-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Tariffs Initiate Talks With Mexico

Mild Sell-Off After Lowe's MonPol Remarks, Jobs Market Data Eyed

A risk-on reaction to FOMC monetary policy decision pushed AUD/USD higher, amid a supportive tone for global equity markets. The Fed doubled the pace of their asset purchase taper and projected three rate hikes in 2022, but participants voted with their money that the withdrawal of stimulus will not derail the economic recovery.

- Focus then turned to comments from RBA Gov Lowe, who outlined three options for ending the Reserve Bank's QE programme next year. His speech has applied some very mild pressure to the AUD, as the Governor reiterated that "we are still a fair way from" the point where inflation is sustainably within the target range.

- In the Q&A session, Lowe noted that the decision to end QE is completely separable from the timing of interest rate hikes, adding that the Reserve Bank expect the AUD to weaken if other central banks tighten policy and the RBA do not.

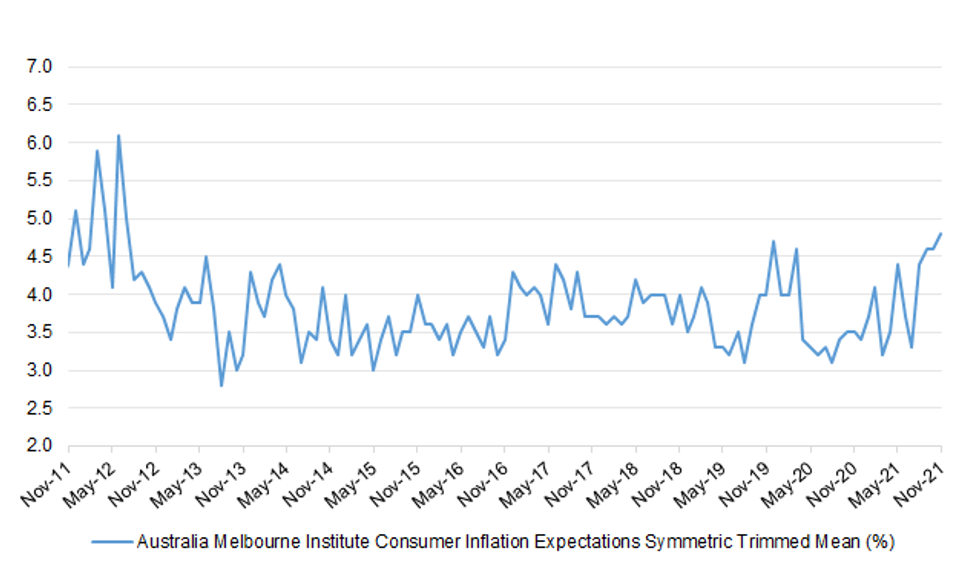

- Australia's year-ahead consumer inflation expectations rose to +4.8% Y/Y this month from +4.8% registered in November, reaching levels last seen almost a decade ago.

- All eyes are on Australia's monthly labour market report, due at the bottom of the hour. Employment is expected to rise by 200k, resulting in a dip in headline unemployment rate to 5.0%, according to Bloomberg consensus forecast.

- AUD/USD last trades at $0.7160, 10 pips lower on the day. Bears look for a sell-off past Dec 14 low of $0.7090, which would expose Dec 3, 2021/Nov 2, 2020 lows of $0.6993/91. Bulls need a jump above Dec 9 high of $0.7187 to bring former channel base around the $0.7300 figure into view.

Fig. 1: Australia Melbourne Institute Consumer Inflation Expectations Symmetric Trimmed Mean (%

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.