bond.”

- Recall that the BoC has previously attributed the growing popularity of the basis trade by hedge funds to CORRA trading above the overnight target through late 2023/early 2024 rather than being down to QT.

Source: Bank of Canada FSR

Source: Bank of Canada FSR

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.