May 20, 2024 13:26 GMT

Improvement In Supply Availability Has Stalled - NY Fed Staff

FED

Homepagemarkets-real-timeCreditEmerging Market NewsBulletMarketsFixed Income BulletsForeign Exchange Bullets

NY Fed staff in an update from their new measures of supply availability that will be published on a monthly basis from June (full note here):

- “These indexes indicate that supply availability had generally been improving since early 2023, but over the past couple of months, improvement has stalled.”

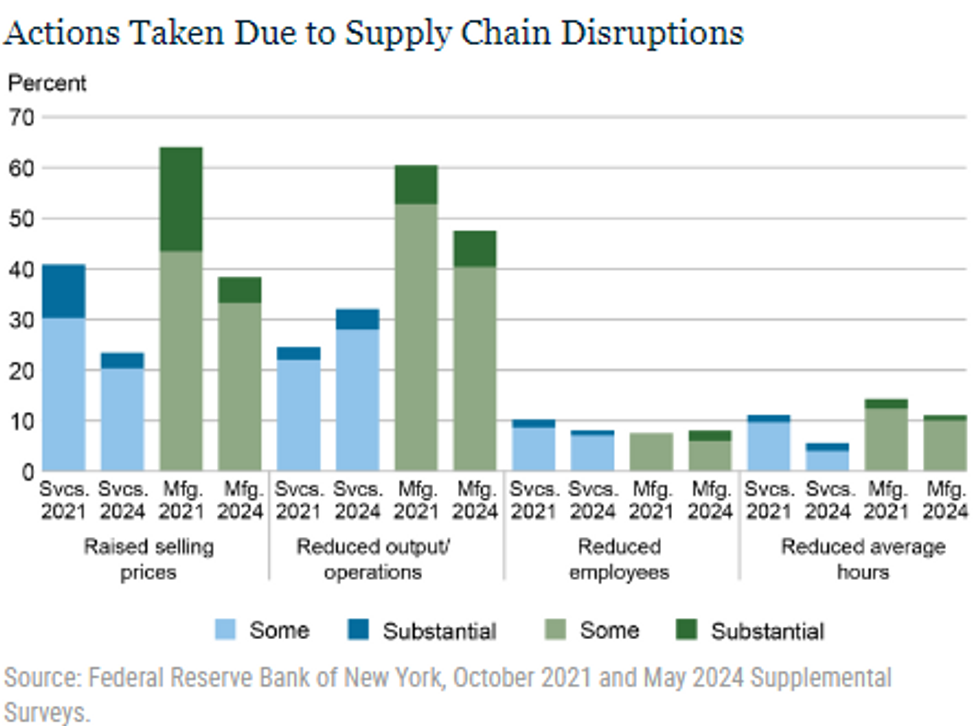

- “This trend is concerning since our May Supplemental Survey indicates that between a third and a half of businesses in the region are experiencing difficulties obtaining supplies, and many are reducing operations and raising prices to compensate, though to a lesser extent than a few years ago.”

- See the actions taken by firms in light of these supply pressures and how it compares to 2021 in the chart below with a breakdown by goods and services:

Source: NY Fed

Source: NY Fed

141 words