May 16, 2024 06:37 GMT

Inflation Expectations Remain Well Anchored

SWEDEN

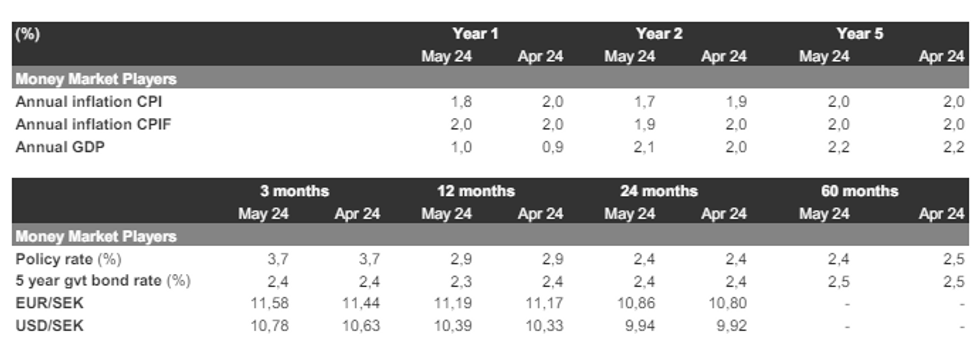

Swedish money market participants’ inflation expectations remained anchored in May, with 1-year and 5-year ahead CPIF expectations remaining at 2.0%, and 2-year ahead expectations falling a touch to 1.9% (vs 2.0% prior).

- All Executive Board members emphasised the importance of well-anchored medium-term inflation expectations in the May Riksbank meeting minutes.

- 1-year and 2-year ahead annual GDP growth expectations were each revised a tenth higher (1-year to 1.0%, 2-year to 2.1%).

- The 3-month ahead policy rate was seen at 3.7%, indicating that respondents view a June Riksbank cut as unlikely.

- Full details from Prospera below:

103 words