-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 10Y Yld Surge Over 4.3% on Hot CPI

- MNI US: Senate Passes USD$95B National Security Supplemental

- MNI US: Biden Calls For House To Pass USD95bn Nat Sec Supplemental

- MNI US: 2nd Mayorkas Impeachment Vote Today Ahead Of NY Special Election Result

- MNI US: Senate Finance Republicans Could Slow Walk Tax Bill Until After Election

- MNI SECURITY: Axios: Israel Blocking Delivery Of US Aid To Gaza

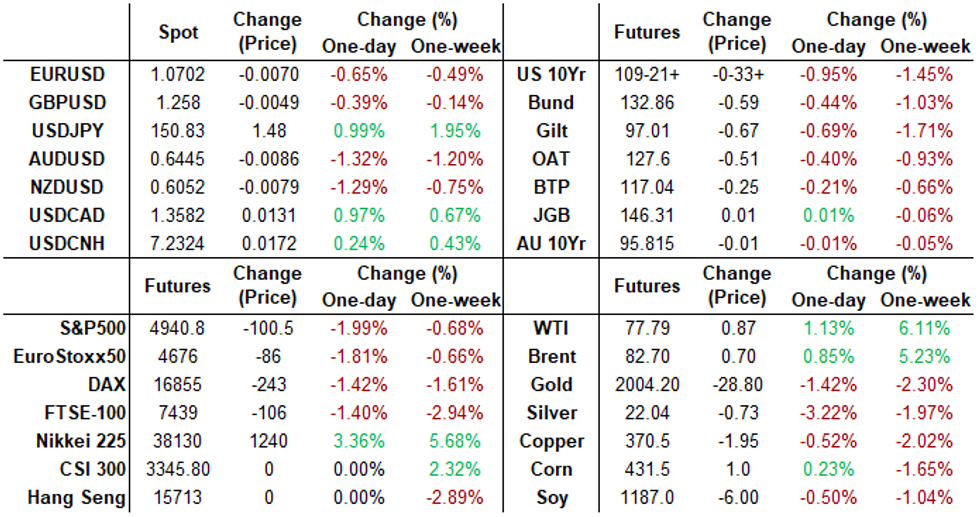

US TSYS Markets Update: Extending Lows

- Largely quiet since this morning's hot CPI related sell-off, Treasury futures and stocks have quietly extended respective session lows in late trade.

- Currently, Mar'24 10Y futures are -1-03 at 109-20 (early Dec'23 level), nearing initial technical support of 109-17 (50.0% of the Oct 19 - Dec 27 bull phase), 10Y yield marking 4.3104% high (Dec 1 lvl). Treasury curves are bear flattening (2s10s -4.853 -34.727) with short end underperforming as projected rate cut continue to evaporate in light of today's hot inflation measure.

- Projected rate cut pricing continues to ebb: March 2024 chance of 25bp rate cut currently -10.6% (-18.3% late Monday) w/ cumulative of -2.6bp at 5.302%; May 2024 at -28.9% vs. -53.0% late Monday w/ cumulative cut of -9.9bp at 5.230%; June 2024 -57.7% vs. -80.3% late Monday w/ cumulative -24.3bp at 5.086%. Fed terminal at 5.3275% in Feb'24.

- Look ahead: Wednesday dat focus on PPI revisions, Fed speakers Chicago Fed Goolsbee and Fed VC Barr.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00276 to 5.31764 (-0.00308/wk)

- 3M +0.00046 to 5.30699 (-0.00206/wk)

- 6M +0.00516 to 5.19615 (+0.00749/wk)

- 12M +0.00138 to 4.90000 (+0.01975/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.725T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $683B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $670B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $268B

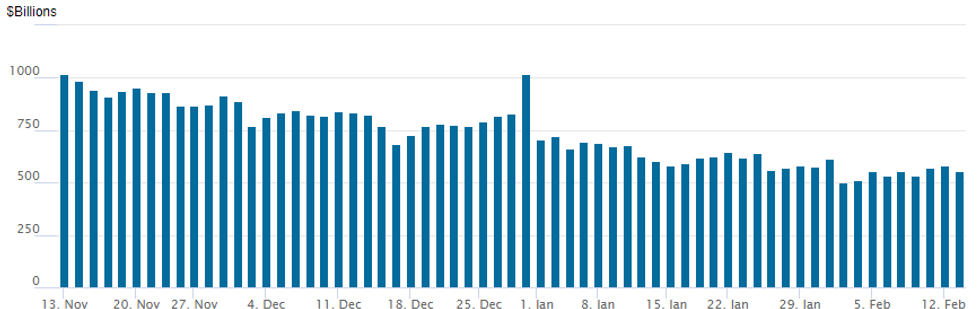

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage recedes to $553.684B vs. $581.568B Monday - remains well above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 84 from 78 Monday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

The bulk of Tuesday's post-CPI options trade looked bullish on the surface: fading the post data sell-off in underlying futures via upside call structure buying and put selling driven in good part by position unwinds so far. Projected rate cut pricing continues to ebb: March 2024 chance of 25bp rate cut currently -10.6% (-18.3% late Monday) w/ cumulative of -2.6bp at 5.302%; May 2024 at -28.9% vs. -53.0% late Monday w/ cumulative cut of -9.9bp at 5.230%; June 2024 -57.7% vs. -80.3% late Monday w/ cumulative -24.3bp at 5.086%. Fed terminal at 5.3275% in Feb'24.

- SOFR Options:

- -20,000 SFRU4 96.50/98.00 call spds vs. 2QU4 97.00/97.37 call spd, 0.25 net flattener

- Block, 15,000 SFRH4 94.93/95.37 call spds, 0.5 ref 94.72 to -.725

- +15,000 SFRK4 95.00/95.06 call spds, 2.0 ref 94.97 to -.965

- Block, 5,000 SFRM4 94.87/95.00/95.25/95.37 put condors, 4.5

- +10,000 2QM4 97.25/98.25 call spds, 4.0 ref 96.34

- Block, 15,000 SFRM4 94.62 puts, 3.25 ref 94.98

- +10,000 0QH4 95.75/96.25 put over risk reversals, 1.5 vs. 95.94/0.50%

- -9,000 SFRK4 94.87/95.06/95.25 put trees, 6.5 ref 94.99

- -5,000 0QG4 95.87 puts, 3.0 ref 95.94

- +5,000 SFRM4 94.87/94.93/95.06/95.12 call condors, 1.5 ref 94.99

- -5,000 SFRK4 95.18/95.31 call spds vs. 95.50/95.75/95.87 call flys, 1.5 net

- +10,000 SFRM/SFRN 94.50 put spds, 0.75

- +4,000 SFRN4 94.50 puts, 2.5 ref 95.325

- Block, +10,000 SFRM4 95.50/96.25 call spds, 3.75

- +4,000 SFRM4 95.50/95.75 call spds, 1.75

- -2,000 SFRU4 95.31 puts, 41.5 vs. 95.315/0.58%

- +5,000 SFRZ4 97.50/98.00/98.50/99.00 call condors, 2.25 ref 95.65

- +2,500 0QH4 95.75/96.25 strangles, 14.0 ref 95.94/0.08%

- -5,000 SFRJ4 94.93/95.06 2x1 put spds 0.25

- -5,000 SFRJ4 94.81/95.00 2x1 put spds 4.5

- +6,000 SFRH4 94.75 puts, 6.0 ref 94.72

- +8,000 SFRK4 95.06/95.25/95.43 call flys, 2.5

- Block, 21,289 0QG4 96.25 calls, 0.5 vs 95.93/0.05%

- Block, 7,000 0QH4 96.37/96.50 call spds vs. 3QH4 96.62/96.75 call spds, 0.0

- Block, 2,500 SFRM4 95.00/95.12/95.25 put flys, 1.0 ref 95.11

- Block, 10,000 SFRJ4 95.06/95.25/95.37 broken put flys, 7.5k 2cr, 2.5k 0.0

- -1,000 SFRM4 95.12 straddles, 36.0

- +2,500 0QG4 96.25/96.37 1x2 call spds, 1.0 ref 96.13

- 2,000 0QG4 96.00/96.25 strangles ref 96.115

- 2,000 SFRM4 94.93/95.06/95.18 call flys ref 95.11

- 1,800 SFRH4 94.62/94.87 call spds ref 94.765

- 10,000 SFRH4 94.62 puts ref 94.765

- 5,000 0QG4 96.18/96.31/96.43 call flys ref 96.11

- 1,800 SFRM4 95.50/95.75 call spds ref 95.10

- Treasury Options:

- 1,500 FVH4 107.25/108 1x2 call spds ref 107-08.25

- 2,000 TYH4 112.5 calls, 4 ref 110-23

- 2,000 TYH4 110/111 2x1 put spds ref 110-23

- 1,800 TYH4 109/109.5/110 put flys, 1 ref 110-23.5 vs.

- 1,800 wk3 TY 108.5/109.5/110/110.5 broken put condors ref 110-23.5

- over 4,800 FV weekly 107.75 calls, 4 ref 107-07.25

- over 8,500 TY weekly 111.25 calls, 6 ref 110-22

- Block, 12,000 TY weekly 111.5 calls, 4 ref 110-23 (expire tomorrow)

- Block, 10,000 TYH4 112.5 calls, 4 ref 110-23

EGBs-GILTS CASH CLOSE: Futures Move Off US CPI-Inspired Intraday Lows

Bunds pared some of their CPI-inspired losses, and have now stabilised somewhat with futures having traded in a ~20 tick range for the past 90 minutes. The first support at 132.89 (50% retracement of the Oct 4 - Dec 27 bull phase) was pierced following the US CPI release but prices quickly rebounded.

- Gilts have seen less of a recovery, likely a function of today's firmer than expect wage data and heightened concerns r.e. tomorrow's domestic CPI print (due 0700GMT/0800CET).

- Cash curves have bear flattened as ECB/BoE rate cut expectations have moderated further. Schatz yields are over 7bps higher today while 2-year Gilt yields are over 13bps higher. Gilt yields operate at or near year-to-date highs across the curve at typing.

- In spite of the rate cut repricing and European equity market weakness, periphery spreads are generally tighter to Bunds. The 10-year BTP/Bund spread is the exception, trading +0.2bps wider at 154.9bps.

- Tomorrow's focus will be on the aforementioned UK CPI data, though we also get the preliminary Eurozone Q4 GDP reading at 1000GMT/1100CET. The advance release from Jan 30 printed at 0.0% Q/Q and 0.1% Y/Y.

FOREX Greenback Surges On Firmer-Than-Expected US CPI, Swiss Franc Slides

- Hotter-than-expected US inflation data prompted a surge higher for the greenback on Tuesday. As Fed rate cut expectations continue to be pushed back, the USD index remains at the best levels of the session as we approach the APAC crossover, having risen 0.72% to a fresh near-three month high.

- Kiwi remains among the worst performers on Tuesday with multiple themes helping NZDUSD (-1.25%) to slide back towards the 0.6050 mark, and the worst levels of the year. Weakness was initiated overnight after RBNZ’s Q1 inflation expectations eased further making any further RBNZ tightening unlikely. The firm dollar and significant weakness for equities exacerbated the NZDUSD decline.

- USDJPY has continued to inch higher across the session, piercing initial resistance in late trade above 150.78, the November 17 high. This extends the intra-day advance to 1.00%, with yield differentials the primary driver following the hot US inflation figures.

- With price now firmly above the psychological 150.00 mark and edging towards last years highs, market participants may once again be cautious of any verbal warnings from the Ministry of Finance, who will no doubt be wary of the impressive 7% advance this year.

- CHF is also among the poorest performer so far, slipping against all others as Swiss CPI also came in soft relative to expectations. The release prompted an extension of recent EUR/CHF gains, putting the cross well through the mid-January highs and above key resistance at the 100-dma of 0.9496. USDCHF rose an impressive 1.35%.

- Wednesday’s data focus will be on UK CPI, after the higher-than-expected earnings data this morning. Fed speakers include Chicago Fed Goolsbee and Fed VC Barr.

FX Expiries for Feb14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0625(E520mln), $1.0700(E1.7bln), $1.0745-50(E698mln), $1.0766-70(E611mln), $1.0800(E723mln), $1.0825-40(E1.3bln)

- USD/JPY: Y149.00($965mln), Y150.00($2.2bln), Y151.00-05($1.0bln)

- GBP/USD: $1.2550(Gbp643mln)

- EUR/GBP: Gbp0.8600(E791mln)

- AUD/USD: $0.6463(A$634mln), $0.6835-55(A$2.0bln)

- USD/CAD: C$1.3100($1bln)

- USD/CNY: Cny7.2000($1.2bln)

Late Equities Roundup: Extending Lows

- Stocks remain weaker, extending lows after the bell. Broad based risk-off followed this morning's hot January CPI data, stocks and rates sold off as hopes of rate cuts this year withered. Currently, the DJIA is down 721 points (-1.86%) at 38075.55, S&P E-Minis down 99.25 points (-1.97%) at 4942.25, Nasdaq down 373.5 points (-2.3%) at 15569.42.

- Laggers: Real Estate and Consumer Discretionary sectors underperformed in the second half, estate management shares weighed on the former: CBRE Group -4.37%, CoStar Group -2.22%. Broad based weakness in Durables saw Marriott Int -6.41%, Aptiv -6.02%, Etsy and VF Corp -6.0%.

- Meanwhile, Health Care and Consumer Staples sectors resisted the selloff the most, equipment and services companies buoyed the former: McKesson +1.78% Cardinal Health +0.1%, Cencora +0.07%. Household and personal products names weighed on Consumer Staples the least: Clorox -0.74%, Procter & Gamble -0.91%, Church & Dwight -1.21%.

- Looking ahead: corporate earnings expected after the close: Welltower Inc, Robinhood Markets, GoDaddy Inc, AIG, Airbnb, MGM Resorts, Zillow, Lyft, Topgolf Callaway.

E-MINI S&P TECHS: (H4) Retracement Mode

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5110.50 2.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5100.00 Round number resistance

- RES 1: 5066.50 High Feb 12 and the bull trigger

- PRICE: 4942.75 @ 1530 ET Feb 13

- SUP 1: 4937.25 20-day EMA

- SUP 2: 4866.000/4823.72 Low Jan 31 / 50-day EMA values

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis is unchanged and remains bullish. The pullback from yesterday’s 5066.50 high is - for now - considered corrective. Support to watch lies at 4937.25, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possible towards 4866.00 key support, the Jan 31 low. For bulls, the trigger for a resumption of gains is 5066.50, the Feb 12 high.

COMMODITIES Middle East Tensions Override USD Headwind For Crude, But Not Gold

- Crude markets found further support today, despite higher-than-expected US CPI data and the resultant USD bid. Continued Middle East tensions amid little hope for a ceasefire in Gaza, coupled with a stable OPEC demand outlooks have added support. The crude time spreads have also rallied on the day after yesterday’s narrowing.

- OPEC maintained its oil demand growth forecast for 2024 and 2025 steady on the month according to the latest OPEC Monthly Oil Market Report.

- Global oil demand is expected to grow slower this year by 1.2-1.3mbpd this year, IEA Executive Director, Fatih Birol, said to Bloomberg.

- The number of tankers that have diverted around southern Africa continues to rise as shippers look to avoid the Red Sea, according to Oil Brokerage.

- WTI is +1.1% at $77.77, with an earlier high of $78.47 clearing $78.14 (Jan 30 high) to open key resistance at $79.29 (Jan 29 high).

- Brent is +0.8% at $82.68, with an earlier high of $83.24 clearing support at $82.86 (Jan 30 high) to open key resistance at $84.17 (Jan 29 high).

- Gold is -1.4% at $1992.44, slumping on the US CPI report to breach a key short-term support at $2001.9 (Jan 17 low) with next firm support seen at $1973.2 (Dec 13 low).

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2024 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 14/02/2024 | 0700/0700 | *** |  | UK | Producer Prices |

| 14/02/2024 | 0700/0800 | ** |  | NO | Norway GDP |

| 14/02/2024 | 0830/0930 |  | EU | ECB's De Guindos speech at Mediterranean CB's conference | |

| 14/02/2024 | 1000/1100 | ** |  | EU | Industrial Production |

| 14/02/2024 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/02/2024 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 14/02/2024 | 1400/1500 |  | EU | ECB's Cipollone statement on digital euro | |

| 14/02/2024 | 1430/0930 |  | US | Chicago Fed's Austan Goolsbee | |

| 14/02/2024 | 1500/1500 |  | UK | BOE's Bailey Lord Economic Affairs Committee | |

| 14/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 14/02/2024 | 1630/1730 |  | EU | ECB's Cipollone in CEO Summit | |

| 14/02/2024 | 1930/1430 |  | CA | BOC Deputy Mendes panel talk. | |

| 15/02/2024 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.