-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessIndustrial Output Shrinks, C/A Deficit Widens, M'fing PMI Remains In Contraction

Spot USD/THB rallied to THB31.400 Wednesday but pared gains and finished the day in negative territory. The rate has extended its pullback from multi-month highs this morning and last changes hands -0.017 at THB31.243.

- Thailand's industrial output shrank 1.08% Y/Y in Feb, missing consensus forecast of a 0.60% increase. Declines in oil, refinery, clothing and beer productions weighed on the composite index.

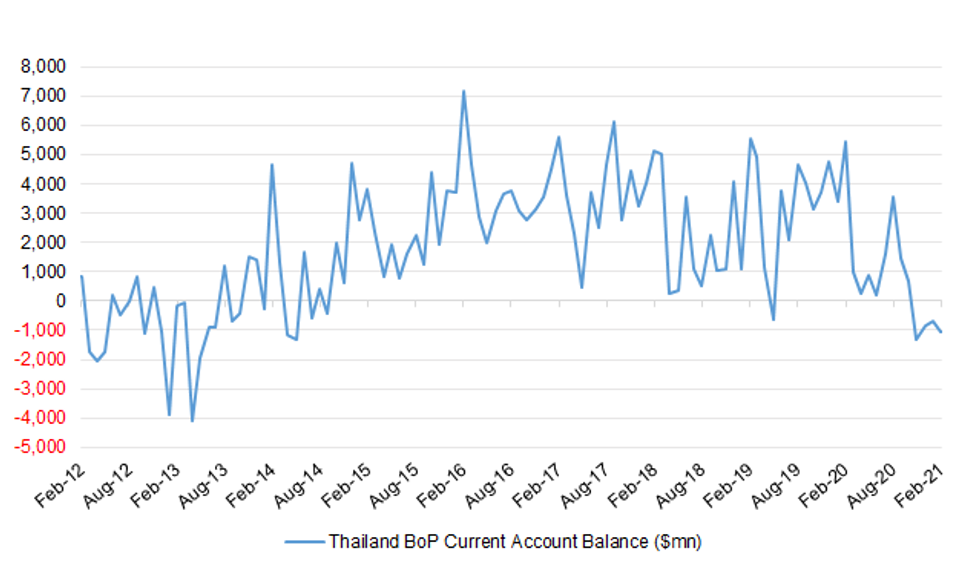

- BoP current account deficit widened in Feb, as did trade surplus. Current account was in deficit for the fourth month in a row. BBG cited snr director at the BoT as noting that "high freight rate and payment on intellectual property rights put pressure on net services, income and transfer."

- Thailand's Markit M'fing PMI came in at 48.8 in Mar after printing at 47.2 in Feb. IHS Markit said that "output, new orders, purchasing and input inventories all declined for the third month running in March. There were signs of encouragement, however, as all four indicators registered slower rates of contraction than in February, while firms were less pessimistic about the 12-month outlook."

- Dep PM Supattanapong said that the gov't has a "proactive economic plan" to attract at least 1mn wealthy foreign investors and tourists, particularly in the S-curve industries.

- A break above yesterday's cycle high of THB31.400 would open up Sep 28, 2020 high of THB31.745. Bears look for a dip through Mar 26 low of THB31.060, which would expose the 200-DMA at THB30.777.

- PM Prayuth takes part in the national energy policy committee's meeting today.

- Thai Business Sentiment Index comes out later today, while tomorrow the BoT will release its weekly foreign reserves data.

Fig. 1: Thailand BoP Current Account Balance ($mn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.