-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMalaysia's Statistics Department To Revise Consumer Price Index

Malaysia's Department of Statistics is planning to revise its Consumer Price Index (CPI) next year amid suggestions that it does not reflect the true cost of living. The Department is conducting a study on income patterns that will affect the composition of the underlying basket of items and their relative weights.

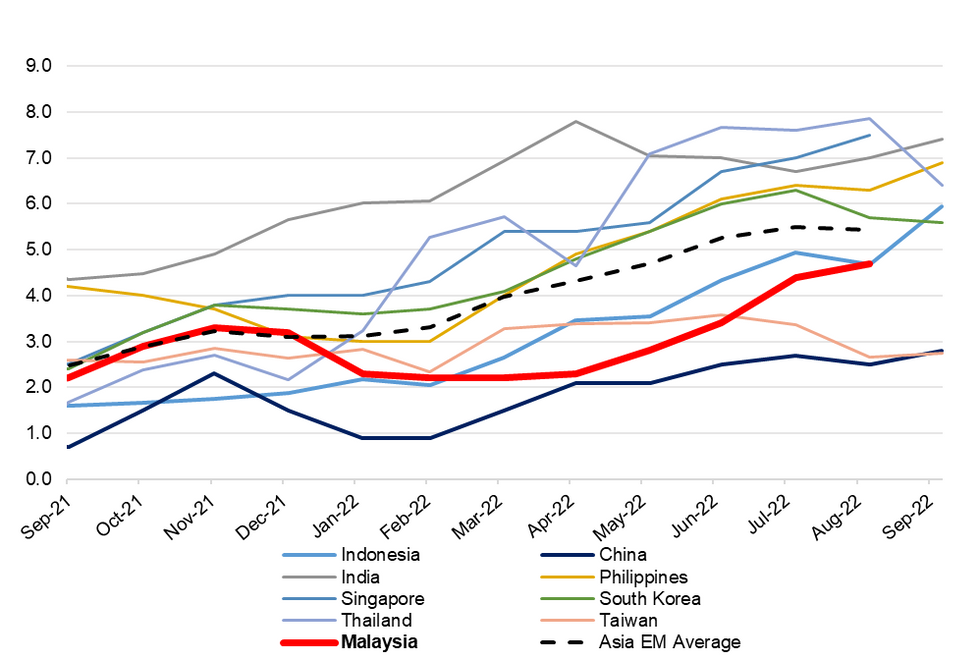

- While the widespread dynamic of strengthening, broadening price pressures has not been alien to Malaysia, headline inflation has stayed relatively low compared to emerging Asian peers (Fig. 1). This has been attributed to the nation's status as a net commodity exporter. Similar to the neighbouring Indonesia, windfall revenue from the global commodity rally allowed the Malaysian government to fund subsidies and keep the costs of living in check.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Factors shielding Malaysia from offshore inflationary pressures have subsided, with the commodity rally running out of steam, as the BBG Commodity Index sits ~18% off its June peak, while palm oil futures (generic contract) have tumbled more than 50% from its March cyclical highs. Meanwhile, continued recovery in domestic economic activity is generating wage pressures, while aggressive Fed tightening is applying pressure to USD/Asia crosses. Against this backdrop, the plan to revise the CPI suggests that actual inflation might be not only accelerating, but also faster than captured by recent prints.

- The argument that there's a disconnect between Malaysia's CPI and consumers' experience has been doing the rounds for some time, prompting the Malay Mail newspaper to construct an alternative gauge of price growth. The Cik Kiah Index tracks a basket of goods and services consumed by a typical household from the bottom 40% income group, thus focusing on staple products. The latest publicly available reading of the CKI (April 2022) was 1pp higher than the official CPI reading of +2.3% Y/Y, partly because food is a notable driver of overall prices.

- An effective CPI rebase to reflect a larger perceived increase in the costs of living would raise pressure on Bank Negara Malaysia to increase interest rates at a faster clip. Although Malaysia's central bank does not operate an explicit inflation target, it is mandated with promoting monetary stability, which includes low and predictable inflation. With its Monetary Policy Committee holding just six meetings per year, factoring the revised CPI into the MPC's deliberations would incentivise tightening by larger increments.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.