-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Cap-Gains Tax Hike Prop Saps Stock

US TSY SUMMARY: Cap-Gains Tax Proposal Saps Stock Gains

Rates higher after the closing bell -- a choppy session on an inside range day.Salient factors:

- Data finally returned but markets appeared indifferent to lower than expected weekly claims (547k vs. 610k est; prior revisions 586K; continuing claims -0.034M to 3.674M).

- First half attention more on ECB policy annc: unchanged (as expected), the most market-moving comment was Lagarde saying negative interest rates were an effective tool for providing accommodation - not a big surprise, but triggered a reversal higher in Bunds and Euribor.

- Rates traded lower as quietly equities gained through midday, S&Ps did not quiet make it to Apr 16 all-time highs of 4179.75.

- Torpor broken around 1300ET over headlines Pres Biden PROPOSAL over capital gains tax increase to 39.6% to as high as 43.4% for wealthy. Risk-on reversed: equities sold off sharply/Bonds lead rebound while VIX neared 20.0.

- Late chop ensued as markets digested the headlines, estimating success of proposal to nearly double current cap gains tax as unlikely.

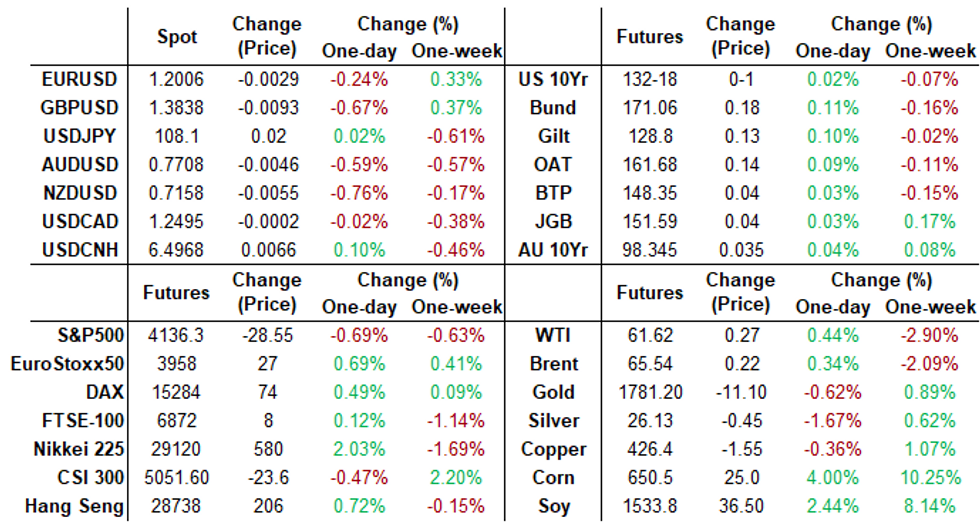

- The 2-Yr yield is up 0.2bps at 0.1492%, 5-Yr is up 0.3bps at 0.8001%, 10-Yr is down 0.3bps at 1.5521%, and 30-Yr is down 1.6bps at 2.2346%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N +0.00125 at 0.07338% (+0.00063/wk)

- 1 Month -0.00412 to 0.10613% (-0.00975/wk)

- 3 Month +0.0287 to 0.17575% (-0.01250/wk) ** (New Record Low 0.17288% on 4/22/21)

- 6 Month -0.00587 to 0.21063% (-0.01300/wk)

- 1 Year -0.00150 to 0.28075% (-0.01163/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.01%, $882B

- Broad General Collateral Rate (BGCR): 0.01%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $346B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, appr $1.735B accepted vs. $3.624B submission

- Next scheduled purchases:

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO: Steady-On

Holding steady, Bills unchanged. Current levels:

T-Bills: 1M -0.0025%, 3M 0.0152%, 6M 0.0304%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | -0.02% | -0.01% |

| 3Y | -0.01% | -0.06% |

| 5Y | -0.08% | -0.06% |

| 7Y | -0.01% | -0.06% |

| 10Y | -0.09% | -0.08% |

| 30Y | -0.04% | -0.04% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Green Jun 91/92 2x1 put spds, 0.5

- +7,000 Blue Sep 81/83 put spds 2.0-2.75 over the 88/91 call spd

- -10,000 Green Dec 87 puts, 14.0

- Block +10,700 Dec 98 calls, 1.0 vs. 99.625/0.05% after 10k traded in pit

- +5,000 Blue Sep 80/90 put over risk reversals, 1.0

- -40,000 short Dec 96 calls 4.0 over the 91/93 put spds

- over 14,000 short Sep 92/93 put spds, 0.5

- 10,000 Blue May 90/91/92 1x3x1 call flys, 0.0

- Overnight trade

- Block, +7,200 Blue May 87/88/90 call flys, 2.0

- 2,500 Green May 99.25/99.331 put spds

- 14,000 TYK 132 puts, 4/64 pushes total volume in strike over 24,000

- +11,000 TYM 133/133.5 call spds, 10

- -2,800 TYM 133 calls, 30

- 10,000 FVM 122.25 puts

- +7,500 TYM 129/130.5/132 put flys, 17

- -2,000 TYM 132.5 calls, 43

- TYM 131/134 strangles sold down to 24

- -5,000 TYM 131/134 strangles, 25

- +2,500 TYM 133/134 1x2 call spd

- Overnight trade

- Block, +20,000 TYM 130.5/131.5 put spds, 12

- -6,300 TYN 129 puts, 15

- +10,000 FVM 122.25 puts, 1.5

- 2,700 USM 157 puts, 105

- 2,400 USM 159 calls

EGBs-GILTS CASH CLOSE: Lagarde's "Negative" Comments Positive For Bunds

Gilts outperformed Bunds Thursday, with morning weakness in both reversing early afternoon amid ECB Pres Lagarde's press conference. Curves little changed, with periphery spreads flat too.

- With the ECB leaving policy unchanged (as expected), the most market-moving comment was Lagarde saying negative interest rates were an effective tool for providing accommodation - not a big surprise, but triggered a reversal higher in Bunds and Euribor.

- But those moves faded, and RX and ER are trading more or less where they were at ECB decision time. Reuters sources piece after the meeting saying that the policy "hawks" did not call for a PEPP taper merely corroborated what Lagarde said.

- Large supply from France and Spain (>E16bn in nominals combined) saw little reaction.

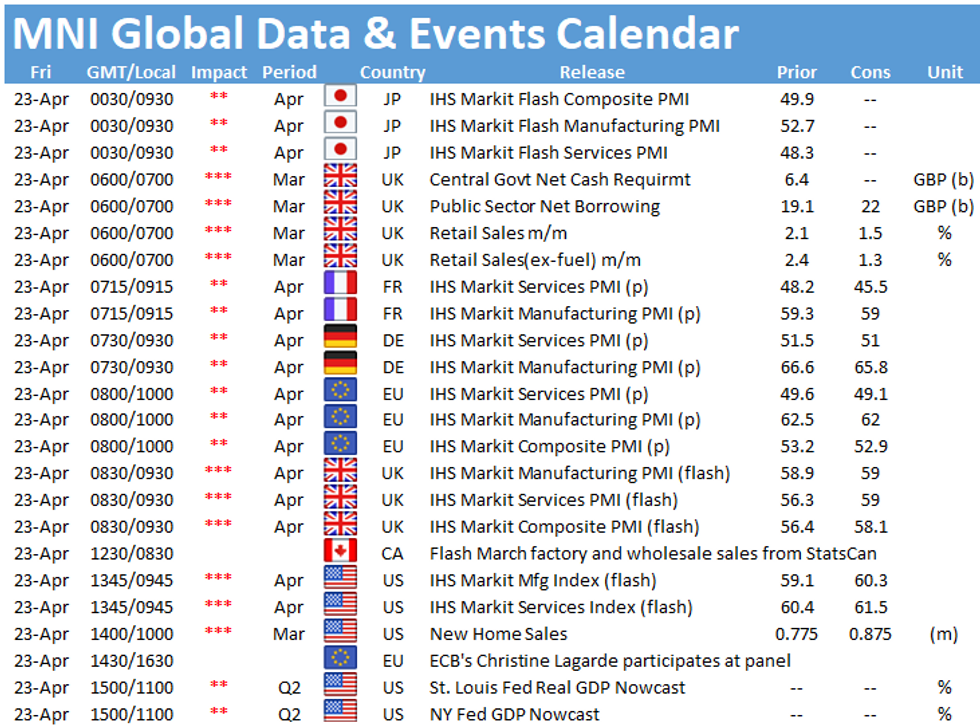

- Friday sees flash PMIs and UK retail sales.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.6bps at -0.69%, 5-Yr is up 0.8bps at -0.599%, 10-Yr is up 1bps at -0.252%, and 30-Yr is up 0.5bps at 0.286%.

- UK: The 2-Yr yield is up 0.5bps at 0.043%, 5-Yr is unchanged at 0.316%, 10-Yr is unchanged at 0.74%, and 30-Yr is down 1bps at 1.275%.

- Italian BTP spread down 0.8bps at 100.7bps /Spanish down 0.9bps at 64.5bps

OPTIONS/EUROPE SUMMARY: Large Profit Taking In Euribor Mids

Thursday's options flow included:

- DUM1 112.30/20/10/00p ladder, bought for 6.5 in 5k

- RXM1 173/174.50cs 1x1.5, bought for 13 in 1k

- RXM1 170.5/169.5ps, bought for 30 in 4.8k

- 2RM1 100.50p, bought for 9.25 in 4k

- 3RM1 100.37p, bought for 14.5 in 2.5k

- 3RM1 100.125/100.00 put spread sold at 1 in 5k

- 3RU1 100.25/100.37cs, 1x2 sold at 1.75 in 16k. Previously bought for 1.5 in 25k

- 3RZ1 99.87/99.62/99.50 broken put ladder trades in 1.5k

- 2LV1 99.375^ bought for 28 in 1.5k

- 3LU1 98.87/98.62ps, bought for 3.75 in 15k

FOREX SUMMARY

EURUSD pare gains following ECB Lagarde on Negative rates.

- "Based on our experience, negative rates are an effective tool for providing monetary accommodation. It provides additional stimulus to the euro area economy.

- Negative rates in the euro area are passed on to Corporates in many cases. As far as households are concerned, it is 5% of deposits that have negative rates imposed.

- It is higher than that in Germany. I appreciate that people who are saving are not satisfied with being charged negative rates. But we have to look at the whole economy.

- Negative rates supporting the economy"

- Most notable price action has been in the Pound today, as Cable mean reversed, after falling to break above the 1.400 handle multiple times of late.

- Desks saw the Monday's spike as overdone, Cable is now at 1.3837.

- Market participants squared on shorter term profit taking.

FX OPTIONS: Expiries for Apr23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-05(E714mln), $1.1980-90(E1.2bln-EUR puts)

- GBP/USD: $1.3900(Gbp650mln-GBP puts), $1.4000(Gbp494mln-GBP puts)

- USD/CAD: C$1.2440-50($1.5bln-USD puts), C$1.2500-10($1.1bln-USD puts),

C$1.2545-55($575mln), C$1.2580-85($1.3bln-USD puts), C$1.2600-10($786mln) - USD/CNY: Cny6.65($630mln)

PIPELINE: Still Waiting for Royal Bank of Canada

- Date $MM Issuer (Priced *, Launch #)

- 04/22 $750M *BOC Aviation 3Y +140

- 04/22 $500M *EIB 5Y TAP SOFR+17

- 04/22 $Benchmark Royal Bank of Canada 5Y +45, 5Y FRN SOFR

- 04/22 $Benchmark Petronas +10Y +135a, 40Y +155a

EQUITIES: Capital Gains Tax-Hike Proposal Scare

Equities pressed on the back of capital gains tax re: header

"BIDEN TO PROPOSE CAPITAL GAINS TAX AS HIGH AS 43.4% FOR WEALTHY" Bbg

- DJIA down 344.99 points (-1.01%) at 33805.8

- S&P E-Mini Future down 40 points (-0.96%) at 4126.5

- Nasdaq down 141.8 points (-1%) at 13822.23

COMMODITIES: Dollar Bid Takes The Wind Out Of Metals Rally

- Both Gold and Silver struggled on Thursday as the greenback firmed. Prices gradually retreated as little new information was received from the ECB prompting some marginal dollar strength as the path of least resistance prevailed.

- Gold maintains a technically bullish tone. The focus is on $1805.7, Feb 25 high.

- Spot gold trades down 0.72% at $1780.70

- Spot silver is down 1.58% at $26.1350

- Oil benchmarks were broadly unchanged on Thursday with both Brent and WTI consolidating towards the lower end of the week's range. Brent futures stalled at Tuesday's high of $68.08. Key support to watch is $63.22 the 50-day EMA. Similarly, WTI found resistance at $64.38 this week, Tuesday's high. The 50-day EMA at $59.54 is seen as a firm near-term support.

- OPEC+ are said to hold a full ministerial meeting on April 28, according to a draft agenda of the gathering seen by Bloomberg. Previously, OPEC+ had been discussing downgrading next week's full-scale ministerial meeting.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.